Answered step by step

Verified Expert Solution

Question

1 Approved Answer

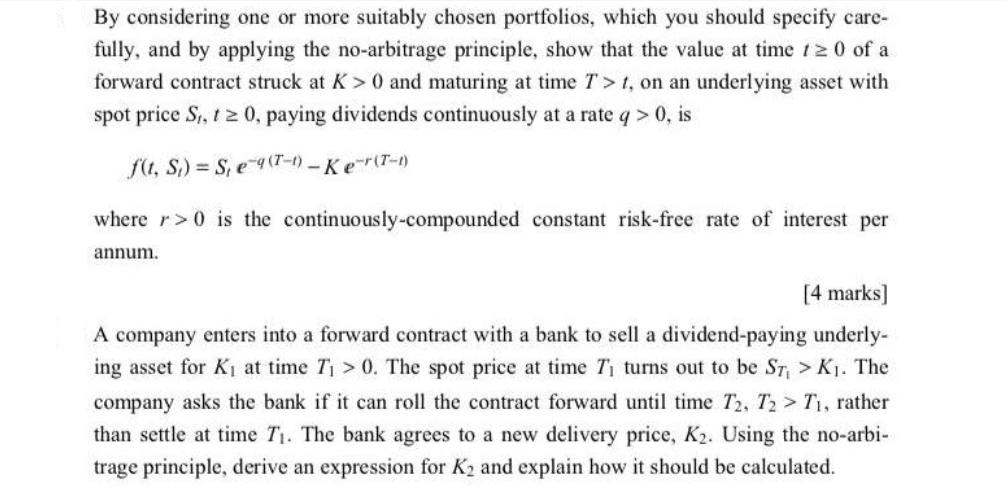

By considering one or more suitably chosen portfolios, which you should specify care- fully, and by applying the no-arbitrage principle, show that the value

By considering one or more suitably chosen portfolios, which you should specify care- fully, and by applying the no-arbitrage principle, show that the value at time 120 of a forward contract struck at K> 0 and maturing at time T> t, on an underlying asset with spot price S,, t 0, paying dividends continuously at a rate q > 0, is f(t, S)= S, e-9 (T-1)-Ke-r(T-1) where r> 0 is the continuously-compounded constant risk-free rate of interest per annum. [4 marks] A company enters into a forward contract with a bank to sell a dividend-paying underly- ing asset for K at time T > 0. The spot price at time T turns out to be ST, > K. The company asks the bank if it can roll the contract forward until time T2, T2 > T, rather than settle at time T. The bank agrees to a new delivery price, K. Using the no-arbi- trage principle, derive an expression for K and explain how it should be calculated.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To derive the expression for K2 we use the noarbitrage principle This principle ensur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started