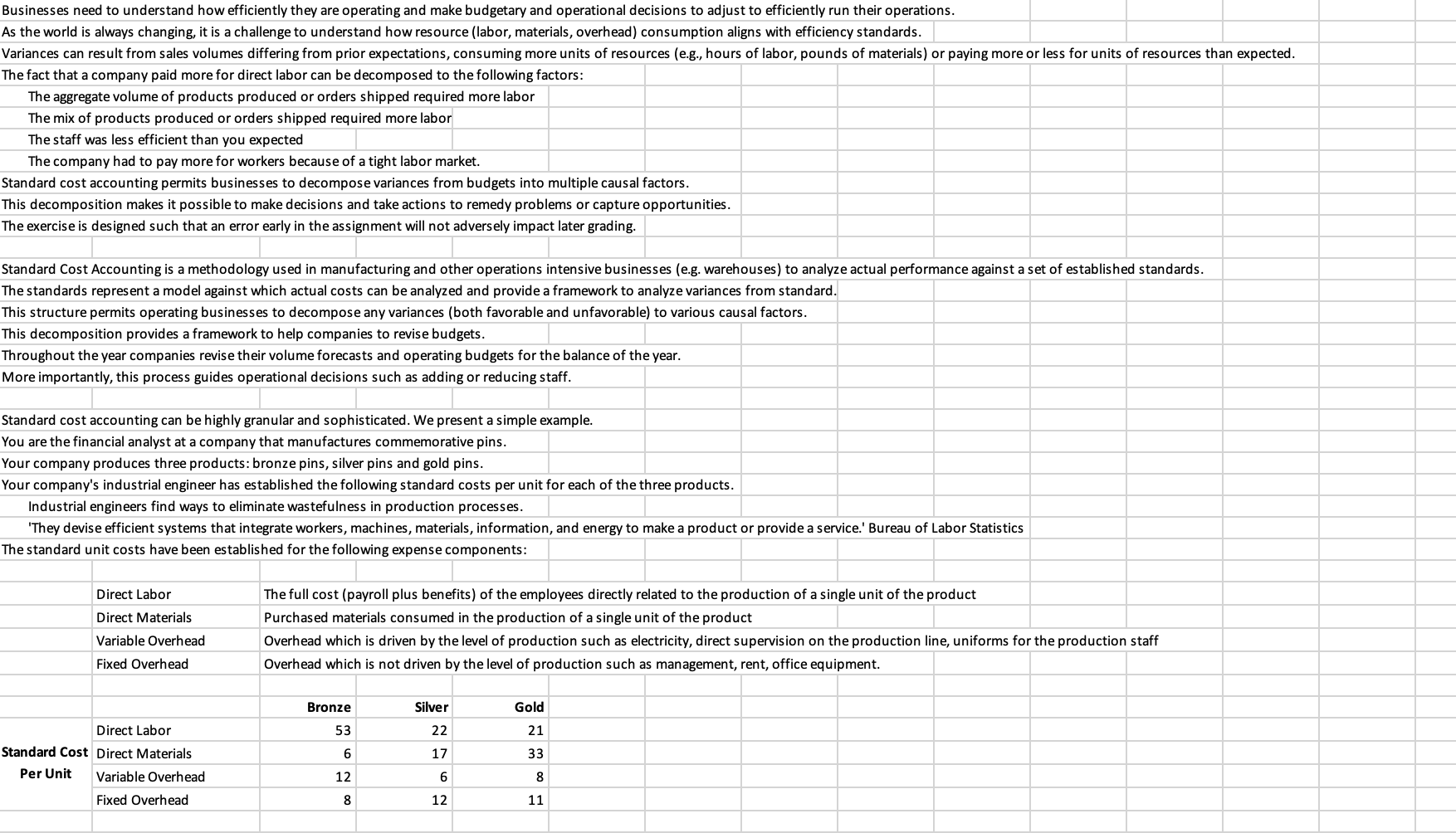

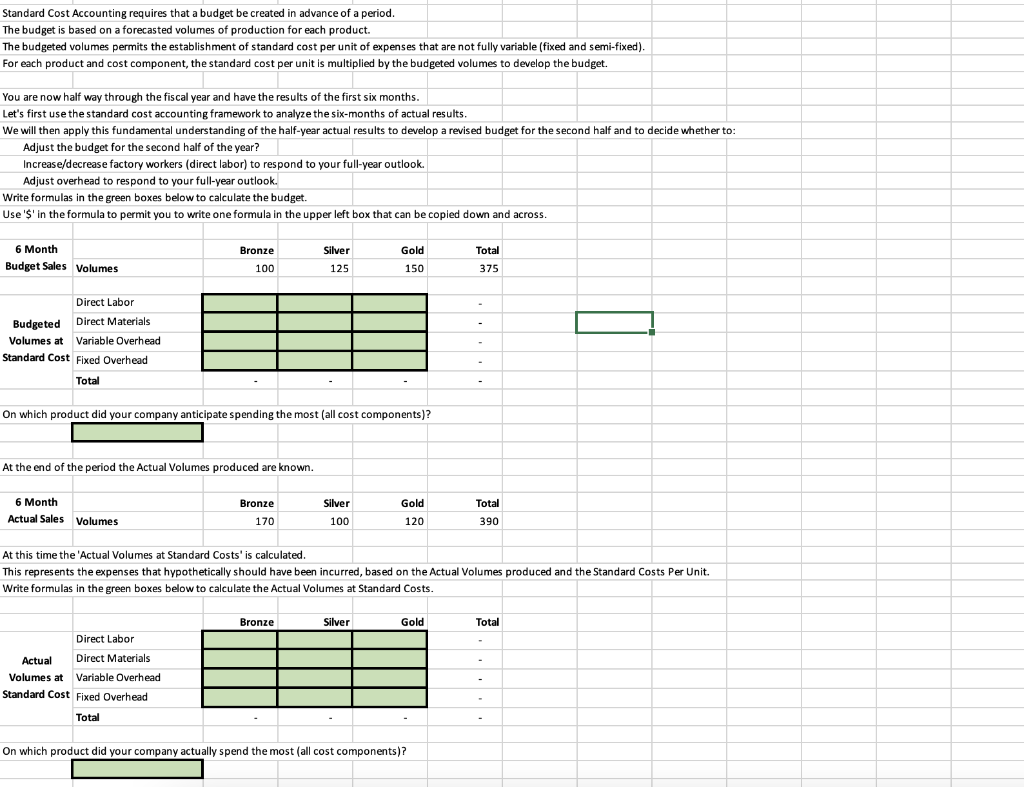

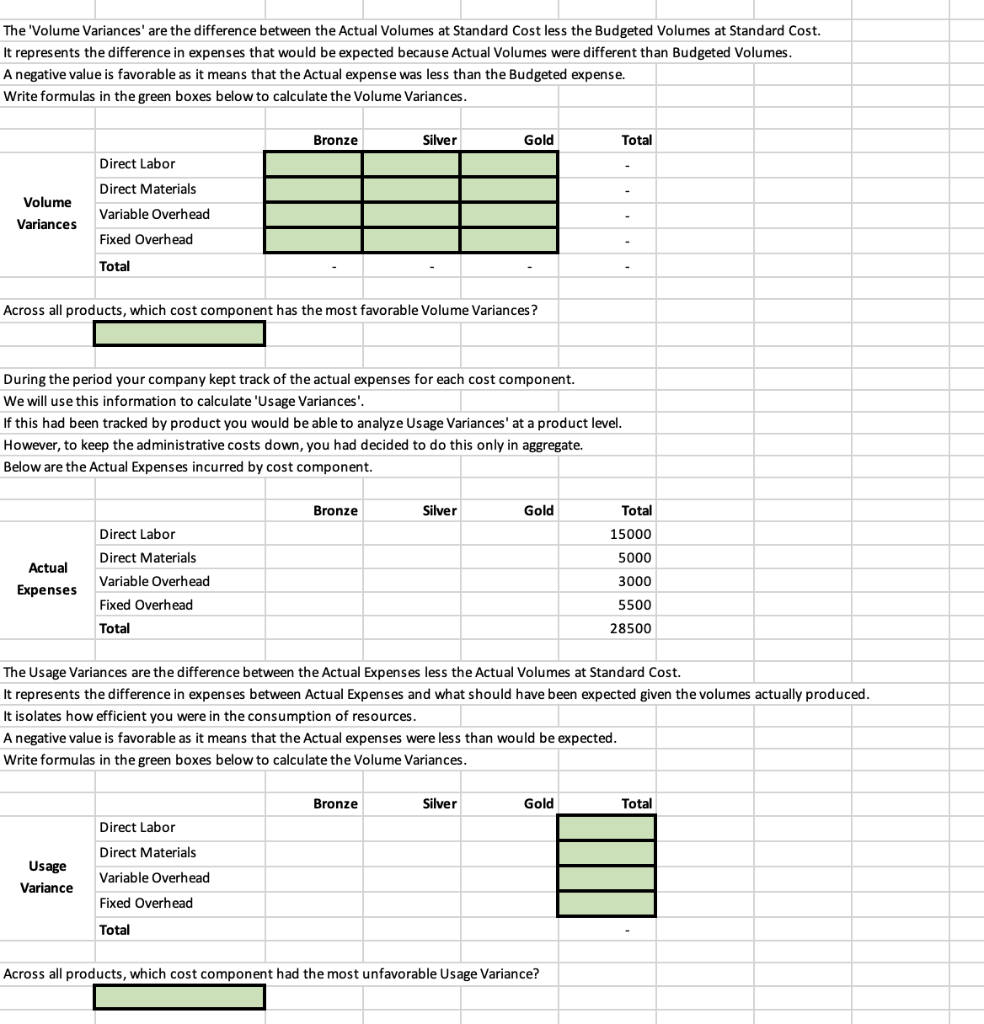

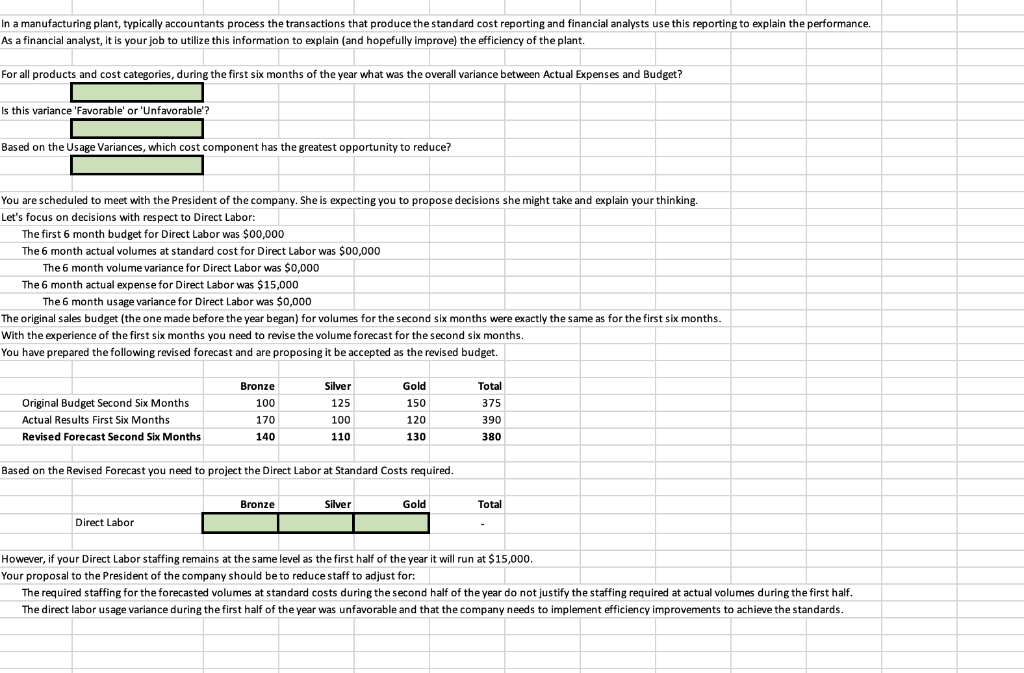

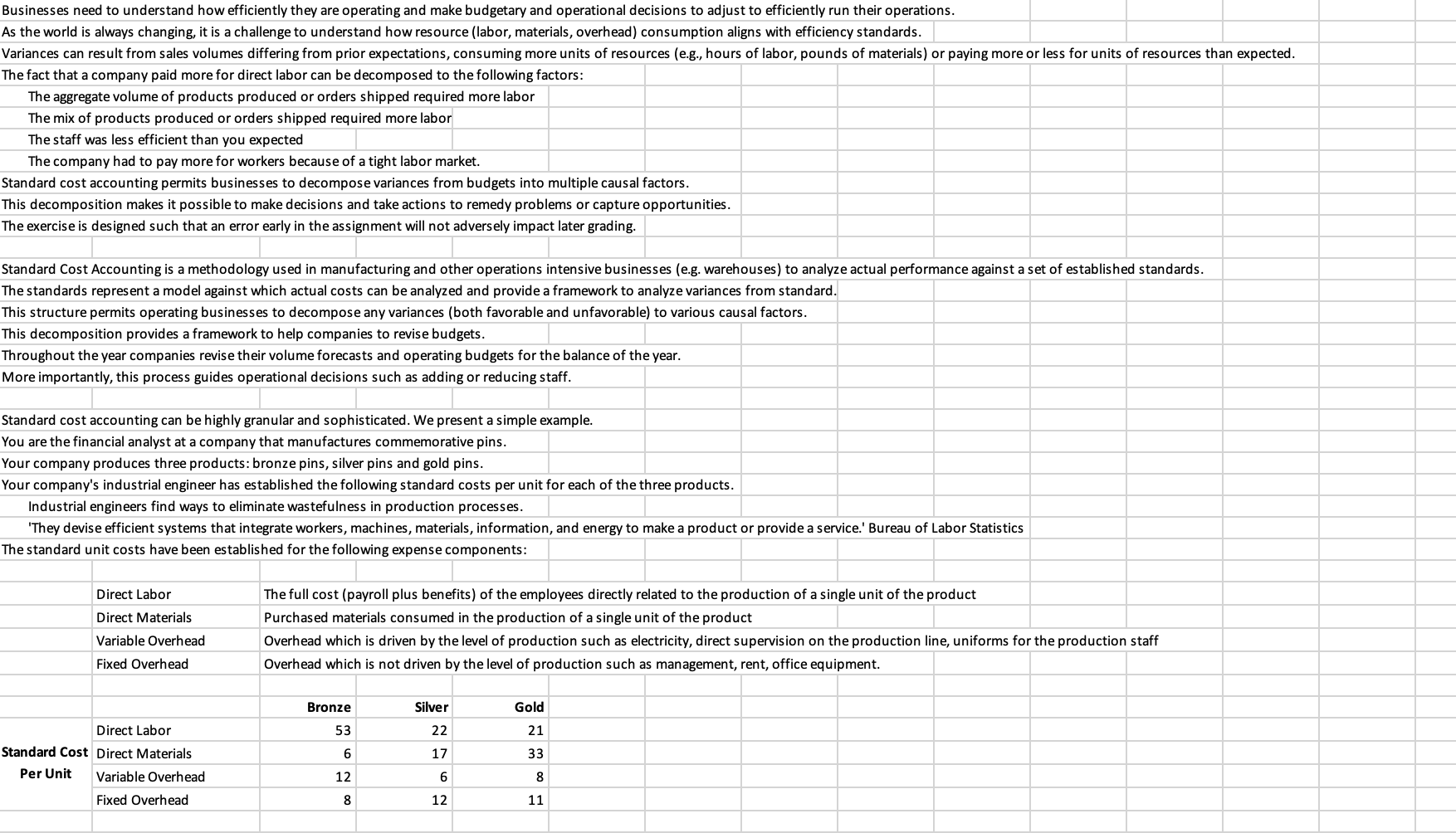

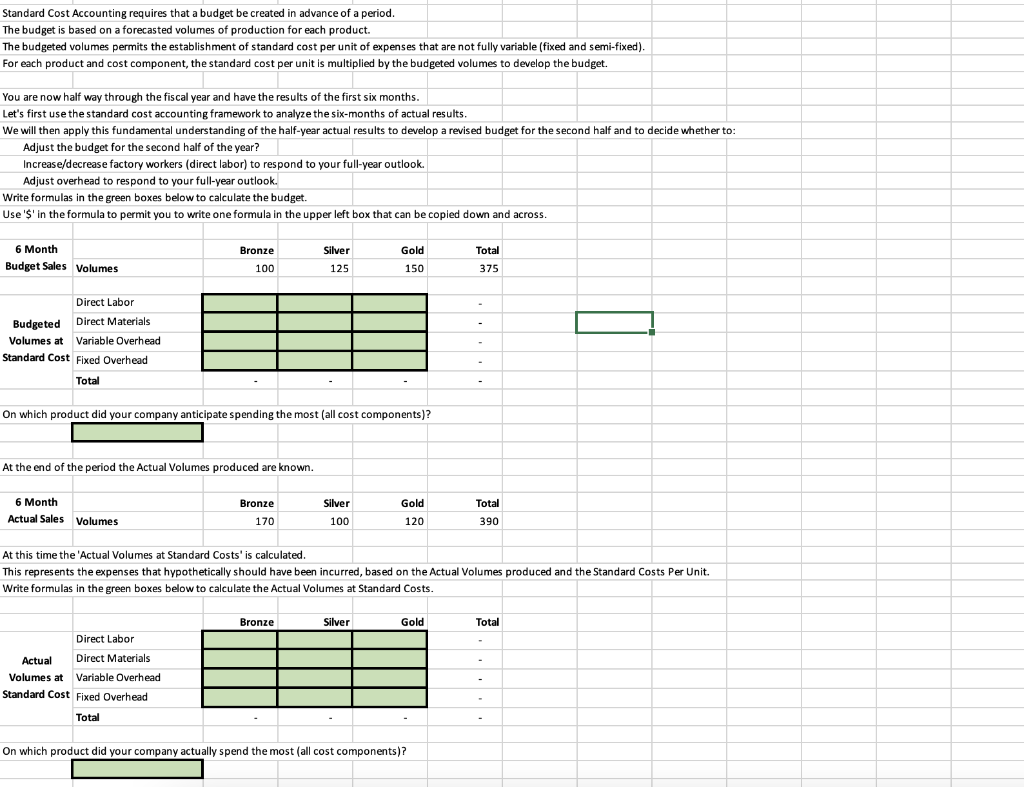

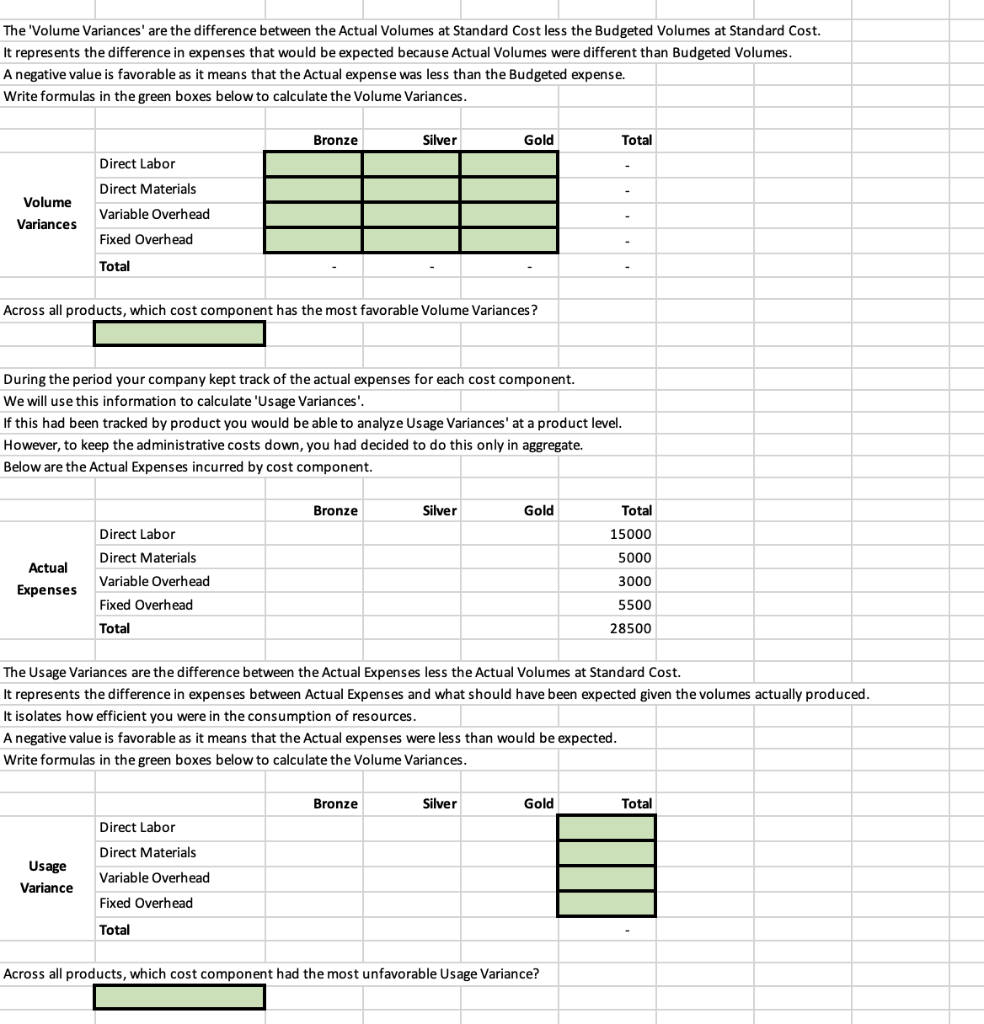

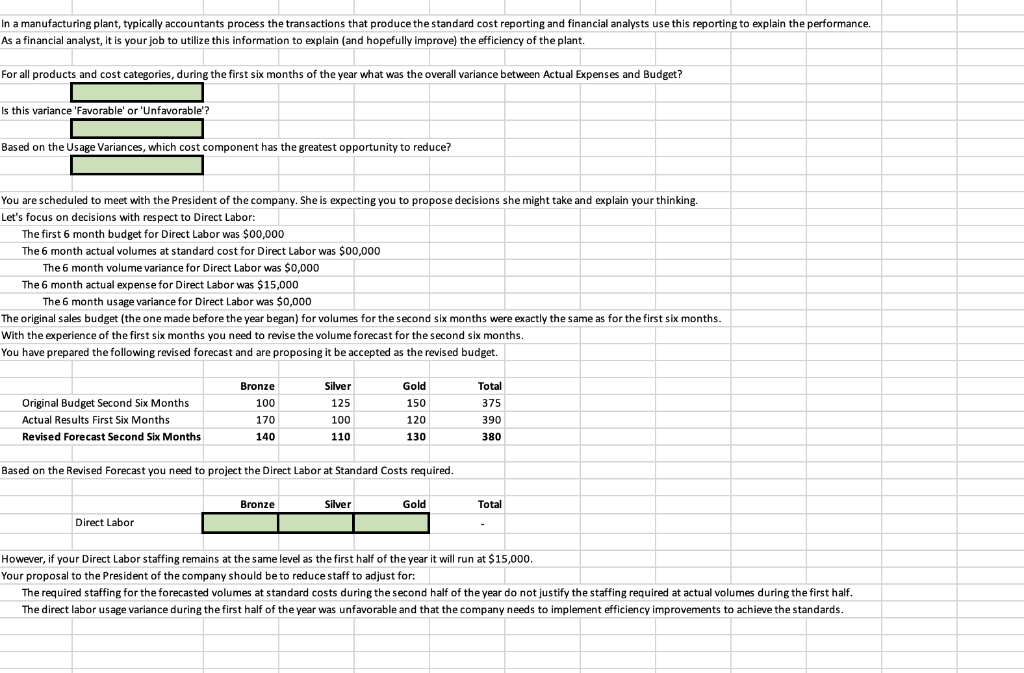

Businesses need to understand how efficiently they are operating and make budgetary and operational decisions to adjust to efficiently run their operations. As the world is always changing, it is a challenge to understand how resource (labor, materials, overhead) consumption aligns with efficiency standards. Variances can result from sales volumes differing from prior expectations, consuming more units of resources (e.g., hours of labor, pounds of materials) or paying more or less for units of resources than expected. The fact that a company paid more for direct labor can be decomposed to the following factors: The aggregate volume of products produced or orders shipped required more labor The mix of products produced or orders shipped required more labor The staff was less efficient than you expected The company had to pay more for workers because of a tight labor market. Standard cost accounting permits businesses to decompose variances from budgets into multiple causal factors. This decomposition makes it possible to make decisions and take actions to remedy problems or capture opportunities. The exercise is designed such that an error early in the assignment will not adversely impact later grading. Standard Cost Accounting is a methodology used in manufacturing and other operations intensive businesses (e.g. warehouses) to analyze actual performance against a set of established standards. The standards represent a model against which actual costs can be analyzed and provide a framework to analyze variances from standard. This structure permits operating businesses to decompose any variances (both favorable and unfavorable) to various causal factors. This decomposition provides a framework to help companies to revise budgets. Throughout the year companies revise their volume forecasts and operating budgets for the balance of the year. More importantly, this process guides operational decisions such as adding or reducing staff. Standard cost accounting can be highly granular and sophisticated. We present a simple example. You are the financial analyst at a company that manufactures commemorative pins. Your company produces three products: bronze pins, silver pins and gold pins. Your company's industrial engineer has established the following standard costs per unit for each of the three products. Industrial engineers find ways to eliminate wastefulness in production processes. 