Answered step by step

Verified Expert Solution

Question

1 Approved Answer

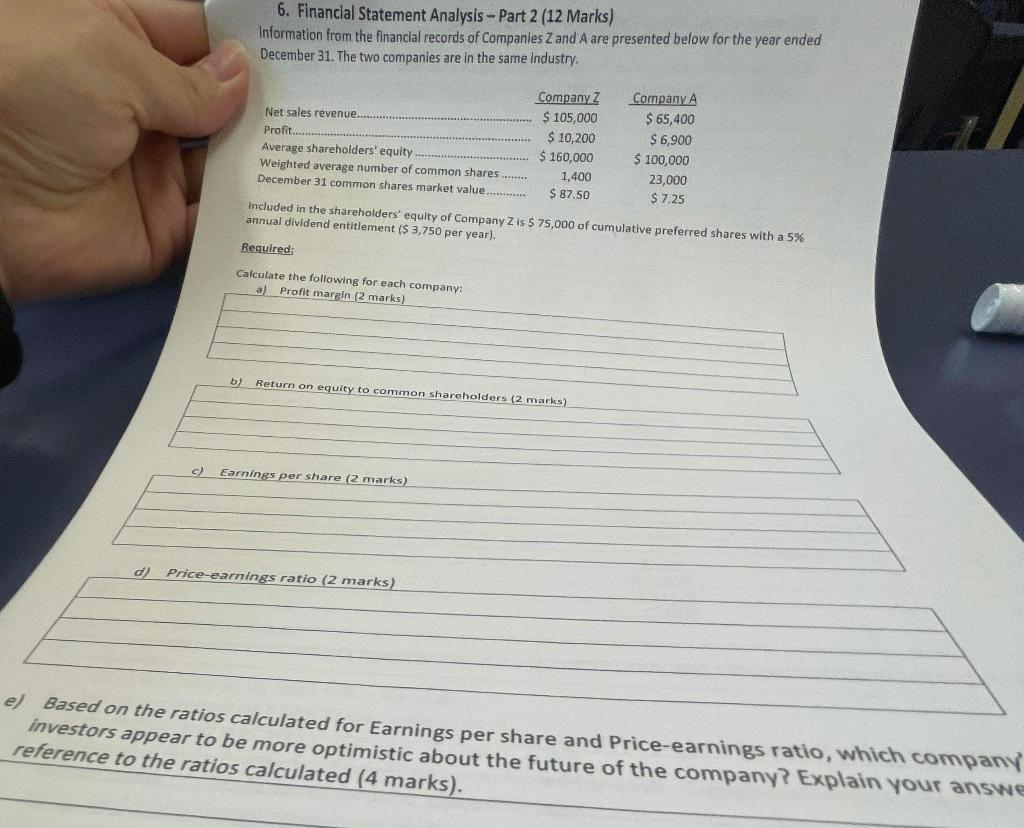

c) 6. Financial Statement Analysis - Part 2 (12 Marks) Information from the financial records of Companies Z and A are presented below for

c) 6. Financial Statement Analysis - Part 2 (12 Marks) Information from the financial records of Companies Z and A are presented below for the year ended December 31. The two companies are in the same industry. b) Net sales revenue. Profit. Average shareholders' equity Weighted average number of common shares........ December 31 common shares market value............. Required: Calculate the following for each company: a) Profit margin (2 marks) Company Z $ 105,000 $ 10,200 $160,000 Earnings per share (2 marks) 1,400 $87.50 Included in the shareholders' equity of Company Z is $ 75,000 of cumulative preferred shares with a 5% annual dividend entitlement ($ 3,750 per year). Return on equity to common shareholders (2 marks) d) Price-earnings ratio (2 marks) Company A $ 65,400 $ 6,900 $ 100,000 23,000 $7.25 e) Based on the ratios calculated for Earnings per share and Price-earnings ratio, which company investors appear to be more optimistic about the future of the company? Explain your answe reference to the ratios calculated (4 marks).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Profit Marg in Company Z Profit Net Sales Revenue 160 000 105 000 1 52 Company A Profit Net Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started