Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BuyCo, Incorporated, holds 25 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related

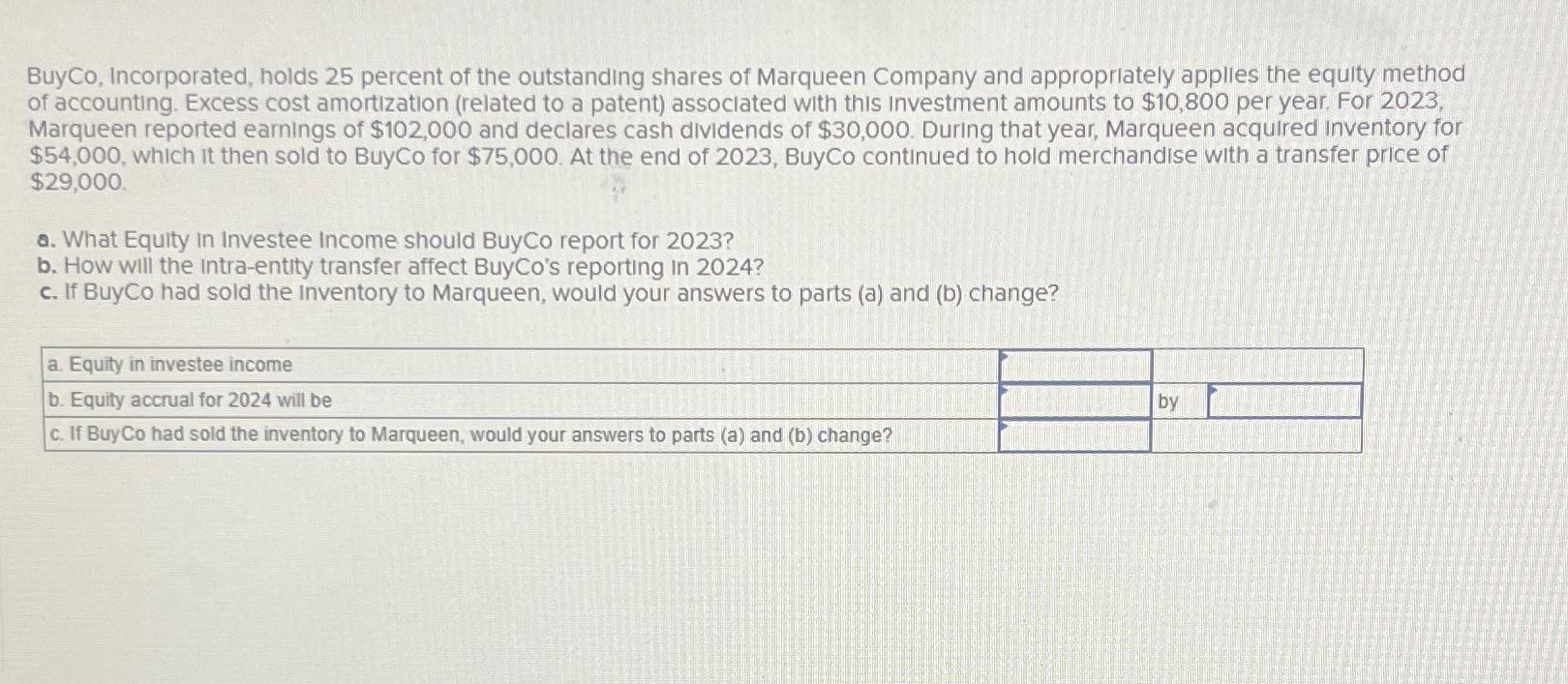

BuyCo, Incorporated, holds 25 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this Investment amounts to $10,800 per year. For 2023, Marqueen reported earnings of $102,000 and declares cash dividends of $30,000. During that year, Marqueen acquired Inventory for $54,000, which it then sold to BuyCo for $75,000. At the end of 2023, BuyCo continued to hold merchandise with a transfer price of $29,000. a. What Equity In Investee Income should BuyCo report for 2023? b. How will the intra-entity transfer affect BuyCo's reporting in 2024? c. If BuyCo had sold the inventory to Marqueen, would your answers to parts (a) and (b) change? a. Equity in investee income b. Equity accrual for 2024 will be c. If Buy Co had sold the inventory to Marqueen, would your answers to parts (a) and (b) change? by

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the image youve provided we need to determine the equity income and accrual for BuyCo under the equity method of accounting for its investmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started