'They devise efficient systems that integrate workers, machines, materials, information, and energy to make a product or provide a service.' Bureau of Labor Statistics The standard unit costs have been established for the following expense components: Direct Labor Direct Materials Variable Overhead The full cost (payroll plus benefits) of the employees directly related to the production of a single unit of the product Purchased materials consumed in the production of a single unit of the product Overhead which is driven by the level of production such as electricity, direct supervision on the production line, uniforms for the production staff Overhead which is not driven by the level of production such as management, rent, office equipment. Fixed Overhead Bronze Silver Gold 21 53 22 6 17 33 Direct Labor Standard Cost Direct Materials Per Unit Variable Overhead Fixed Overhead 12 6 8 8 12 11 Standard Cost Accounting requires that a budget be created in advance of a period. The budget is based on a forecasted volumes of production for each product. The budgeted volumes permits the establishment of standard cost per unit of expenses that are not fully variable (fixed and semi-fixed). For each product and cost component, the standard cost per unit is multiplied by the budgeted volumes to develop the budget. You are now half way through the fiscal year and have the results of the first six months. Let's first use the standard cost accounting framework to analyze the six-months of actual results. We will then apply this fundamental understanding of the half-year actual results to develop a revised budget for the second half and to decide whether to: Adjust the budget for the second half of the year? Increase/decrease factory workers (direct labor) to respond to your full-year outlook. Adjust overhead to respond to your full-year outlook. Write formulas in the green boxes below to calculate the budget. Use 'S' in the formula to permit you to write one formula in the upper left box that can be copied down and across. Gold Total 6 Month Budget Sales Volumes Bronze 100 