Question

Buttercup is a family business specializing in the development and production of commercially packaged baby foods. The objective of the business is to maximize the

Buttercup is a family business specializing in the development and production of commercially packaged baby foods. The objective of the business is to maximize the shareholders wealth. Buttercup has three divisions. A variety of food products are manufactured in two of the divisions: Buttercup Jar Foods (Jar) and Buttercup Cereal Foods (Cereal). The third division - R&D - does research on new flavours and develops new healthy products based on consumer research. R&D is considered to be vital to the survival and growth of Buttercup. Currently, Economic Value Added (EVA) is used to measure divisional performance. However, there has been disagreement at Buttercups board level regarding the appropriate choice of divisional performance measure. Some directors have been questioning the value of EVA, complaining that it is too complicated to understand. Residual Income (RI) and Return on Investment (ROI) have been proposed as alternatives. The board is evaluating these alternative measures, and are considering using them to evaluate Jar division as a start. The following data has been gathered about Jar Division for the past year.

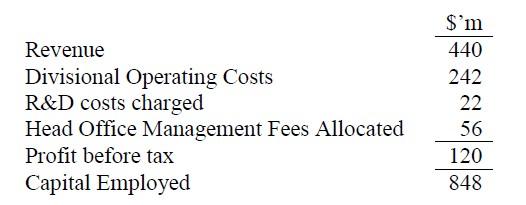

Notes: (1) The notional cost of capital for Jar division is estimated to be 11%, WACC for Buttercup at 7.5%. (2) ROI for similar entities in the industry is at 20%. (3) EVA of Jar division is calculated as $70m.

Required: (a) Evaluate the use of EVA for performance assessment of the three divisions at Buttercup. (8 marks) (b) Based on available information for Jar division, explain by showing clear computations the different possible computations of ROI and RI for the division. Compare the suitability of the different computations for evaluation of Jar divisions performance. (Round up your computations to one decimal place of a percentage for ROI and $m for RI.) (18 marks)

Revenue Divisional Operating Costs R&D costs charged Head Office Management Fees Allocated Profit before tax Capital Employed $'m 440 242 22 56 120 848 Revenue Divisional Operating Costs R&D costs charged Head Office Management Fees Allocated Profit before tax Capital Employed $'m 440 242 22 56 120 848Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started