Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BYUI updated for Accounting Cycle # 4 from Problem 2 - 7 A ( Algo ) Preparing an income statement, statement of retained earnings, and

BYUI updated for Accounting Cycle # from Problem A Algo Preparing an income statement, statement of retained earnings, and balance sheet. LO P Added closing entries

Angel Valdez is an owner and manager of Angel Vs Inc., which began operations a few years prior. On December AV's shows the following selected accounts and amounts for the fiscal year ended December tableAccountDebit,Credit,Account,Debit,Credit$Common stock,,$Additional information:

The Note receivable is due to the company in months.

The Notes payable is not due for years.

The Prepaid insurance is for a policy that expires October good for more months

The Prepaid rent is for the next months.

Bonds payable mature in years.

The Mortgage payable is due over a year period and $ of the principal is due next year.

The company plans to hold the Investments in stock for at least the next months.

Required:

Prepare a January December income statement for the business.

Prepare a January December statement of retained earnings.

Prepare a December balance sheet.

Prepare the closing entries in the order outlined in the book and in clas.Required:

Prepare a January December income statement for the business.

Prepare a January December statement of retained earnings.

Prepare a December balance sheet.

Prepare the closing entries in the order outlined in the book and in class.

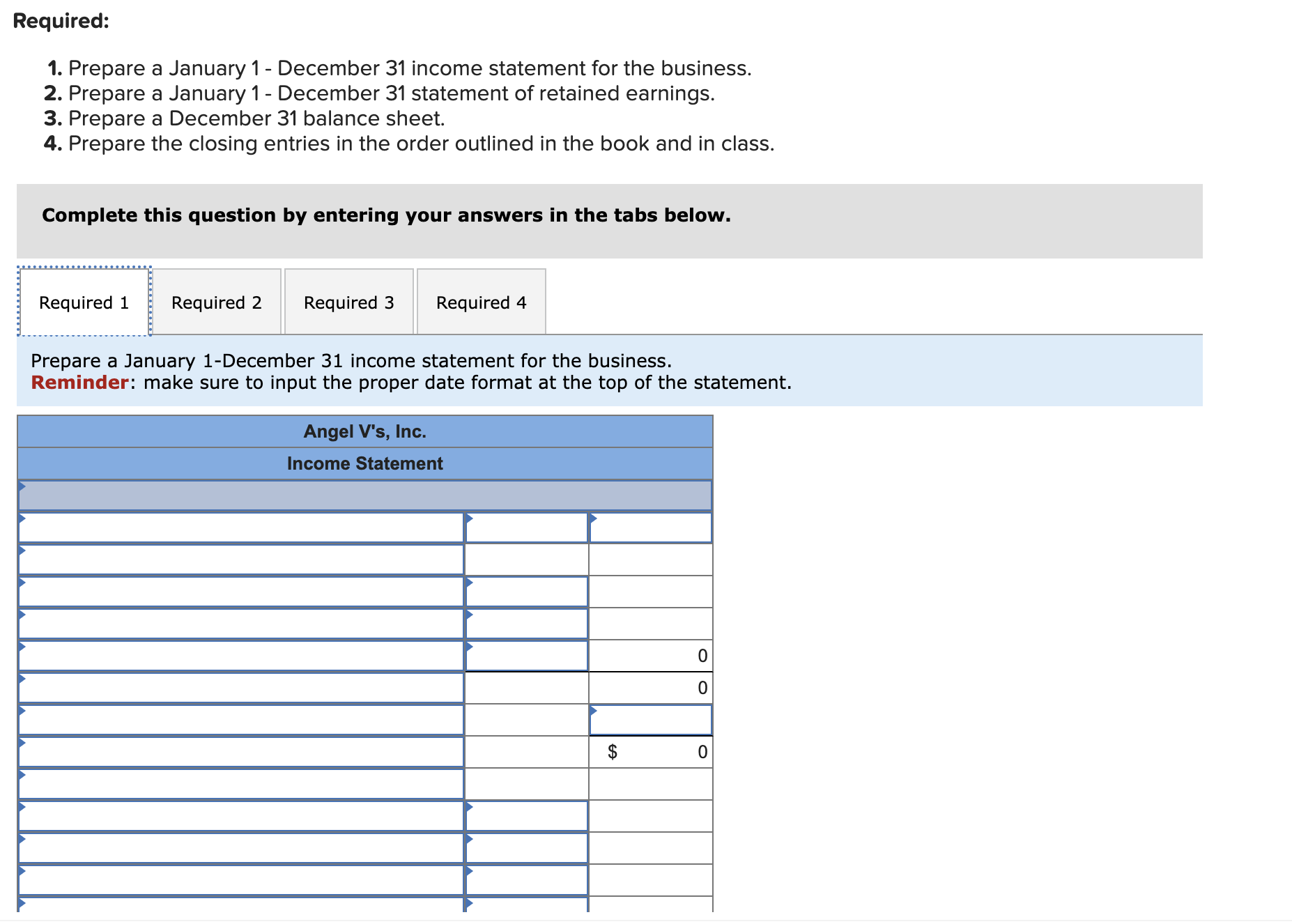

Complete this question by entering your answers in the tabs below.

Required

Required

Prepare a January December income statement for the business.

Reminder: make sure to input the proper date format at the top of the statement.

tableAngel Vs Inc.,Income Statement,,

Account Debit Credit Account Debit Credit

Cash $ Common stock $

Accounts receivable Paidin capital in excess of parCS

Allowance for doubtful accounts Retained earnings

Interest receivable Cash Dividends

Inventory Sales

Supplies Sales discounts

Prepaid insurance Sales returns & allowances

Prepaid rent Interest revenue

Notes receivable Gain on sale of plant asset

Investment in stock Cost of goods sold

Land Depreciation expense

Buildings Amortization expense

Equipment Salaries expense

Accumulated Depreciation Buildings Insurance expense

Accumulated Depreciation Equipment Rent expense

Patents Supplies expense

Accounts payable Utilities expense

Salaries payable Interest expense

Interest payable Income tax expense

Income tax payable Bad debts expense

Unearned revenue Freightout

Notes payable Loss on sale of plant asset

Mortgage payable

Bonds payable Totals $ $

prepare an income statment, statement of retained earnings, balance sheet, closing journal entries from these numbers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started