Buyer B pays $10, 000 to New Orleans grain dealer D in exchange of D's promise to deliver grain to buyer B's London office on Oct. 1. As a result of signing the contract, B decides not to sign a contract with another dealer that would charge $10,500 for the grain. D ships the grain via shipping company S. In reliance to the grain delivery on time, Buyer B agrees to resell the grain on arrival in London for $11000 to another party. B pays $100 in advance (nonrefundable) as docking and unloading fees for the ship's projected arrival in London. The ship begins taking water several days out of New Orleans and returns to port. Inspection reveals that the grain is badly damaged by salt water. As a result, B purchases the same quantity of grain for delivery on Oct.1 at the price of $12,000 in order to fulfill his contract to resell the grain in London for $11,000. D refuses to return B's payment of $10000 since it insists that B was responsible for purchasing insurance that would cover such damage. B promptly sues D for breach of contract.

Question 1

Fill in the Blanks

Top of Form

If the court determines that B is entitled to expectation damages, what is the amount of damages that B should receive?

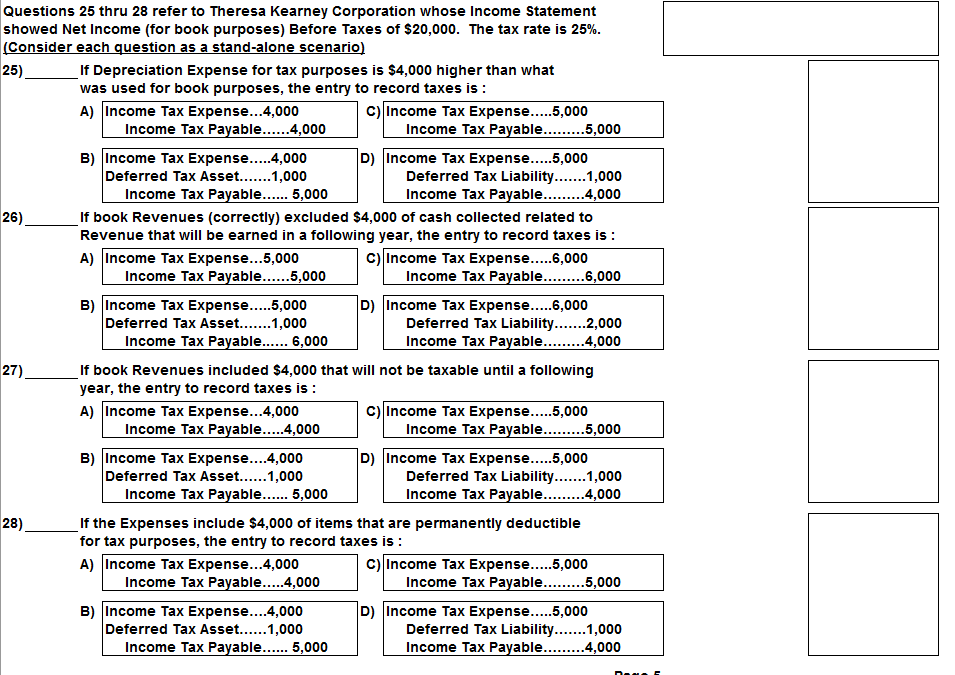

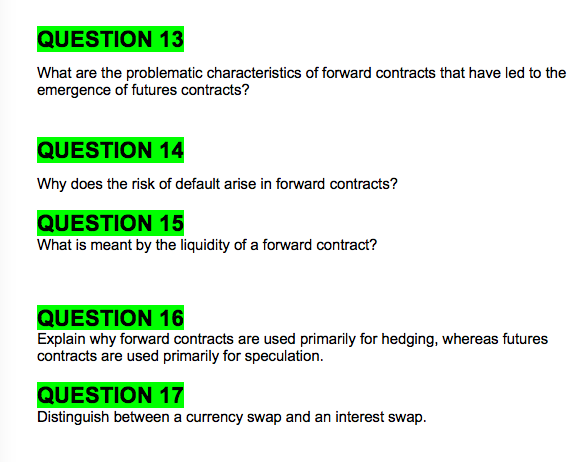

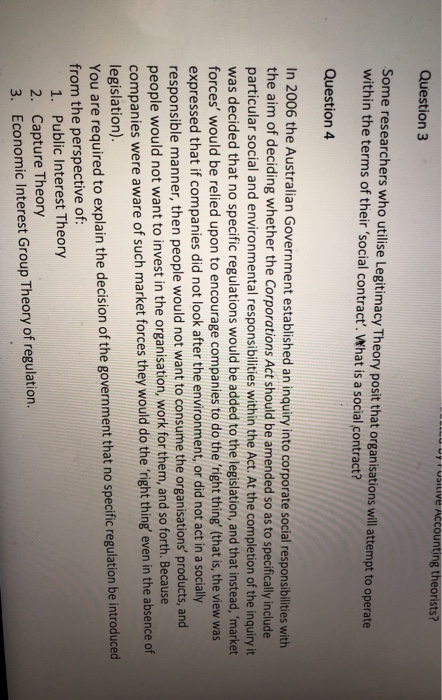

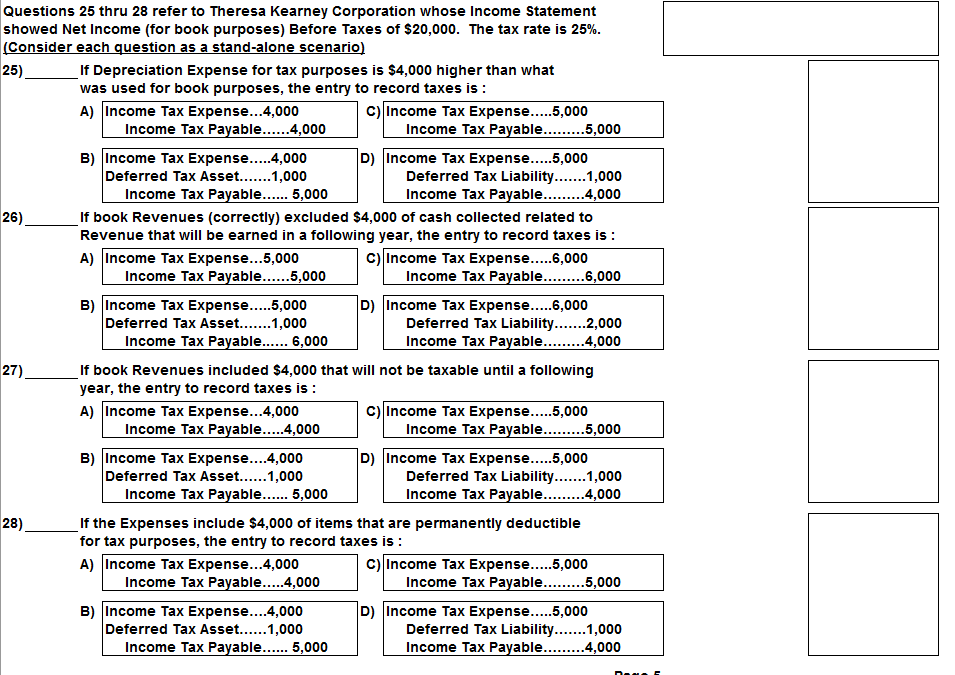

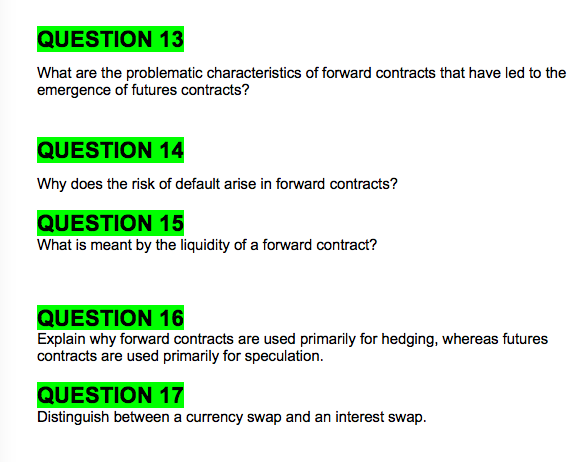

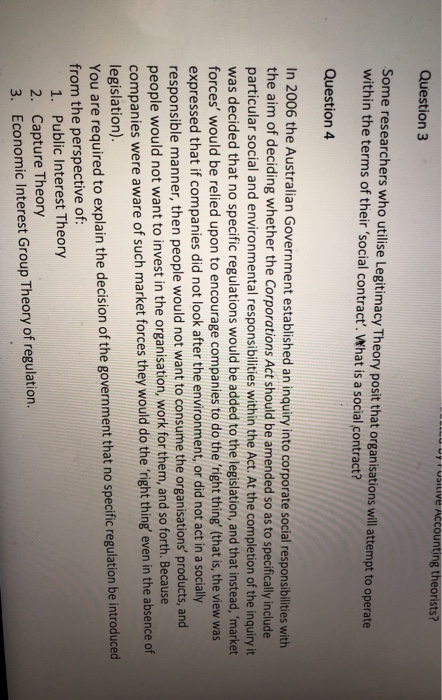

Questions 25 thru 20 refer to Theresa Kearney Corporation whose Income Statement showed Net Income [for book purposes] Before Taxes of $20,000. The tax rate is 25%. [Consider each question as a stand-alone scenario] 25] 25] 27] 29] If Depreciation Expense for tax purposes is $4,000 higher than what was used for book purposes, the entry to record taxes is : A] Income Tax Expense...4,000 Income Tax Payable......4,000 B] Income Tax Expense ..... 4,000 Deferred Tax Asset.......1,000 Income Tax Payable ...... 5,000 C] Di Income Tax Expense ..... 5,000 Income Tax Payable.........5,000 Income Tax Expense ..... 5,000 Deferred Tax Liability.......1,000 Income Tax Payable.........4,000 If book Revenues [correctly] excluded $4,000 of cash collected related to ng year, the entry to record taxes is: Revenue that will be earned in a followi A] Income Tax Expense...5,000 Income Tax Payable......5,000 0] Income Tax Expense ..... 5,000 Income Tax Payable.........6,000 B] Income Tax Expense ..... 