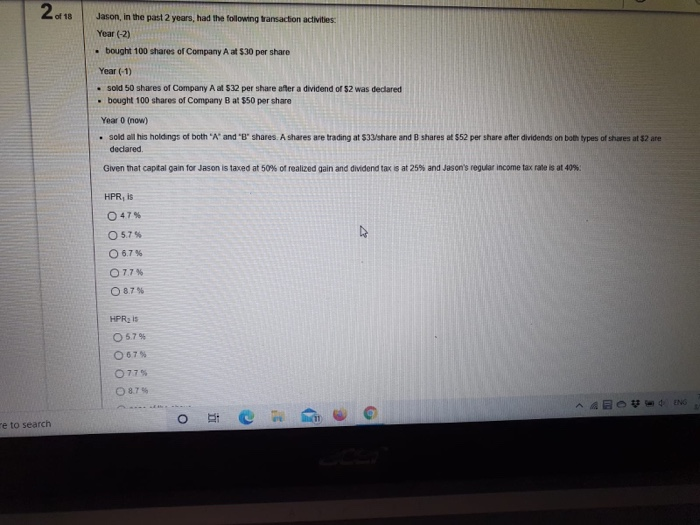

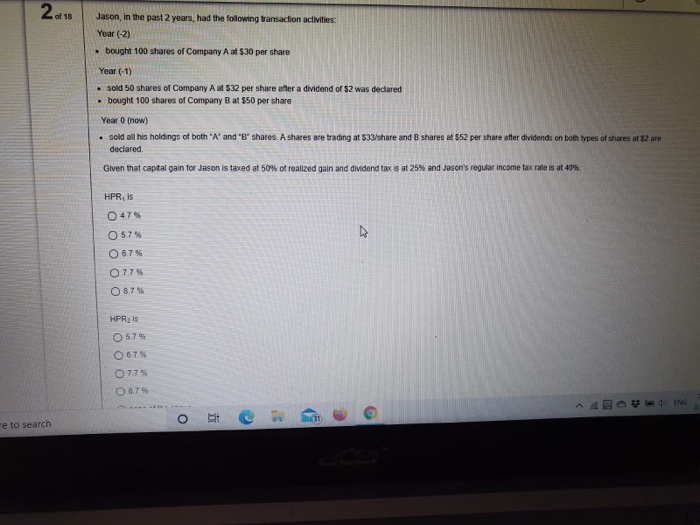

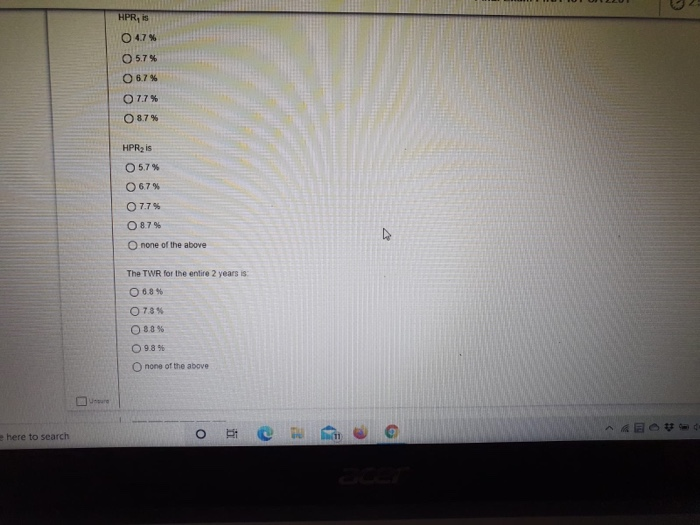

.but wes of Company A $1 per she Year . She pershare there is - 10 of Companyats per Yew of dams Ashares we trading when she was 04 OS 0775 OS OSS 067 0775 O. OS OTS 2018 of 18 Jason, in the past 2 years, had the following transaction activities: Year (-2) bought 100 shares of Company A at $30 per share Year (-1) sold 50 shares of Company A at 532 per share after a dividend of 2 was declared bought 100 shares of Company B at $50 per share Year 0 (now) sold all his holdings of both 'A' and 'B' shares. A shares are trading at $33/share and shares af 552 per share after dividends on both types of shares at $2 are declared Given that capital gain for Jason is taxed at 50% of realized gain and dividend tax is at 25% and Jason's regular income tax rate is at 40% HPR, is O 47% 0575 06.7% O 7.7% O 8.7% HPR, IS 5.7% 0679 0775 8.7% O me to search 2018 of 18 Jason, in the past 2 years, had the following transaction activities: Year (-2) bought 100 shares of Company A at $30 per share Year (-1) sold 50 shares of Company A at 532 per share after a dividend of 2 was declared bought 100 shares of Company B at $50 per share Year 0 (now) sold all his holdings of both 'A' and 'B' shares. A shares are trading at $33/share and shares af 552 per share after dividends on both types of shares at $2 are declared Given that capital gain for Jason is taxed at 50% of realized gain and dividend tax is at 25% and Jason's regular income tax rate is at 40% HPR, is O 47% 0575 06.7% O 7.7% O 8.7% HPR, IS 5.7% 0679 0775 8.7% O me to search HPR, is O 47% 0 5.7% O 6.7% 07.7% 8.7% HPR is 5.7% 67% 07.7% 8.7% O none of the above The TWR for the entire 2 years is O 0.8% 78% 8.8% O 98% none of the above e here to search o .but wes of Company A $1 per she Year . She pershare there is - 10 of Companyats per Yew of dams Ashares we trading when she was 04 OS 0775 OS OSS 067 0775 O. OS OTS 2018 of 18 Jason, in the past 2 years, had the following transaction activities: Year (-2) bought 100 shares of Company A at $30 per share Year (-1) sold 50 shares of Company A at 532 per share after a dividend of 2 was declared bought 100 shares of Company B at $50 per share Year 0 (now) sold all his holdings of both 'A' and 'B' shares. A shares are trading at $33/share and shares af 552 per share after dividends on both types of shares at $2 are declared Given that capital gain for Jason is taxed at 50% of realized gain and dividend tax is at 25% and Jason's regular income tax rate is at 40% HPR, is O 47% 0575 06.7% O 7.7% O 8.7% HPR, IS 5.7% 0679 0775 8.7% O me to search 2018 of 18 Jason, in the past 2 years, had the following transaction activities: Year (-2) bought 100 shares of Company A at $30 per share Year (-1) sold 50 shares of Company A at 532 per share after a dividend of 2 was declared bought 100 shares of Company B at $50 per share Year 0 (now) sold all his holdings of both 'A' and 'B' shares. A shares are trading at $33/share and shares af 552 per share after dividends on both types of shares at $2 are declared Given that capital gain for Jason is taxed at 50% of realized gain and dividend tax is at 25% and Jason's regular income tax rate is at 40% HPR, is O 47% 0575 06.7% O 7.7% O 8.7% HPR, IS 5.7% 0679 0775 8.7% O me to search HPR, is O 47% 0 5.7% O 6.7% 07.7% 8.7% HPR is 5.7% 67% 07.7% 8.7% O none of the above The TWR for the entire 2 years is O 0.8% 78% 8.8% O 98% none of the above e here to search o