Question

By using net asset value approach, compute the fair market values of LTC Biotech Ltd, supporting with your own logical assumptions.(show all the calculation procedures

By using net asset value approach, compute the fair market values of LTC Biotech Ltd, supporting with your own logical assumptions.(show all the calculation procedures and formula and results.)

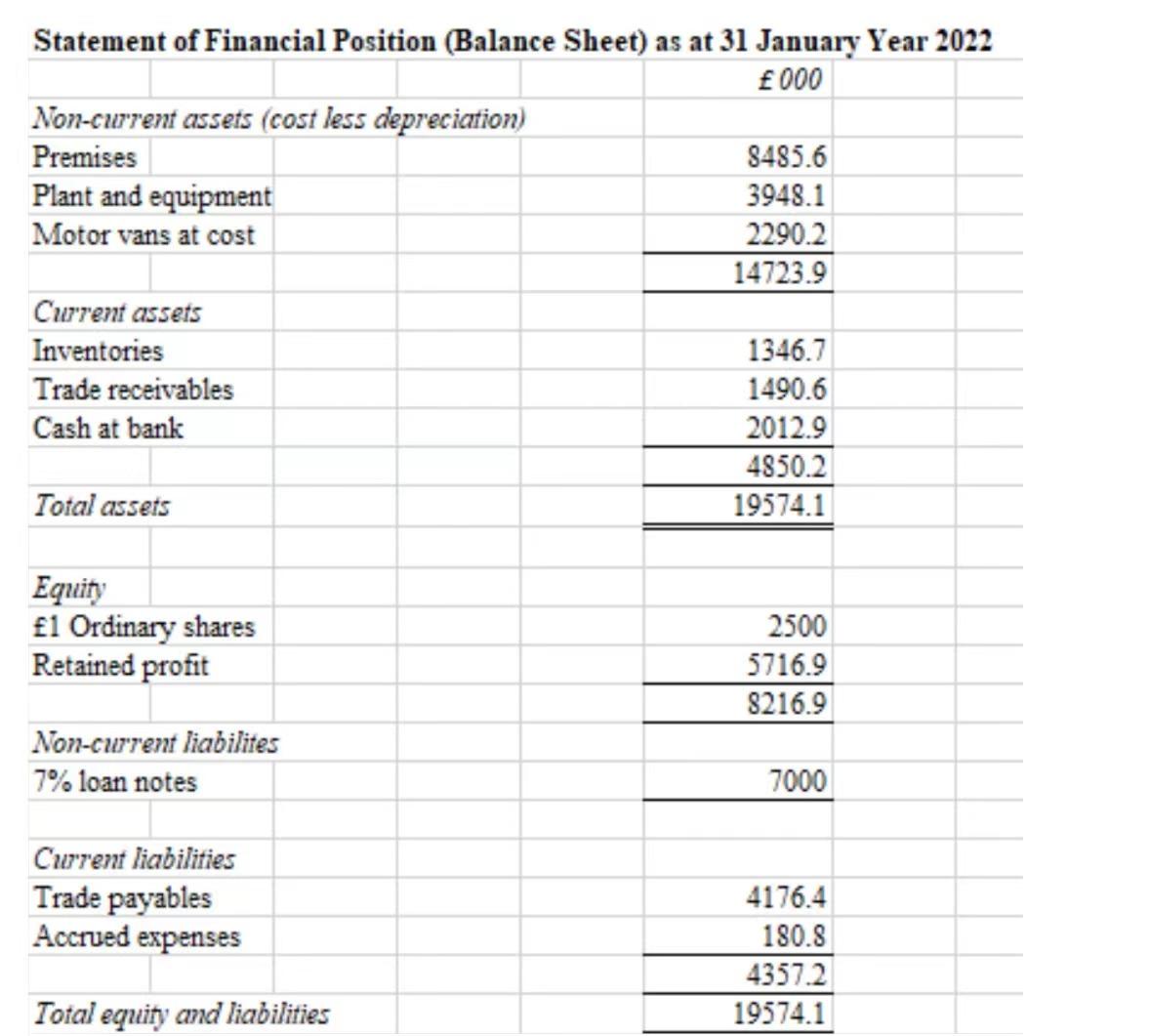

• The market value of the premises of LTC Biotech Ltd was estimated to be between £31 million and £33 million.