Silver 125 150 375 Direct Labor Budgeted Direct Materials Volumes at Variable Overhead Standard Cost Fixed Overhead Total On which product did your company anticipate spending the most (all cost components)? At the end of the period the Actual Volumes produced are known. Silver 6 Month Actual Sales Volumes Bronze 170 Gold 120 Total 390 100 At this time the 'Actual Volumes at Standard Costs' is calculated. This represents the expenses that hypothetically should have been incurred, based on the Actual Volumes produced and the Standard Costs Per Unit. Write formulas in the green boxes below to calculate the actual Volumes at Standard Costs. Bronze Silver Gold Total Direct Labor Actual Direct Materials Volumes at Variable Overhead Standard Cost Fixed Overhead Total On which product did your company actually spend the most (all cost components)? The 'Volume Variances' are the difference between the Actual Volumes at Standard Cost less the Budgeted Volumes at Standard Cost. It represents the difference in expenses that would be expected because Actual Volumes were different than Budgeted Volumes. A negative value is favorable as it means that the Actual expense was less than the Budgeted expense. Write formulas in the green boxes below to calculate the Volume Variances. Bronze Silver Gold Total Direct Labor Direct Materials Volume Variances Variable Overhead Fixed Overhead Total Across all products, which cost component has the most favorable Volume Variances ? During the period your company kept track of the actual expenses for each cost component. We will use this information to calculate 'Usage Variances'. If this had been tracked by product you would be able to analyze Usage Variances' at a product level. However, to keep the administrative costs down, you had decided to do this only in aggregate. Below are the Actual Expenses incurred by cost component. Bronze Silver Gold Total 15000 Actual Expenses Direct Labor Direct Materials Variable Overhead Fixed Overhead Total 5000 3000 5500 28500 The Usage Variances are the difference between the Actual Expenses less the Actual Volumes at Standard Cost. It represents the difference in expenses between Actual Expenses and what should have been expected given the volumes actually produced. It isolates how efficient you were in the consumption of resources. A negative value is favorable as it means that the Actual expenses were less than would be