Answered step by step

Verified Expert Solution

Question

1 Approved Answer

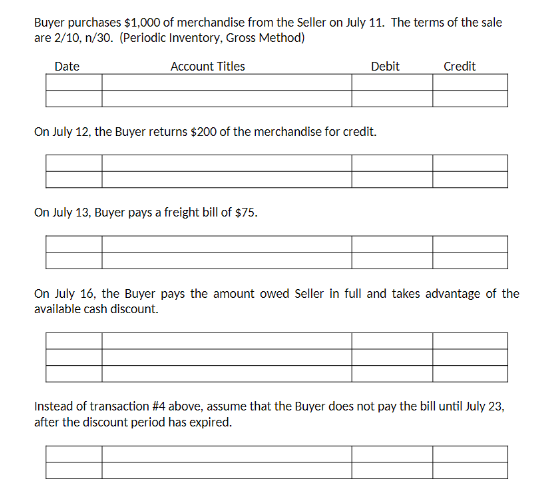

Buyer purchases $1,000 of merchandise from the Seller on July 11. The terms of the sale are 2/10, n/30. (Periodic Inventory, Gross Method) Account

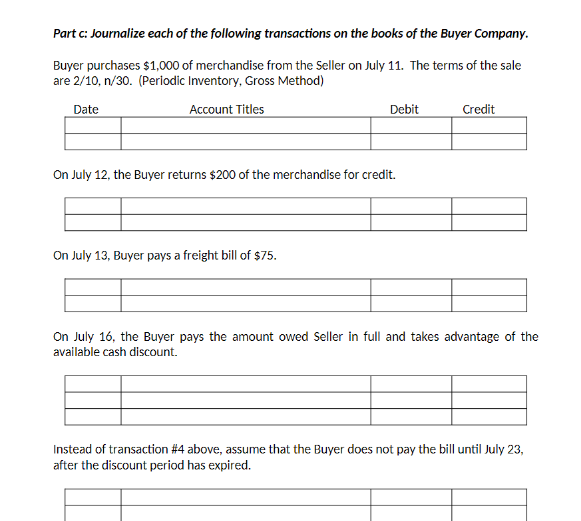

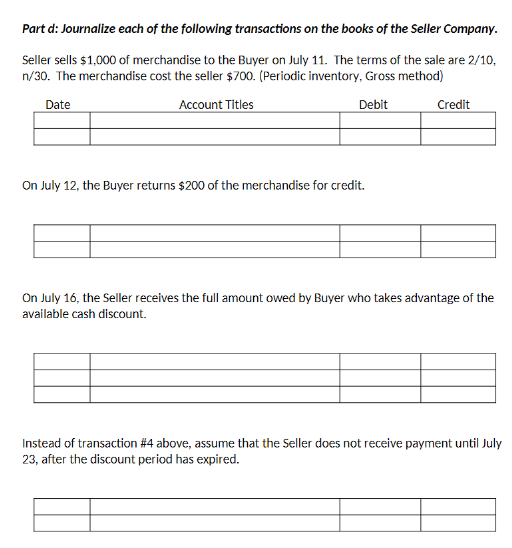

Buyer purchases $1,000 of merchandise from the Seller on July 11. The terms of the sale are 2/10, n/30. (Periodic Inventory, Gross Method) Account Titles Date Debit On July 12, the Buyer returns $200 of the merchandise for credit. On July 13, Buyer pays a freight bill of $75. Credit On July 16, the Buyer pays the amount owed Seller in full and takes advantage of the available cash discount. Instead of transaction #4 above, assume that the Buyer does not pay the bill until July 23, after the discount period has expired. Part c: Journalize each of the following transactions on the books of the Buyer Company. Buyer purchases $1,000 of merchandise from the Seller on July 11. The terms of the sale are 2/10, n/30. (Periodic Inventory, Gross Method) Account Titles Date Debit On July 12, the Buyer returns $200 of the merchandise for credit. On July 13, Buyer pays a freight bill of $75. Credit On July 16, the Buyer pays the amount owed Seller in full and takes advantage of the available cash discount. Instead of transaction #4 above, assume that the Buyer does not pay the bill until July 23, after the discount period has expired. Part d: Journalize each of the following transactions on the books of the Seller Company. Seller sells $1,000 of merchandise to the Buyer on July 11. The terms of the sale are 2/10, n/30. The merchandise cost the seller $700. (Periodic inventory, Gross method) Date Account Titles Debit On July 12, the Buyer returns $200 of the merchandise for credit. Credit On July 16, the Seller receives the full amount owed by Buyer who takes advantage of the available cash discount. Instead of transaction #4 above, assume that the Seller does not receive payment until July 23, after the discount period has expired.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution Assuming that the buyer uses the periodic inventory system and the gross method the journal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started