Answered step by step

Verified Expert Solution

Question

1 Approved Answer

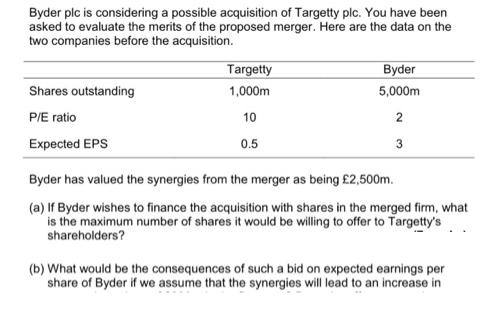

Byder plc is considering a possible acquisition of Targetty plc. You have been asked to evaluate the merits of the proposed merger. Here are

Byder plc is considering a possible acquisition of Targetty plc. You have been asked to evaluate the merits of the proposed merger. Here are the data on the two companies before the acquisition. Targetty Byder Shares outstanding 1,000m 5,000m PIE ratio 10 Expected EPS 0.5 3 Byder has valued the synergies from the merger as being 2,500m. (a) If Byder wishes to finance the acquisition with shares in the merged firm, what is the maximum number of shares it would be willing to offer to Targetty's shareholders? (b) What would be the consequences of such a bid on expected earnings per share of Byder if we assume that the synergies will lead to an increase in (a) If Byder wishes to finance the acquisition with shares in the merged firm, what is the maximum number of shares it would be willing to offer to Targetty's shareholders? (b) What would be the consequences of such a bid on expected earnings per share of Byder if we assume that the synergies will lead to an increase in expected earnings of 200m in the first year? Does the effect on earninas per share of the merged firm affect the merits of the transaction? (c) Instead of the share exchange, Byder has sufficient surplus cash on its balance sheet to finance the acquisition with a cash offer. Alternatively, Byder could return the cash to its shareholders before making the bid, and continue with the share exchange. How would you advise Byder to decide between the share offer and returning the cash to shareholders versus using the cash to make the acquisition? (d) Independently of the specific example above, discuss the validity of risk diversification as a motivation for companies engaging in merger and acquisition activity.

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Solution a 833333333 No of Shares in Byder b 312 c 5000000000 d Explained below Targetty Byder Share Outstanding A 1000000000 5000000000 PE Ratio B 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started