expected. Write formulas in the green boxes below to calculate the Volume Variances. Bronze Silver Gold Total Direct Labor Usage Variance Direct Materials Variable Overhead Fixed Overhead Total Across all products, which cost component had the most unfavorable Usage Variance? In a manufacturing plant, typically accountants process the transactions that produce the standard cost reporting and financial analysts use this reporting to explain the performance. As a financial analyst, it is your job to utilize this information to explain (and hopefully improve the efficiency of the plant. For all products and cost categories, during the first six months of the year what was the overall variance between Actual Expenses and Budget? Is this variance 'Favorable' or 'Unfavorable'? Based on the Usage Variances, which cost component has the greatest opportunity to reduce? You are scheduled to meet with the President of the company. She is expecting you to propose decisions she might take and explain your thinking. Let's focus on decisions with respect to Direct Labor: The first 6 month budget for Direct Labor was $00,000 The 6 month actual volumes at standard cost for Direct Labor was $00,000 The 6 month volume variance for Direct Labor was $0,000 The 6 month actual expense for Direct Labor was $15,000 The 6 month usage variance for Direct Labor was $0,000 The original sales budget (the one made before the year began) for volumes for the second six months were exactly the same as for the first six months. With the experience of the first six months you need to revise the volume forecast for the second six months. You have prepared the following revised forecast and are proposing it be accepted as the revised budget. Silver Original Budget Second Six Months Actual Results First Six Months Revised Forecast Second Six Months Bronze 100 170 140 125 100 110 Gold 150 120 130 Total 375 390 380 Based on the Revised Forecast you need to project the Direct Labor at Standard Costs required. Bronze Silver Gold Total Direct Labor However, if your Direct Labor staffing remains at the same level as the first half of the year it will run at $15,000. Your proposal to the President of the company should be to reduce staff to adjust for: The required staffing for the forecasted volumes at standard costs during the second half of the year do not justify the staffing required at actual volumes during the first half. The