Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(c) A financial company allows its clients to transfer money between accounts in the company using messages that consist of three parts, M =

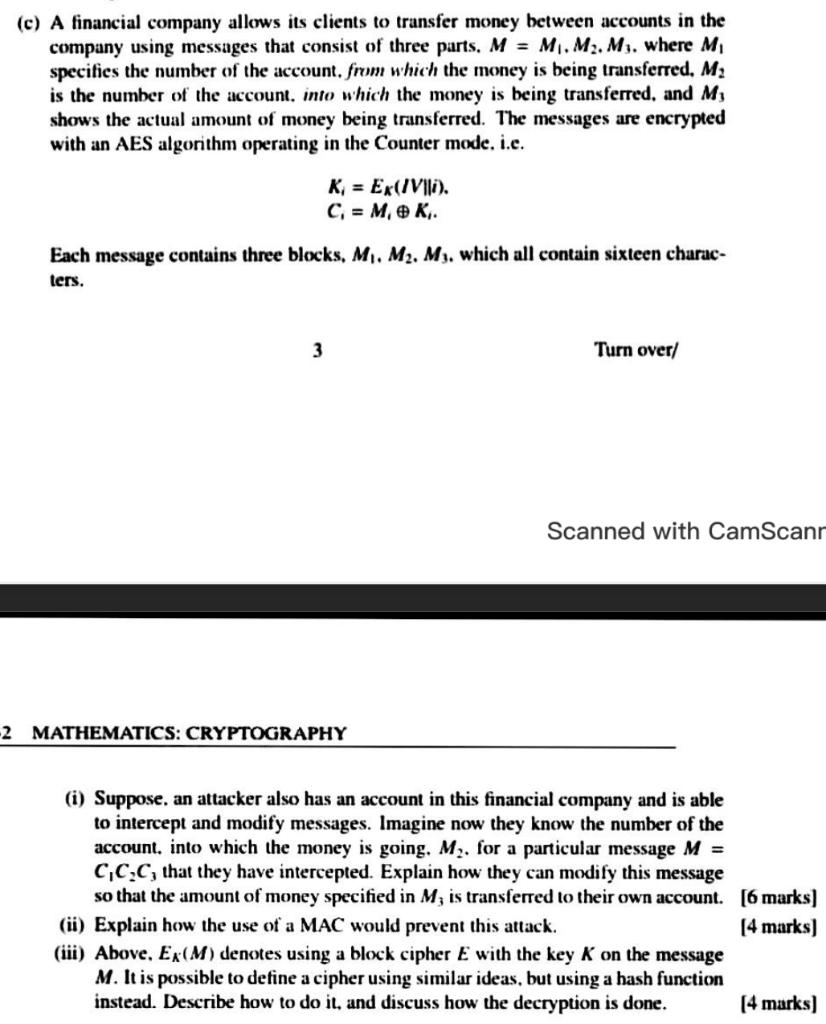

(c) A financial company allows its clients to transfer money between accounts in the company using messages that consist of three parts, M = M. M2. M. where M specifies the number of the account, from which the money is being transferred, M is the number of the account, into which the money is being transferred, and M shows the actual amount of money being transferred. The messages are encrypted with an AES algorithm operating in the Counter mode. i.e. K = Ex(IV\\i). C = M, K,. Each message contains three blocks, M. M2. M. which all contain sixteen charac- ters. 3 2 MATHEMATICS: CRYPTOGRAPHY Turn over/ Scanned with CamScann (i) Suppose, an attacker also has an account in this financial company and is able to intercept and modify messages. Imagine now they know the number of the account, into which the money is going. M, for a particular message M = CCC, that they have intercepted. Explain how they can modify this message so that the amount of money specified in M, is transferred to their own account. (ii) Explain how the use of a MAC would prevent this attack. (iii) Above, Ex(M) denotes using a block cipher E with the key K on the message M. It is possible to define a cipher using similar ideas, but using a hash function instead. Describe how to do it, and discuss how the decryption is done. [6 marks] [4 marks] [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started