Buy, Sell or Hold using 2 methods below Absolute Valuation Method and Relative Valuation Method for Walmart. Explain both methods.

Scenario: you are an analyst presenting your recommendation (is your stock undervalued or overvalued) and the rationale behind it.

1. Clearly show your calculations to back your opinion (rating).

2. Why is this stock under or overvalued?

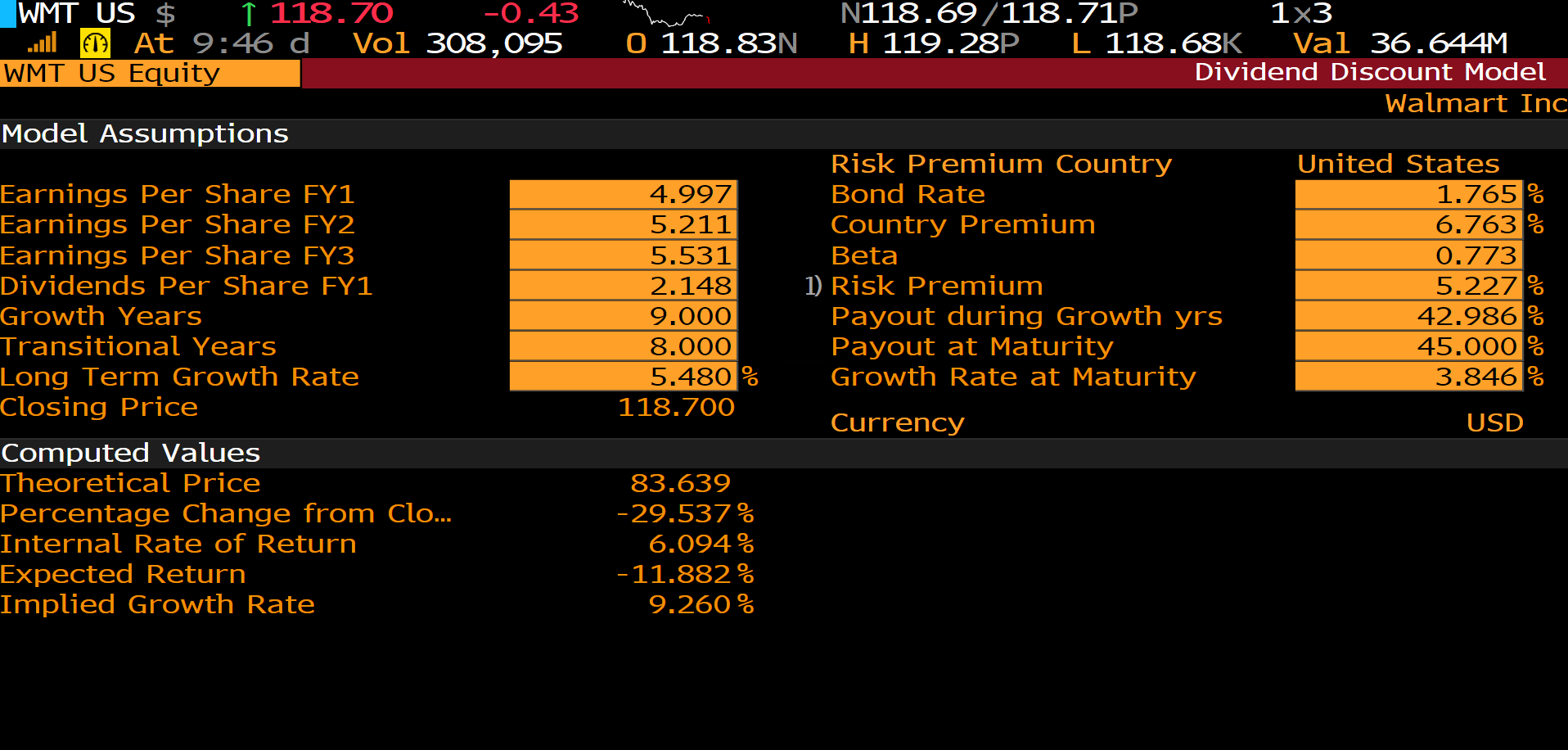

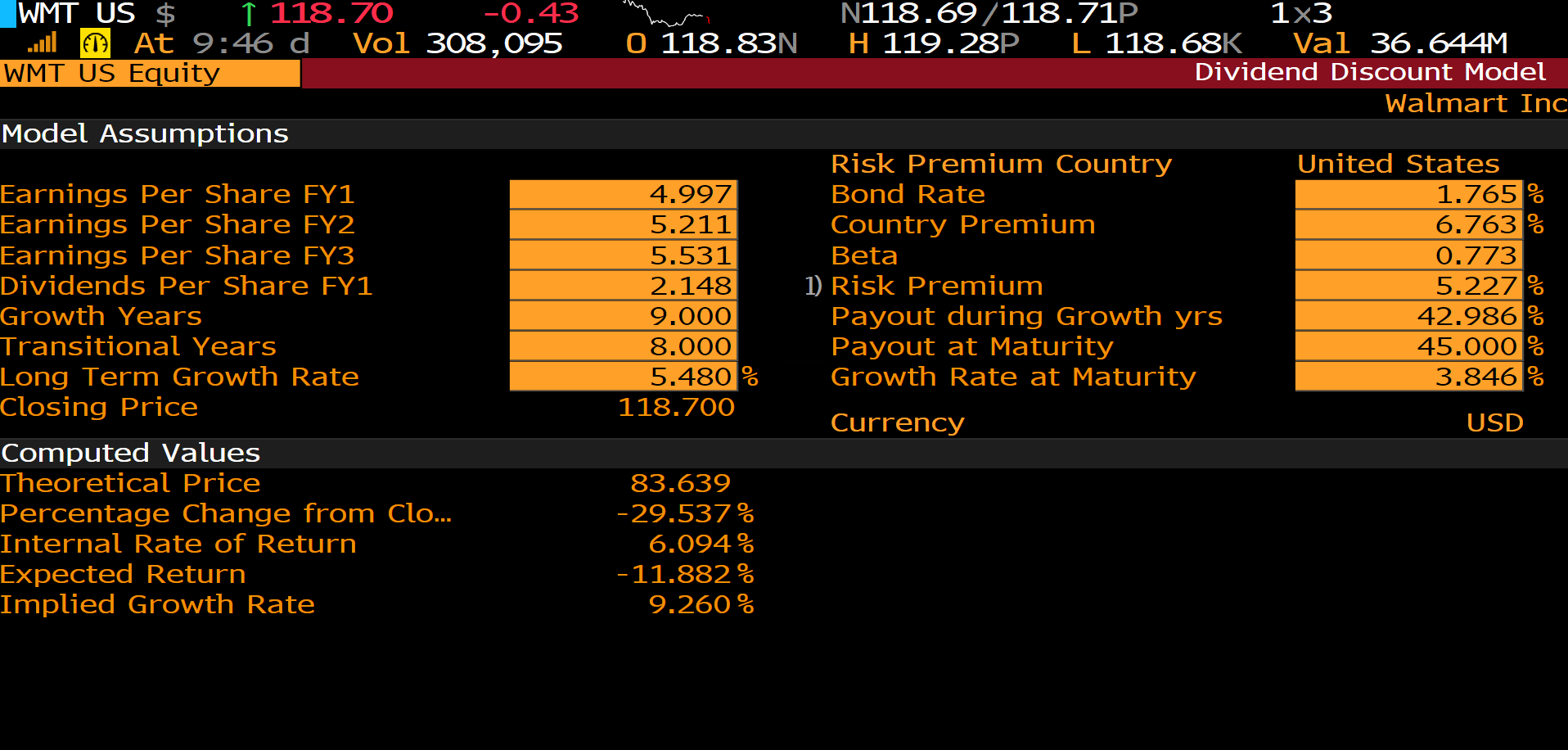

Absolute Valuation Method: DDM

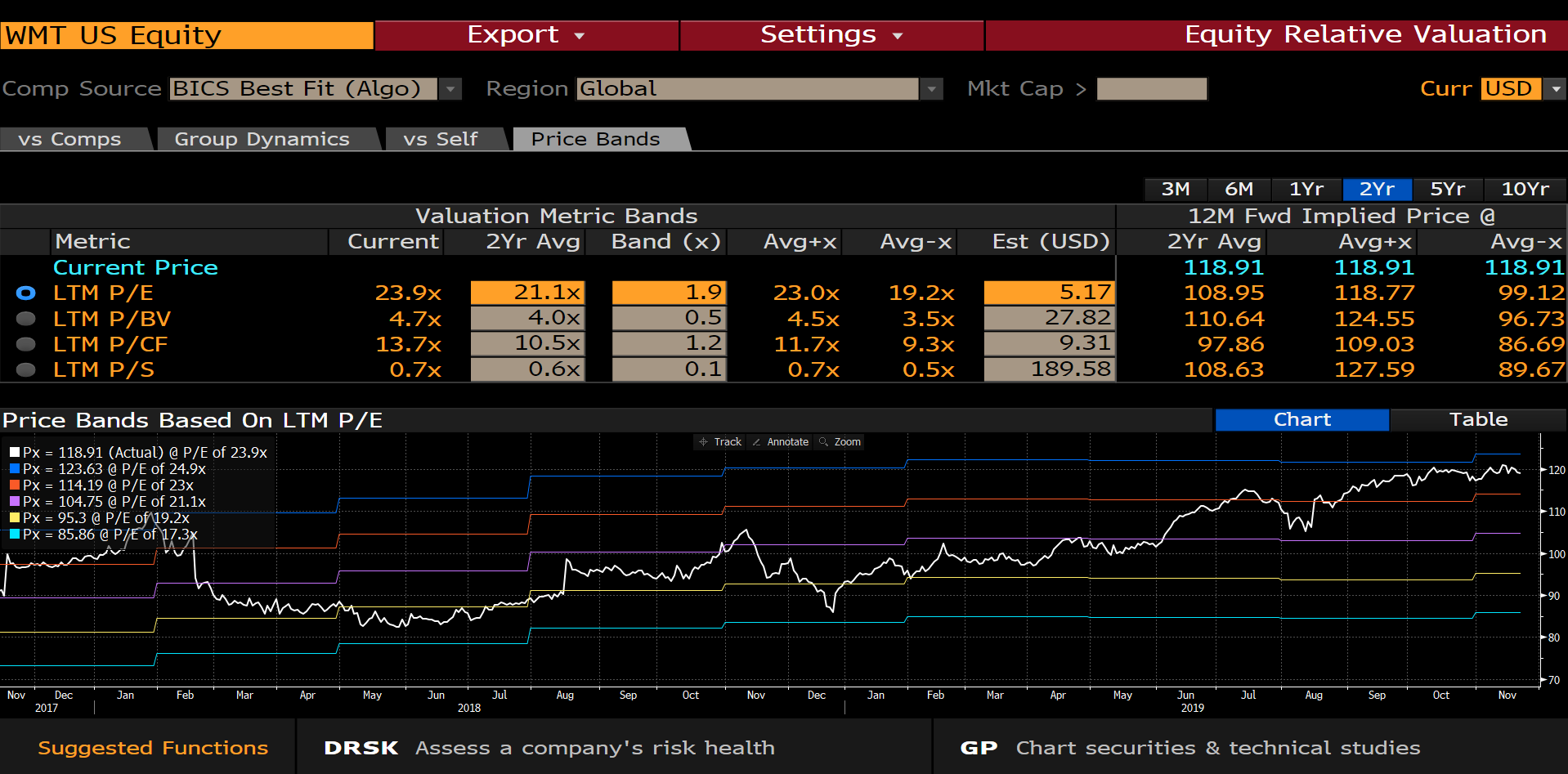

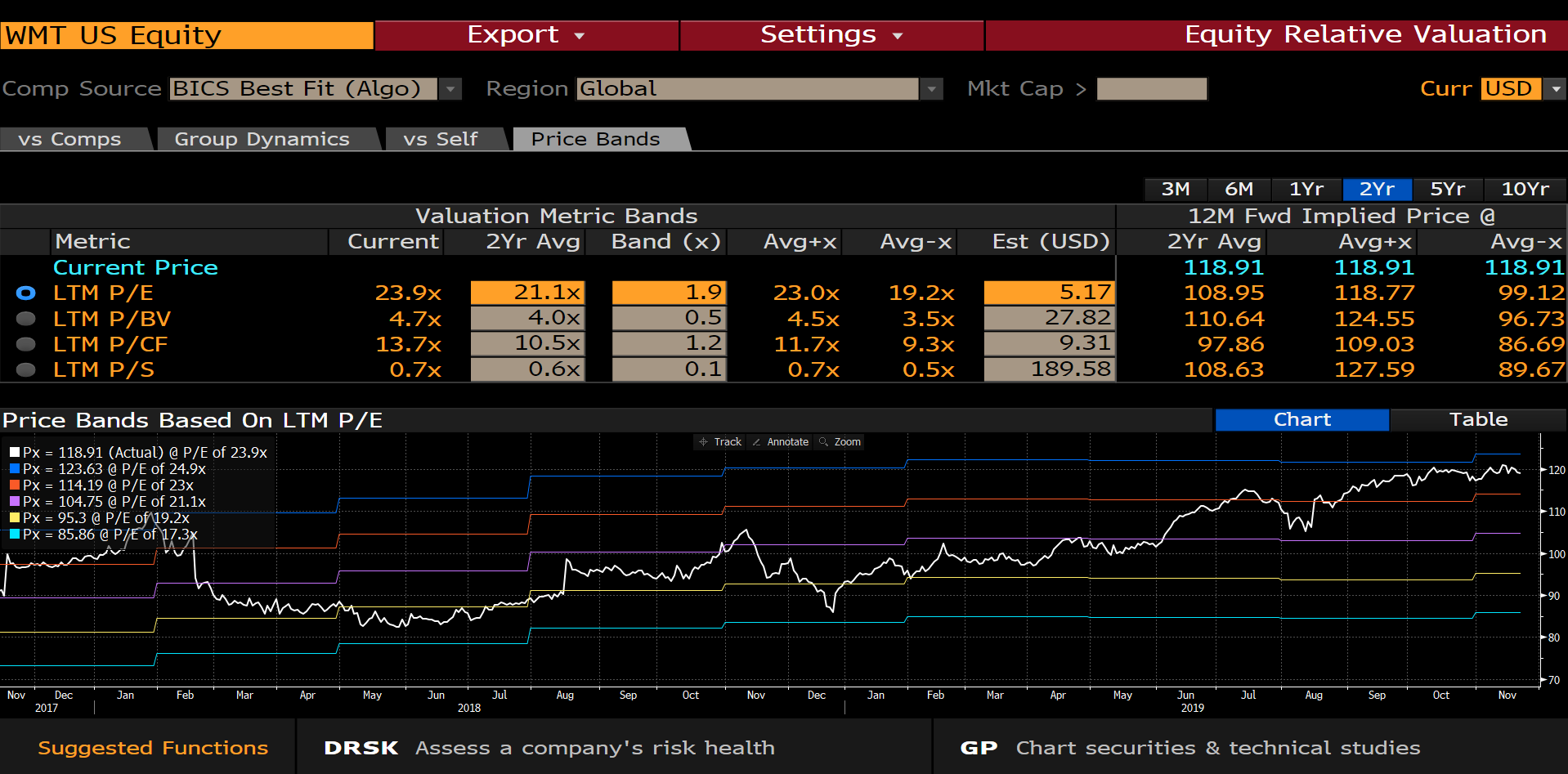

Relative Valuation Method: PEBD

WMT US $ 1 118.70 -0.43 ... At 9:46 d Vol 308,095 WMT US Equity 0 118.83N N118.69/118.71P 1x3 H 119.28P L 118.68K Val 36.644M Dividend Discount Model Walmart Inc Model Assumptions Risk Premium Country Bond Rate Country Premium Beta 