direct labor usage variance during the first half of the year was unfavorable and that the company needs to implement efficiency improvements to achieve the standards. Businesses need to understand how efficiently they are operating and make budgetary and operational decisions to adjust to efficiently run their operations. As the world is always changing, it is a challenge to understand how resource (labor, materials, overhead) consumption aligns with efficiency standards. Variances can result from sales volumes differing from prior expectations, consuming more units of resources (e.g., hours of labor, pounds of materials) or paying more or less for units of resources than expected. The fact that a company paid more for direct labor can be decomposed to the following factors: The aggregate volume of products produced or orders shipped required more labor The mix of products produced or orders shipped required more labor The staff was less efficient than you expected The company had to pay more for workers because of a tight labor market. Standard cost accounting permits businesses to decompose variances from budgets into multiple causal factors. This decomposition makes it possible to make decisions and take actions to remedy problems or capture opportunities. The exercise is designed such that an error early in the assignment will not adversely impact later grading. Standard Cost Accounting is a methodology used in manufacturing and other operations intensive businesses (e.g. warehouses) to analyze actual performance against a set of established standards. The standards represent a model against which actual costs can be analyzed and provide a framework to analyze variances from standard. This structure permits operating businesses to decompose any variances (both favorable and unfavorable) to various causal factors. This decomposition provides a framework to help companies to revise budgets. Throughout the year companies revise their volume forecasts and operating budgets for the balance of the year. More importantly, this process guides operational decisions such as adding or reducing staff. Standard cost accounting can be highly granular and sophisticated. We present a simple example. You are the financial analyst at a company that manufactures commemorative pins. Your company produces three products: bronze pins, silver pins and gold pins. Your company's industrial engineer has established the following standard costs per unit for each of the three products. Industrial engineers find ways to eliminate wastefulness in production processes. 