BUSINESS TAXATION

PLEASE SHOW SOLUTION

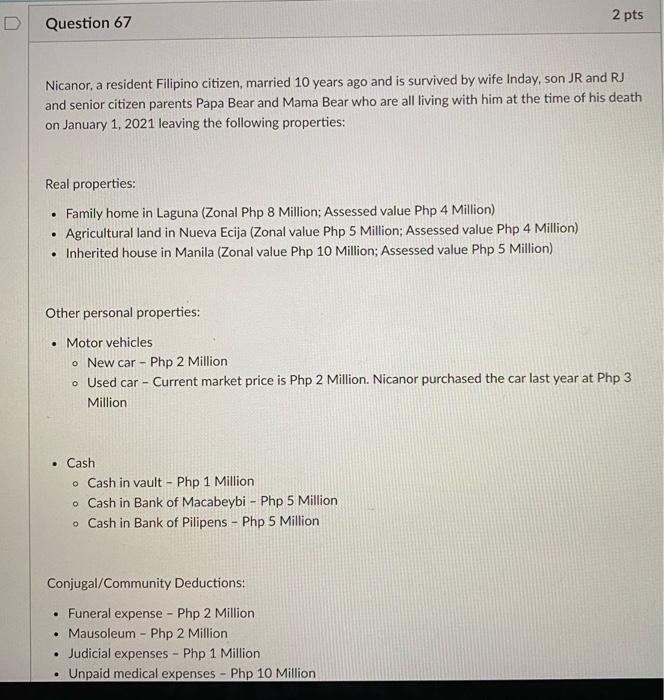

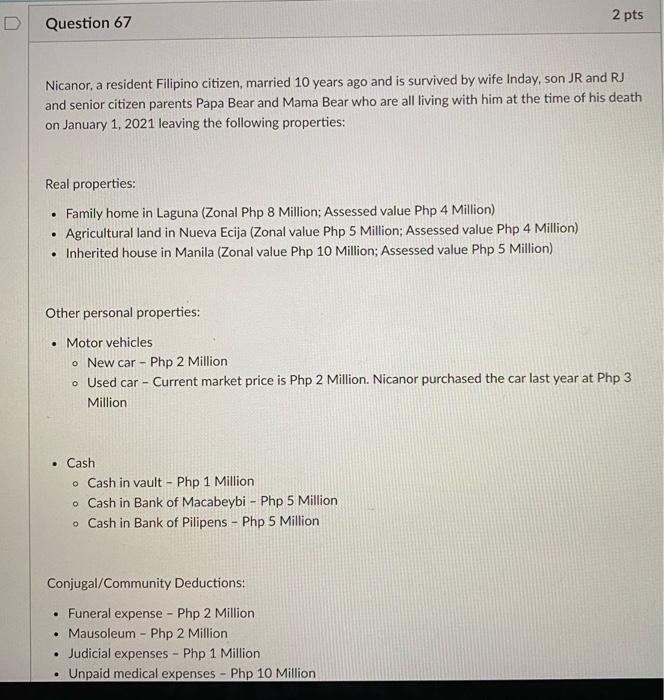

D 2 pts Question 67 Nicanor, a resident Filipino citizen, married 10 years ago and is survived by wife Inday, son JR and RJ and senior citizen parents Papa Bear and Mama Bear who are all living with him at the time of his death on January 1, 2021 leaving the following properties: Real properties: . Family home in Laguna (Zonal Php 8 Million; Assessed value Php 4 Million) Agricultural land in Nueva Ecija (Zonal value Php 5 Million; Assessed value Php 4 Million) Inherited house in Manila (Zonal value Php 10 Million; Assessed value Php 5 Million) Other personal properties: Motor vehicles o New car - Php 2 Million o Used car - Current market price is Php 2 Million. Nicanor purchased the car last year at Php 3 Million Cash o Cash in vault - Php 1 Million o Cash in Bank of Macabeybi - Php 5 Million o Cash in Bank of Pilipens - Php 5 Million Conjugal/Community Deductions: - Funeral expense - Php 2 Million Mausoleum - Php 2 Million Judicial expenses - Php 1 Million Unpaid medical expenses - Php 10 Million - Note: Do not apply final taxation unless required. How much is the total deductions (excluding share of surviving spouse) from gross estate? D 2 pts Question 67 Nicanor, a resident Filipino citizen, married 10 years ago and is survived by wife Inday, son JR and RJ and senior citizen parents Papa Bear and Mama Bear who are all living with him at the time of his death on January 1, 2021 leaving the following properties: Real properties: . Family home in Laguna (Zonal Php 8 Million; Assessed value Php 4 Million) Agricultural land in Nueva Ecija (Zonal value Php 5 Million; Assessed value Php 4 Million) Inherited house in Manila (Zonal value Php 10 Million; Assessed value Php 5 Million) Other personal properties: Motor vehicles o New car - Php 2 Million o Used car - Current market price is Php 2 Million. Nicanor purchased the car last year at Php 3 Million Cash o Cash in vault - Php 1 Million o Cash in Bank of Macabeybi - Php 5 Million o Cash in Bank of Pilipens - Php 5 Million Conjugal/Community Deductions: - Funeral expense - Php 2 Million Mausoleum - Php 2 Million Judicial expenses - Php 1 Million Unpaid medical expenses - Php 10 Million - Note: Do not apply final taxation unless required. How much is the total deductions (excluding share of surviving spouse) from gross estate