1) Risk Premium Payout during Growth yrs Payout at Maturity Growth Rate at Maturity 4.997 5.211 5.531 2.148 9.000 8.000 5.480% 118.700 United States 1.765% 6.763% 0.773 5.227% 42.986 % 45.000% 3.846% Earnings Per Share FY1 Earnings Per Share FY2 Earnings Per Share FY3 Dividends Per Share FY1 Growth Years Transitional Years Long Term Growth Rate Closing Price Computed Values Theoretical Price Percentage Change from Clo... Internal Rate of Return Expected Return Implied Growth Rate Currency USD 83.639 -29.537% 6.094% -11.882% 9.260% WMT US Equity Export- Settings Equity Relative Valuation Comp Source BICS Best Fit (Algo) Region Global Mkt Cap > Curr USD vs Comps Group Dynamics vs Self Price Bands Valuation Metric Bands Current 2Yr Avg Band (x) Avg+x Avg-x Est (USD) Metric Current Price LTM P/E LTM P/BV LTM P/CF LTM P/S 3M 6M 1Yr 2Yr 5Yr 10Yr 12M Fwd Implied Price a 2Yr Avg Avg+x Avg-x 118.91 118.91 118.91 108.95 118.77 99.12 110.64 124.55 96.73 97.86 109.03 86.69 108.63 127.59 89.67 O 23.9x 4.7x 13.7x 0.7x 21.1x 4.0x 10.5x 0.6x 1.9 0.5 1.2 0.1 23.0x 4.5x 11.7x 0.7x 19.2x 3.5x 9.3x 0.5x 5.17 27.82 9.31 189.58 Price Bands Based On LTM PE Chart Table Track Annotate Zoom M 120 Px = 118.91 (Actual) @ P/E of 23.9x Px = 123.63 @ P/E of 24.9x IPX = 114.19 @ P/E of 23x Px = 104.75 @ P/E of 21.1x IPx = 95.3 @ P/E of 19.2x PX = 85.86 @ P/E of 17.3x Nov Jan Feb Mar Apr May Jun Jul Aug Sep Dec 2017 Oct Nov Dec Jan Feb Mar Apr May Jun 2019 Jul Aug Sep Oct Nov 2018 Suggested Functions DRSK Assess a company's risk health GP Chart securities & technical studies WMT US $ 1 118.70 -0.43 ... At 9:46 d Vol 308,095 WMT US Equity 0 118.83N N118.69/118.71P 1x3 H 119.28P L 118.68K Val 