'They devise efficient systems that integrate workers, machines, materials, information, and energy to make a product or provide a service.' Bureau of Labor Statistics The standard unit costs have been established for the following expense components: Direct Labor Direct Materials Variable Overhead The full cost (payroll plus benefits) of the employees directly related to the production of a single unit of the product Purchased materials consumed in the production of a single unit of the product Overhead which is driven by the level of production such as electricity, direct supervision on the production line, uniforms for the production staff Overhead which is not driven by the level of production such as management, rent, office equipment. Fixed Overhead Bronze Silver Gold 21 53 22 6 17 33 Direct Labor Standard Cost Direct Materials Per Unit Variable Overhead Fixed Overhead 12 6 8 8 12 11 Standard Cost Accounting requires that a budget be created in advance of a period. The budget is based on a forecasted volumes of production for each product. The budgeted volumes permits the establishment of standard cost per unit of expenses that are not fully variable (fixed and semi-fixed). For each product and cost component, the standard cost per unit is multiplied by the budgeted volumes to develop the budget. You are now half way through the fiscal year and have the results of the first six months. Let's first use the standard cost accounting framework to analyze the six-months of actual results. We will then apply this fundamental understanding of the half-year actual results to develop a revised budget for the second half and to decide whether to: Adjust the budget for the second half of the year? Increase/decrease factory workers (direct labor) to respond to your full-year outlook. Adjust overhead to respond to your full-year outlook. Write formulas in the green boxes below to calculate the budget. Use 'S' in the formula to permit you to write one formula in the upper left box that can be copied down and across. Gold Total 6 Month Budget Sales Volumes Bronze 100 Silver 125 150 375 Direct Labor Budgeted Direct Materials Volumes at Variable Overhead Standard Cost Fixed Overhead Total On which product did your company anticipate