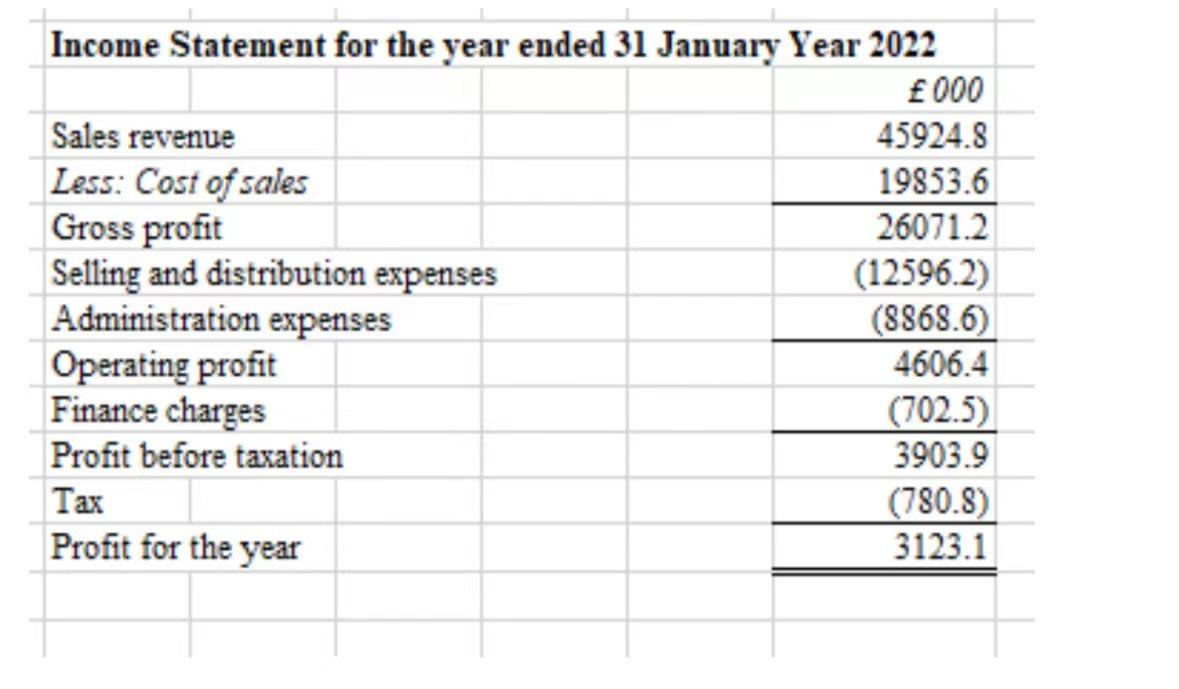

• The sales revenue of LTC Biotech Ltd is expected to grow at about 2 or 3 per cent each year over the next five years. The market is fairly competitive and there is little prospect of improved growth rate over this period. Thereafter, sales are likely to stabilise.

• Operating profit margins (profits/sales) are likely to remain at their historic levels, which are between 9 and 11 per cent, for the foreseeable future.

• Replacement costs of non-current assets will be more or less in line with the annual depreciation charge. In addition, however, the company is committed to a major upgrade of plant and equipment costing £1.5 million over the next three years. The cost of this upgrade would be spread evenly over the three-year period.

• Additional working capital over the next 5 years will be 20 per cent of sales growth.

• An exceptional dividend had been paid during the year to Year 2022 of £2,800,000. In previous years, the dividend paid had varied between £250,000 and £310,000.

Statement of Financial Position (Balance Sheet) as at 31 January Year 2022 000 Non-current assets (cost less depreciation) Premises Plant and equipment Motor vans at cost Current assets Inventories Trade receivables Cash at bank Total assets Equity 1 Ordinary shares Retained profit Non-current liabilites 7% loan notes Current liabilities Trade payables Accrued expenses Total equity and liabilities 8485.6 3948.1 2290.2 14723.9 1346.7 1490.6 2012.9 4850.2 19574.1 2500 5716.9 8216.9 7000 4176.4 180.8 4357.2 19574.1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started