Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anne Murray is planning to buy a property, in addition to the family home she and Henry own, for rental purposes. She is considering

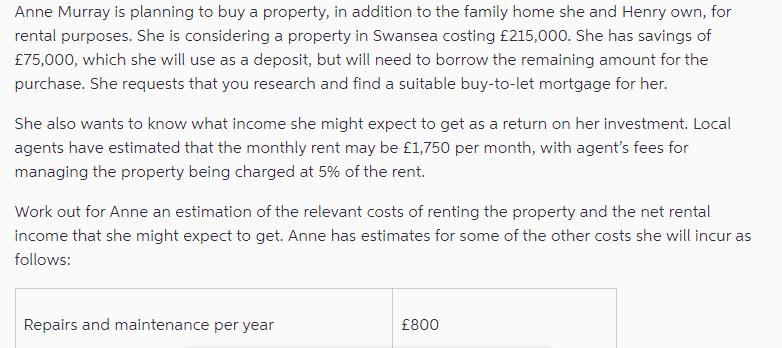

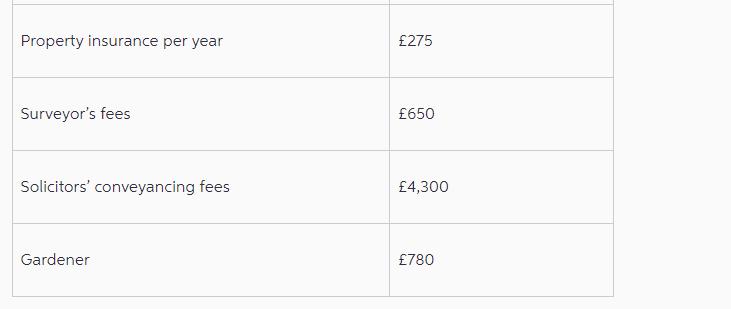

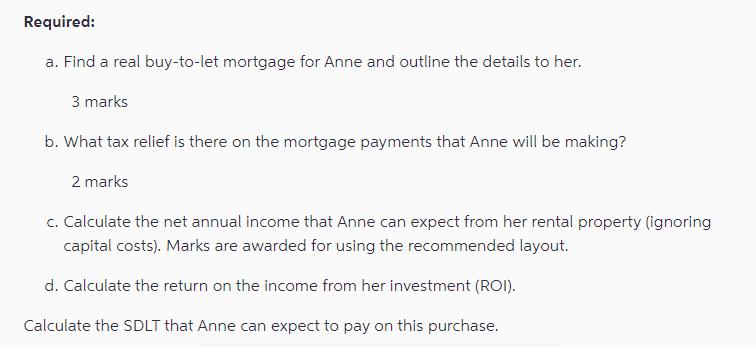

Anne Murray is planning to buy a property, in addition to the family home she and Henry own, for rental purposes. She is considering a property in Swansea costing 215,000. She has savings of 75,000, which she will use as a deposit, but will need to borrow the remaining amount for the purchase. She requests that you research and find a suitable buy-to-let mortgage for her. She also wants to know what income she might expect to get as a return on her investment. Local agents have estimated that the monthly rent may be 1,750 per month, with agent's fees for managing the property being charged at 5% of the rent. Work out for Anne an estimation of the relevant costs of renting the property and the net rental income that she might expect to get. Anne has estimates for some of the other costs she will incur as follows: Repairs and maintenance per year 800 Property insurance per year 275 Surveyor's fees Solicitors' conveyancing fees Gardener 650 4,300 780 Required: a. Find a real buy-to-let mortgage for Anne and outline the details to her. 3 marks b. What tax relief is there on the mortgage payments that Anne will be making? 2 marks c. Calculate the net annual income that Anne can expect from her rental property (ignoring capital costs). Marks are awarded for using the recommended layout. d. Calculate the return on the income from her investment (ROI). Calculate the SDLT that Anne can expect to pay on this purchase.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Value Added Tax VAT levied on the importation of flee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e61d978bde_957215.pdf

180 KBs PDF File

663e61d978bde_957215.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started