36.644M Dividend Discount Model Walmart Inc Model Assumptions Risk Premium Country Bond Rate Country Premium Beta 1) Risk Premium Payout during Growth yrs Payout at Maturity Growth Rate at Maturity 4.997 5.211 5.531 2.148 9.000 8.000 5.480% 118.700 United States 1.765% 6.763% 0.773 5.227% 42.986 % 45.000% 3.846% Earnings Per Share FY1 Earnings Per Share FY2 Earnings Per Share FY3 Dividends Per Share FY1 Growth Years Transitional Years Long Term Growth Rate Closing Price Computed Values Theoretical Price Percentage Change from Clo... Internal Rate of Return Expected Return Implied Growth Rate Currency USD 83.639 -29.537% 6.094% -11.882% 9.260% WMT US Equity Export- Settings Equity Relative Valuation Comp Source BICS Best Fit (Algo) Region Global Mkt Cap > Curr USD vs Comps Group Dynamics vs Self Price Bands Valuation Metric Bands Current 2Yr Avg Band (x) Avg+x Avg-x Est (USD) Metric Current Price LTM P/E LTM P/BV LTM P/CF LTM P/S 3M 6M 1Yr 2Yr 5Yr 10Yr 12M Fwd Implied Price a 2Yr Avg Avg+x Avg-x 118.91 118.91 118.91 108.95 118.77 99.12 110.64 124.55 96.73 97.86 109.03 86.69 108.63 127.59 89.67 O 23.9x 4.7x 13.7x 0.7x 21.1x 4.0x 10.5x 0.6x 1.9 0.5 1.2 0.1 23.0x 4.5x 11.7x 0.7x 19.2x 3.5x 9.3x 0.5x 5.17 27.82 9.31 189.58 Price Bands Based On LTM PE Chart Table Track Annotate Zoom M 120 Px = 118.91 (Actual) @ P/E of 23.9x Px = 123.63 @ P/E of 24.9x IPX = 114.19 @ P/E of 23x Px = 104.75 @ P/E of 21.1x IPx = 95.3 @ P/E of 19.2x PX = 85.86 @ P/E of 17.3x Nov Jan Feb Mar Apr May Jun Jul Aug Sep Dec 2017 Oct Nov Dec Jan Feb Mar Apr May Jun 2019 Jul Aug Sep Oct Nov 2018 Suggested Functions DRSK Assess a company's risk health GP Chart securities & technical studies