Answered step by step

Verified Expert Solution

Question

1 Approved Answer

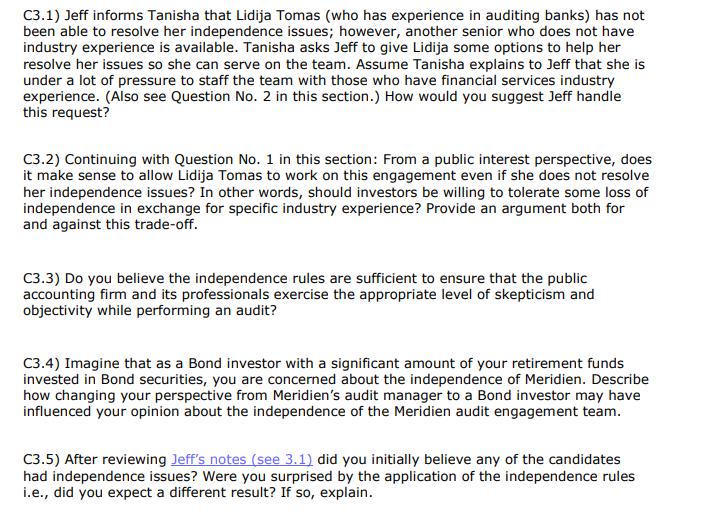

C3.1) Jeff informs Tanisha that Lidija Tomas (who has experience in auditing banks) has not been able to resolve her independence issues; however, another