spending the most (all cost components)? At the end of the period the Actual Volumes produced are known. Silver 6 Month Actual Sales Volumes Bronze 170 Gold 120 Total 390 100 At this time the 'Actual Volumes at Standard Costs' is calculated. This represents the expenses that hypothetically should have been incurred, based on the Actual Volumes produced and the Standard Costs Per Unit. Write formulas in the green boxes below to calculate the actual Volumes at Standard Costs. Bronze Silver Gold Total Direct Labor Actual Direct Materials Volumes at Variable Overhead Standard Cost Fixed Overhead Total On which product did your company actually spend the most (all cost components)? The 'Volume Variances' are the difference between the Actual Volumes at Standard Cost less the Budgeted Volumes at Standard Cost. It represents the difference in expenses that would be expected because Actual Volumes were different than Budgeted Volumes. A negative value is favorable as it means that the Actual expense was less than the Budgeted expense. Write formulas in the green boxes below to calculate the Volume Variances. Bronze Silver Gold Total Direct Labor Direct Materials Volume Variances Variable Overhead Fixed Overhead Total Across all products, which cost component has the most favorable Volume Variances ? During the period your company kept track of the actual expenses for each cost component. We will use this information to calculate 'Usage Variances'. If this had been tracked by product you would be able to analyze Usage Variances' at a product level. However, to keep the administrative costs down, you had decided to do this only in aggregate. Below are the Actual Expenses incurred by cost component. Bronze Silver Gold Total 15000 Actual Expenses Direct Labor Direct Materials Variable Overhead Fixed Overhead Total 5000 3000 5500 28500 The Usage Variances are the difference between the Actual Expenses less the Actual Volumes at Standard Cost. It represents the difference in expenses between Actual Expenses and what should have been expected given the volumes actually produced. It isolates how efficient you were in the consumption of resources. A negative value is favorable as it means that the Actual expenses were less than would be expected. Write formulas in the green boxes below to calculate the Volume Variances. Bronze Silver Gold Total Direct Labor Usage Variance Direct Materials Variable Overhead