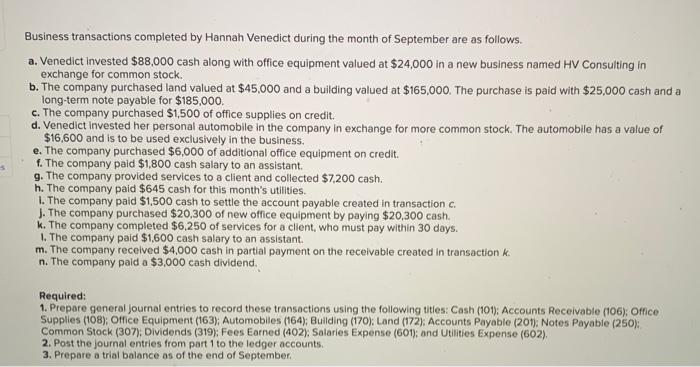

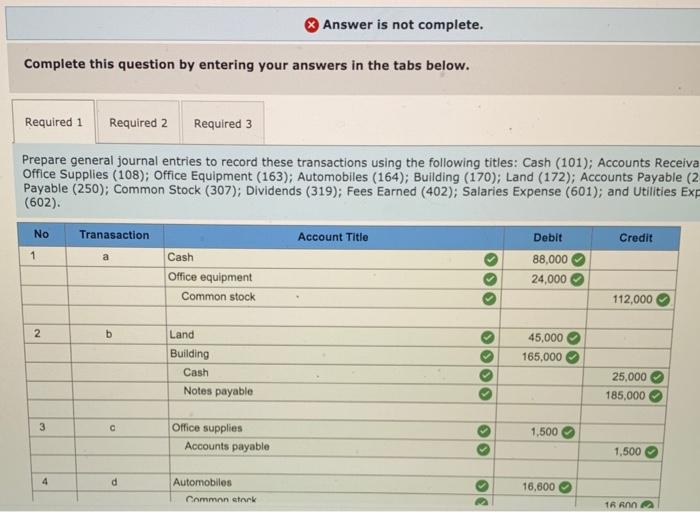

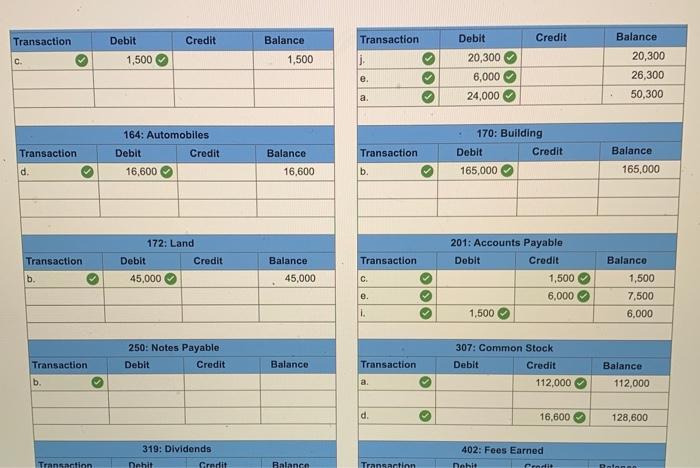

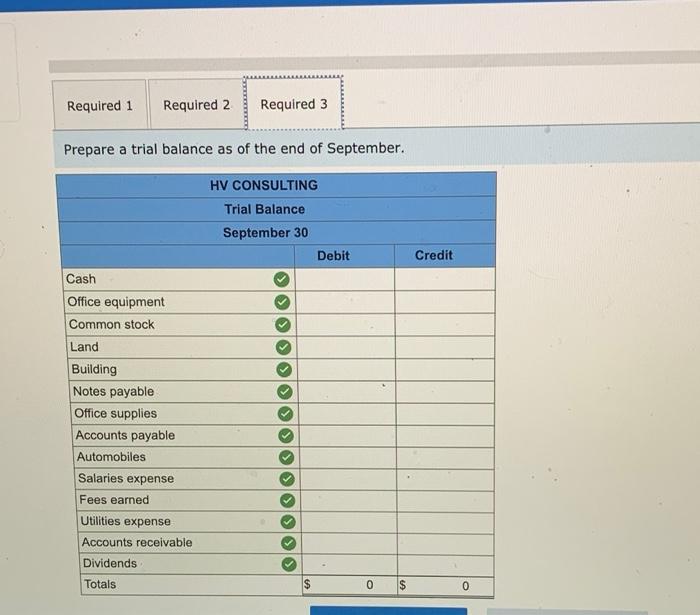

Business transactions completed by Hannah Venedict during the month of September are as follows. a. Venedict invested $88,000 cash along with office equipment valued at $24,000 in a new business named HV Consulting in exchange for common stock. b. The company purchased land valued at $45,000 and a building valued at $165,000. The purchase is paid with $25,000 cash and a long-term note payable for $185,000. c. The company purchased $1,500 of office supplies on credit. d. Venedict invested her personal automobile in the company in exchange for more common stock. The automobile has a value of $16,600 and is to be used exclusively in the business. e. The company purchased $6,000 of additional office equipment on credit. f. The company paid $1,800 cash salary to an assistant 9. The company provided services to a client and collected $7.200 cash. h. The company paid $645 cash for this month's utilities. 1. The company paid $1,500 cash to settle the account payable created in transaction c. J. The company purchased $20,300 of new office equipment by paying $20,300 cash. k. The company completed $6,250 of services for a client, who must pay within 30 days. 1. The company paid $1,600 cash salary to an assistant m. The company received $4,000 cash in partial payment on the receivable created in transaction k n. The company paid a $3,000 cash dividend Required: 1. Prepare general Journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (108) Office Equipment (163); Automobiles (164); Building (170); Land (172), Accounts Payable (201). Notes Payable (250): Common Stock (307); Dividends (319); Fees Earned (402), Salaries Expense (601); and Utilities Expense (602), 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of the end of September, Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receiva Office Supplies (108); Office Equipment (163); Automobiles (164); Building (170); Land (172); Accounts Payable (2 Payable (250); Common Stock (307); Dividends (319); Fees Earned (402); Salaries Expense (601); and Utilities Ex (602). No Tranasaction Account Title Debit Credit 1 Cash Office equipment Common stock 88,000 24,000 112,000 2 b 45,000 165,000 Land Building Cash Notes payable 25,000 185,000 3 c Office supplies Accounts payable 1,500 1.500 4 d Automobiles Comman tark 16,600 . 1 RON Transaction Credit Balance Transaction Debit Credit Balance Debit 1,500 C. 1,500 e. 20,300 6,000 24,000 20,300 26,300 50,300 a. Transaction 164: Automobiles Debit Credit 16,600 Balance Transaction 170: Building Debit Credit 165,000 Balance 165,000 d. 16,600 b. 172: Land Transaction Credit Transaction Debit 45,000 Balance 45,000 b. C. 201: Accounts Payable Debit Credit 1,500 6,000 1,500 Balanco 1,500 7,500 6,000 e. 1. 307: Common Stock 250: Notes Payable Debit Credit Balance Transaction Debit Transaction b. Credit 112,000 Balance 112,000 a. d. 16,600 128,600 402: Fees Earned 319: Dividends Nahit Gradit Transaction Balance Transaction nchie Credit Datan Required 1 Required 2 Required 3 Prepare a trial balance as of the end of September. HV CONSULTING Trial Balance September 30 Debit Credit Cash Office equipment Common stock Land Building Notes payable Office supplies Accounts payable Automobiles Salaries expense Fees earned Utilities expense Accounts receivable Dividends Totals $ 0 $ 0