5,000 Deferred Tax Asset.......1,000 Income Tax Payable ...... B, 000 Di Income Tax Expense ..... 5,000 Deferred Tax Liability.......2,000 Income Tax Payable.........4,000 If book Revenues included 84,000 that will not be taxable until a following year, the entry to record taxes is: A] Income Tax Expense...4,000 Income Tax Payable ..... 4,000 0] Income Tax Expense ..... 5,000 Income Tax Payable.........5,000 B] Income Tax Expense....4,000 Deferred Tax Asset......1,000 Income Tax Payable ...... 5,000 D] Income Tax Expense ..... 5,000 Deferred Tax Liability.......1,000 Income Tax Payable.........4,000 If the Expenses include 54,000 of items that are permanently deductible for tax purposes, the entry to record taxes Is : A] Income Tax Expense...4,000 0] Income Tax Expense ..... 5,000 Income Tax Payable ..... 4,000 Income Tax Payable.........5,000 B] Income Tax Expense....4,000 D] Income Tax Expense ..... 5,000 Deferred Tax Asset......1,000 Income Tax Payable ...... 5,000 Deferred Tax Liability ..... 1,000 Income Tax Payable.........4,000 QUESTION 13 What are the problematic characteristics of forward contracts that have led to the emergence of futures contracts? QUESTION 14 Why does the risk of default arise in forward contracts? QUESTION 15 What is meant by the liquidity of a forward contract? QUESTION 16 Explain why forward contracts are used primarily for hedging, whereas futures contracts are used primarily for speculation. QUESTION 17 Distinguish between a currency swap and an interest swap.Question 3 ccounting theorists? Some researchers who utilise Legitimacy Theory posit that organisations will attempt to operate within the terms of their 'social contract'. What is a social contract? Question 4 In 2006 the Australian Government established an inquiry into corporate social responsibilities with the aim of deciding whether the Corporations Act should be amended so as to specifically include particular social and environmental responsibilities within the Act. At the completion of the inquiry it was decided that no specific regulations would be added to the legislation, and that instead, 'market forces' would be relied upon to encourage companies to do the 'right thing' (that is, the view was expressed that if companies did not look after the environment, or did not act in a socially responsible manner, then people would not want to consume the organisations' products, and people would not want to invest in the organisation, work for them, and so forth. Because