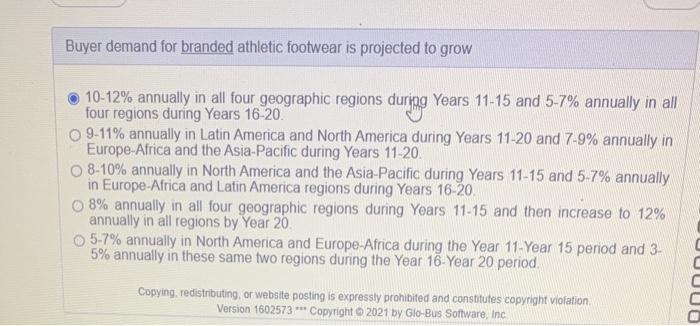

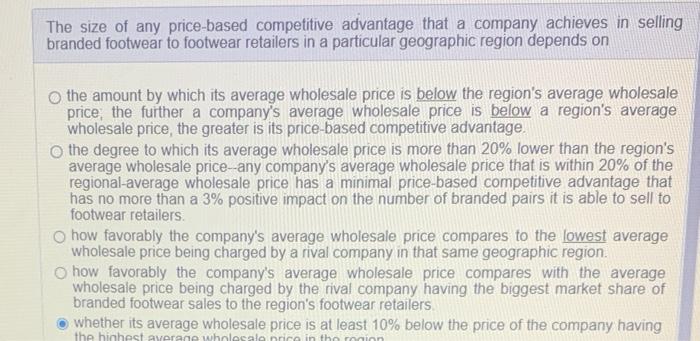

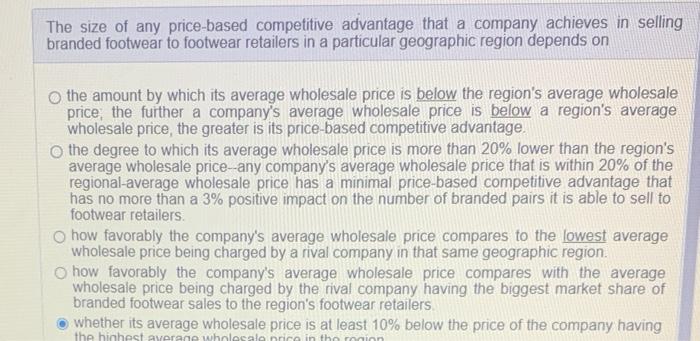

Buyer demand for branded athletic footwear is projected to grow tout polans ually in velafis yra geographic regions during Years 11-15 and 5-7% annually in all four regions during Years O9-11% annually in Latin America and North America during Years 11-20 and 7-9% annually in Europe-Africa and the Asia-Pacific during Years 11-20 O 8-10% annually in North America and the Asia-Pacific during Years 11-15 and 5-7% annually in Europe-Africa and Latin America regions during Years 16-20 O 8% annually in all four geographic regions during Years 11-15 and then increase to 12% annually in all regions by Year 20. 5-7% annually in North America and Europe Africa during the Year 11-Year 15 period and 3. 5% annually in these same two regions during the Year 16-Year 20 period Copying, redistributing, or website posting is expressly prohibited and constitutes copyright violation Version 1602573 *** Copyright 2021 by Glo-Bus Software, Inc UD The size of any price-based competitive advantage that a company achieves in selling branded footwear to footwear retailers in a particular geographic region depends on o the amount by which its average wholesale price is below the region's average wholesale price, the further a company's average wholesale price is below a region's average wholesale price, the greater is its price-based competitive advantage. o the degree to which its average wholesale price is more than 20% lower than the region's average wholesale price--any company's average wholesale price that is within 20% of the regional-average wholesale price has a minimal price-based competitive advantage that has no more than a 3% positive impact on the number of branded pairs it is able to sell to footwear retailers O how favorably the company's average wholesale price compares to the lowest average wholesale price being charged by a rival company in that same geographic region. O how favorably the company's average wholesale price compares with the average wholesale price being charged by the rival company having the biggest market share of branded footwear sales to the region's footwear retailers whether its average wholesale price is at least 10% below the price of the company having the highest average wholesale price in the