Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the information provided by the Statement of Cash Flows, specify two questions that you would ask management if you were a financial analyst attempting

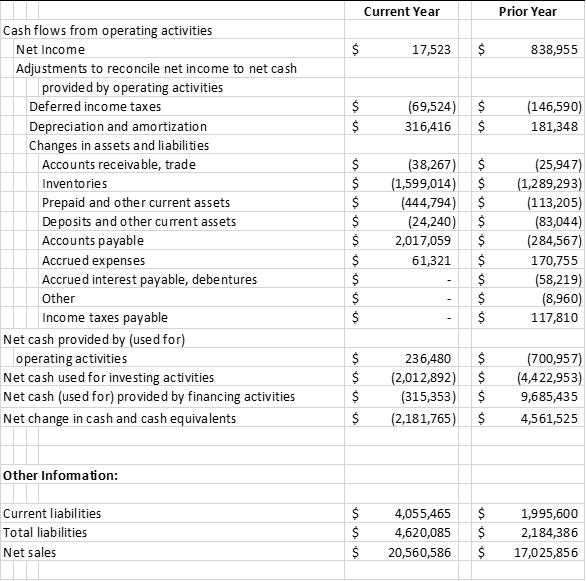

Using the information provided by the Statement of Cash Flows, specify two questions that you would ask management if you were a financial analyst attempting to issue a buy / sell. recommendation to clients. Explain why you would ask each question.

Current Year Prior Year Cash flows from operating activities 838,955 Net Income Adjustments to reconcile net income to net cash provided by operating activities 17,523 (69,524) $ Deferred income taxes (146,590) Depreciation and amortization $ 316,416 181,348 Changes in assets and liabilities Accounts receivable, trade (38,267) $ $ $ (25,947) (1,289,293) (113,205) (83,044) (284,567) Inventories (1,599,014) $ Prepaid and other current assets De posits and other current assets Accounts payable Accrued expenses Accrued interest payable, debentures (444,794) $ (24,240) $ 2,017,059 $ $ 61,321 170,755 (58,219) (8,960) Other Income taxes payable $ $ 117,810 Net cash provided by (used for) operating activities Net cash used for investing activities Net cash (used for) provided by financing activities (700,957) (4,422,953) 236,480 (2,012,892) $ $ (315,353) 2$ 9,685,435 Net change in cash and cash equivalents (2,181,765) 4,561,525 Other Infomation: Current liabilities $ $ $ $ 4,055,465 1,995,600 Total liabilities 4,620,085 2,184,386 Net sales $ 20,560,586 $ 17,025,856

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Why has the depreciation increased by 175 Was there any purchase of high ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started