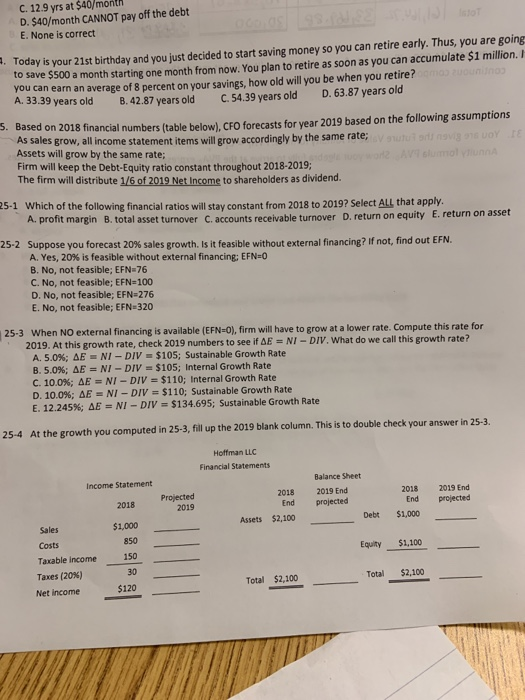

C. 12.9 yrs at $40/montr D. $40/month CANNOT pay off the debt E. None is correct Today is your 21st birthday and you just decided to start saving money so you can retire early. Thus, you are going to save $500 a month starting one month from now. You plan to retire as soon as you can accumulate $1 million. I you can earn an average of 8 percent on your savings, how old will you be when you retire?ma uounino A. 33.39 years old D. 63.87 years old C. 54.39 years old B. 42.87 years old 5. Based on 2018 financial numbers (table below), CFO forecasts for year 2019 based on the following assumptions As sales grow, all income statement items will grow accordingly by the same rate; utuod nvig UoY TE Assets will grow by the same rate; Firm will keep the Debt-Equity ratio constant throughout 2018-2019; The firm will distribute 1/6 of 2019 Net Income to shareholders as dividend. AV slumol yiunnA 25-1 Which of the following financial ratios will stay constant from 2018 to 2019? Select ALL that apply A. profit margin B. total asset turnover C. accounts receivable turnover D. return on equity E. return on asset 25-2 Suppose you forecast 20 % sales growth . Is it feasible without external financing? If not, find out EFN. A. Yes, 20 % is feasible without external financing; EFN-0 B. No, not feasible; EFN-76 C. No, not feasible; EFN=100 D. No, not feasible; EFN-276 E. No, not feasible; EFN-320 25-3 When NO external financing is available (EFN 0), firm will have to grow at a lower rate. Compute this rate for 2019. At this growth rate, check 2019 numbers to see if AE= NI-DIV. What do we call this growth rate? A. 5.0 % ; AE = NI-DIV $105; Sustainable Growth Rate B. 5.0 % ; AE = NI - DIV $105; Internal Growth Rate C. 10.0 % ; AE = NI - DIV= $110; Internal Growth Rate D. 10.0% ; AE = NI - DIV $110; Sustainable Growth Rate E. 12.245 % ; AE = NI - DIV= $134.695; Sustainable Growth Rate 25-4 At the growth you computed in 25-3, fill up the 2019 blank column. This is to double check your answer in 25-3. Hoffman LLC Financial Statements Balance Sheet Income Statement 2019 End projected 2019 End Projected 2019 2018 2018 2018 projected End End Assets $2,100 Debt $1,000 $1,000 Sales 850 Costs $1,100 Equity 150 Taxable income 30 Taxes (20%) Total $2,100 Total $2,100 $120 Net income