Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Button Productions Francine Smeritt founded Buttons Productions (BP) in 2020. BP is an entertainment facility located on 5 acres of land near a major Canadian

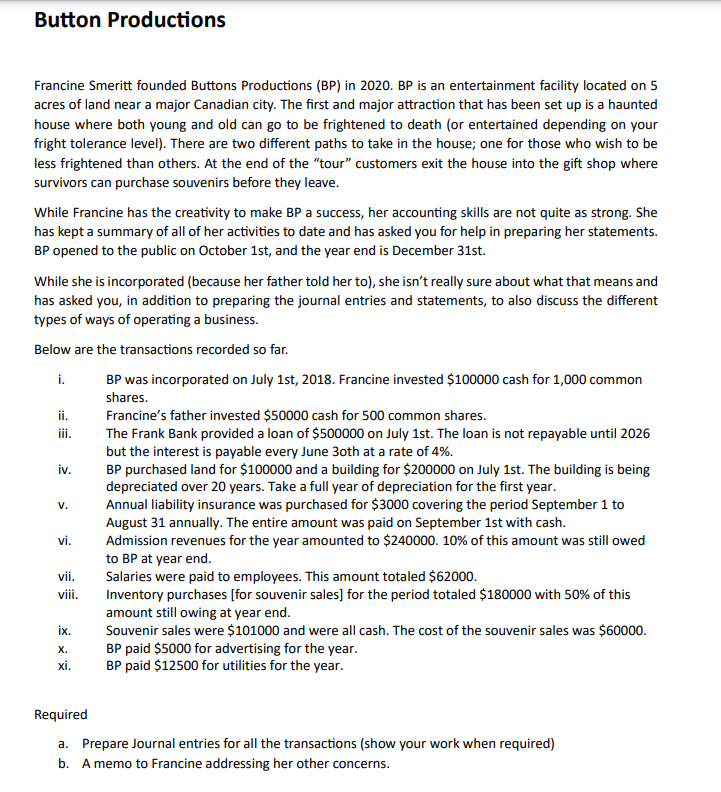

Button Productions Francine Smeritt founded Buttons Productions (BP) in 2020. BP is an entertainment facility located on 5 acres of land near a major Canadian city. The first and major attraction that has been set up is a haunted house where both young and old can go to be frightened to death (or entertained depending on your fright tolerance level). There are two different paths to take in the house; one for those who wish to be less frightened than others. At the end of the "tour" customers exit the house into the gift shop where survivors can purchase souvenirs before they leave. While Francine has the creativity to make BP a success, her accounting skills are not quite as strong. She has kept a summary of all of her activities to date and has asked you for help in preparing her statements. BP opened to the public on October 1st, and the year end is December 31st. While she is incorporated (because her father told her to), she isn't really sure about what that means and has asked you, in addition to preparing the journal entries and statements, to also discuss the different types of ways of operating a business. Below are the transactions recorded so far. i. BP was incorporated on July 1st, 2018. Francine invested $100000 cash for 1,000 common shares. ii. Francine's father invested $50000 cash for 500 common shares. iii. The Frank Bank provided a loan of $500000 on July 1 st. The loan is not repayable until 2026 but the interest is payable every June 3 oth at a rate of 4%. iv. BP purchased land for $100000 and a building for $200000 on July 1 st. The building is being depreciated over 20 years. Take a full year of depreciation for the first year. v. Annual liability insurance was purchased for $3000 covering the period September 1 to August 31 annually. The entire amount was paid on September 1 st with cash. vi. Admission revenues for the year amounted to $240000. 10% of this amount was still owed to BP at year end. vii. Salaries were paid to employees. This amount totaled $62000. viii. Inventory purchases [for souvenir sales] for the period totaled $180000 with 50% of this amount still owing at year end. ix. Souvenir sales were $101000 and were all cash. The cost of the souvenir sales was $60000. x. BP paid $5000 for advertising for the year. xi. BP paid $12500 for utilities for the year. Required a. Prepare Journal entries for all the transactions (show your work when required) b. A memo to Francine addressing her other concerns

Button Productions Francine Smeritt founded Buttons Productions (BP) in 2020. BP is an entertainment facility located on 5 acres of land near a major Canadian city. The first and major attraction that has been set up is a haunted house where both young and old can go to be frightened to death (or entertained depending on your fright tolerance level). There are two different paths to take in the house; one for those who wish to be less frightened than others. At the end of the "tour" customers exit the house into the gift shop where survivors can purchase souvenirs before they leave. While Francine has the creativity to make BP a success, her accounting skills are not quite as strong. She has kept a summary of all of her activities to date and has asked you for help in preparing her statements. BP opened to the public on October 1st, and the year end is December 31st. While she is incorporated (because her father told her to), she isn't really sure about what that means and has asked you, in addition to preparing the journal entries and statements, to also discuss the different types of ways of operating a business. Below are the transactions recorded so far. i. BP was incorporated on July 1st, 2018. Francine invested $100000 cash for 1,000 common shares. ii. Francine's father invested $50000 cash for 500 common shares. iii. The Frank Bank provided a loan of $500000 on July 1 st. The loan is not repayable until 2026 but the interest is payable every June 3 oth at a rate of 4%. iv. BP purchased land for $100000 and a building for $200000 on July 1 st. The building is being depreciated over 20 years. Take a full year of depreciation for the first year. v. Annual liability insurance was purchased for $3000 covering the period September 1 to August 31 annually. The entire amount was paid on September 1 st with cash. vi. Admission revenues for the year amounted to $240000. 10% of this amount was still owed to BP at year end. vii. Salaries were paid to employees. This amount totaled $62000. viii. Inventory purchases [for souvenir sales] for the period totaled $180000 with 50% of this amount still owing at year end. ix. Souvenir sales were $101000 and were all cash. The cost of the souvenir sales was $60000. x. BP paid $5000 for advertising for the year. xi. BP paid $12500 for utilities for the year. Required a. Prepare Journal entries for all the transactions (show your work when required) b. A memo to Francine addressing her other concerns Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started