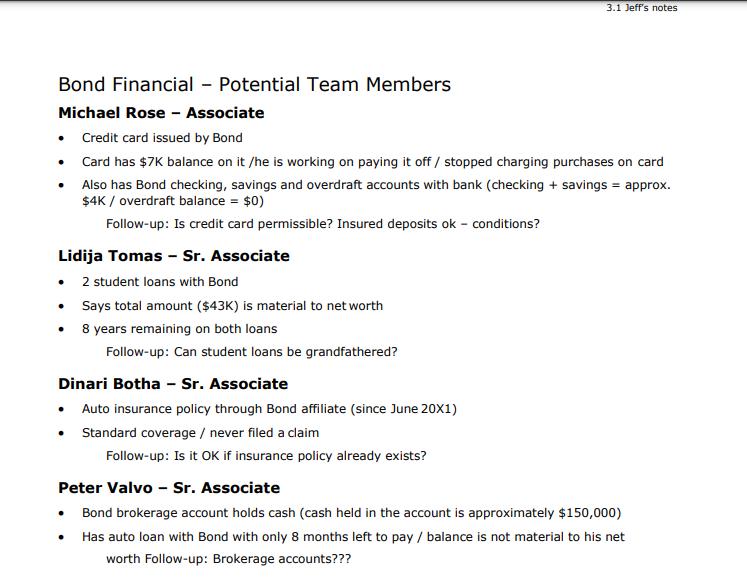

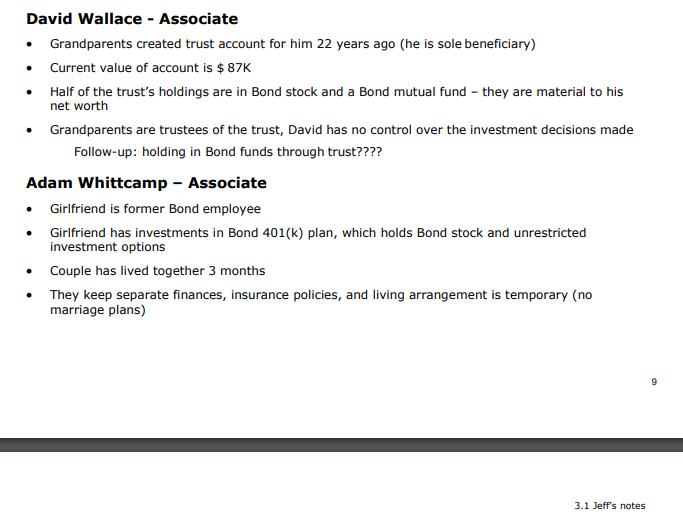

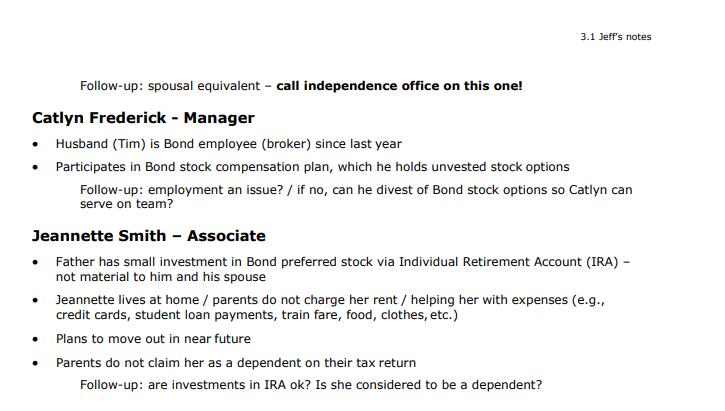

C3.1) Jeff informs Tanisha that Lidija Tomas (who has experience in auditing banks) has not been able to resolve her independence issues; however, another senior who does not have industry experience is available. Tanisha asks Jeff to give Lidija some options to help her resolve her issues so she can serve on the team. Assume Tanisha explains to Jeff that she is under a lot of pressure to staff the team with those who have financial services industry experience. (Also see Question No. 2 in this section.) How would you suggest Jeff handle this request? C3.2) Continuing with Question No. 1 in this section: From a public interest perspective, does it make sense to allow Lidija Tomas to work on this engagement even if she does not resolve her independence issues? In other words, should investors be willing to tolerate some loss of independence in exchange for specific industry experience? Provide an argument both for and against this trade-off. C3.3) Do you believe the independence rules are sufficient to ensure that the public accounting firm and its professionals exercise the appropriate level of skepticism and objectivity while performing an audit? C3.4) Imagine that as a Bond investor with a significant amount of your retirement funds invested in Bond securities, you are concerned about the independence of Meridien. Describe how changing your perspective from Meridien's audit manager to a Bond investor may have influenced your opinion about the independence of the Meridien audit engagement team. C3.5) After reviewing Jeff's notes (see 3.1) did you initially believe any of the candidates had independence issues? Were you surprised by the application of the independence rules i.e., did you expect a different result? If so, explain. Bond Financial - Potential Team Members Michael Rose - Associate Credit card issued by Bond Card has $7K balance on it /he is working on paying it off / stopped charging purchases on card Also has Bond checking, savings and overdraft accounts with bank (checking + savings = approx. $4K / overdraft balance = $0) Follow-up: Is credit card permissible? Insured deposits ok - conditions? . Lidija Tomas - Sr. Associate 2 student loans with Bond Says total amount ($43K) is material to net worth 8 years remaining on both loans . . Dinari Botha - Sr. Associate Auto insurance policy through Bond affiliate (since June 20X1) Standard coverage / never filed a claim Follow-up: Is it OK if insurance policy already exists? Follow-up: Can student loans be grandfathered? 3.1 Jeff's notes . Peter Valvo - Sr. Associate Bond brokerage account holds cash (cash held in the account is approximately $150,000) . Has auto loan with Bond with only 8 months left to pay / balance is not material to his net worth Follow-up: Brokerage accounts??? David Wallace - Associate Grandparents created trust account for him 22 years ago (he is sole beneficiary) Current value of account is $ 87K Half of the trust's holdings are in Bond stock and a Bond mutual fund - they are material to his net worth Grandparents are trustees of the trust, David has no control over the investment decisions made Follow-up: holding in Bond funds through trust???? Adam Whittcamp - Associate Girlfriend is former Bond employee Girlfriend has investments in Bond 401(k) plan, which holds Bond stock and unrestricted investment options . Couple has lived together 3 months They keep separate finances, insurance policies, and living arrangement is temporary (no marriage plans) 3.1 Jeff's notes 9 Follow-up: spousal equivalent - call independence office on this one! Catlyn Frederick - Manager Husband (Tim) is Bond employee (broker) since last year Participates in Bond stock compensation plan, which he holds unvested stock options Follow-up: employment an issue? / if no, can he divest of Bond stock options so Catlyn can serve on team? Jeannette Smith - Associate Father has small investment in Bond preferred stock via Individual Retirement Account (IRA) - not material to him and his spouse 3.1 Jeff's notes Jeannette lives at home / parents do not charge her rent/helping her with expenses (e.g., credit cards, student loan payments, train fare, food, clothes, etc.) Plans to move out in near future Parents do not claim her as a dependent on their tax return Follow-up: are investments in IRA ok? Is she considered to be a dependent?

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

C31 Jeff should discuss with Tanisha that while the bank auditing experience is important to have other qualifications should be taken into consideration such as the candidates educational background ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started