companies were aware of such market forces they would do the 'right thing' even in the absence of legislation). You are required to explain the decision of the government that no specific regulation be introduced from the perspective of: 1. Public Interest Theory 2. Capture Theory 3. Economic Interest Group Theory of regulation.Question 29 (2 points) In a progressive tax system, the marginal tax rate increase as income increases but the average tax rate does not change as income increases. the marginal tax rate and the average tax rate are the same for every income level and the same as income increases. D the marginal tax rate and the average tax rate decrease as income levels Increase and the marginal tax rate is less than the average tax rate. O the marginal tax rate and the average tax rate increase as income levels increase and the marginal tax rate exceeds the average tax rate. Question 30 (2 points) Social Security taxes are paid by (both employers and employees. neither employers nor employees. Oemployers only. Oemployees only. Question 31 (2 points) State and local governments receive most of their revenue from individual income taxes, social insurance contributions, and property taxes. property taxes, sales and excise taxes, and Social Security contribution. corporate income taxes, property taxes, and personal income taxes. sales and excise taxes, revenue from the federal government, and property taxes. Question 32 (2 points) Current concern about Social Security is that () the fund is growing too rapidly and would trigger inflation. D)the government is planning to phase out the program. the fund might be depleted before long and might not be there for workers who retire later. () none of the aboveQUESTION 6 Albert entered into a contract under the name of one of his corporations. After consulting with his accountant regarding tax implications, he asked, and the other party agreed, to change the name of the company in that contract. What has transpired with respect to the contract between these parties? 0 a. amendment 0 b. novation O c. substitution 0 d. assignment QUESTION 7 Although Maybelle's insurance excluded coverage for jewelry loss, her insurer mistakenly sent her a cheque to compensate her for the loss of an expensive piece of jewelry. What legal doctrine might the insurer use to recover the money that was mistakenly paid to Maybelle? O a. misrepresentation O b. frustration O c. the duty to mitigate 0 d. unjust enrichment