Fixed Overhead Total Across all products, which cost component had the most unfavorable Usage Variance? In a manufacturing plant, typically accountants process the transactions that produce the standard cost reporting and financial analysts use this reporting to explain the performance. As a financial analyst, it is your job to utilize this information to explain (and hopefully improve the efficiency of the plant. For all products and cost categories, during the first six months of the year what was the overall variance between Actual Expenses and Budget? Is this variance 'Favorable' or 'Unfavorable'? Based on the Usage Variances, which cost component has the greatest opportunity to reduce? You are scheduled to meet with the President of the company. She is expecting you to propose decisions she might take and explain your thinking. Let's focus on decisions with respect to Direct Labor: The first 6 month budget for Direct Labor was $00,000 The 6 month actual volumes at standard cost for Direct Labor was $00,000 The 6 month volume variance for Direct Labor was $0,000 The 6 month actual expense for Direct Labor was $15,000 The 6 month usage variance for Direct Labor was $0,000 The original sales budget (the one made before the year began) for volumes for the second six months were exactly the same as for the first six months. With the experience of the first six months you need to revise the volume forecast for the second six months. You have prepared the following revised forecast and are proposing it be accepted as the revised budget. Silver Original Budget Second Six Months Actual Results First Six Months Revised Forecast Second Six Months Bronze 100 170 140 125 100 110 Gold 150 120 130 Total 375 390 380 Based on the Revised Forecast you need to project the Direct Labor at Standard Costs required. Bronze Silver Gold Total Direct Labor However, if your Direct Labor staffing remains at the same level as the first half of the year it will run at $15,000. Your proposal to the President of the company should be to reduce staff to adjust for: The required staffing for the forecasted volumes at standard costs during the second half of the year do not justify the staffing required at actual volumes during the first half. The direct labor usage variance during the first half of the year was unfavorable and that the company needs to implement efficiency improvements to achieve the standards