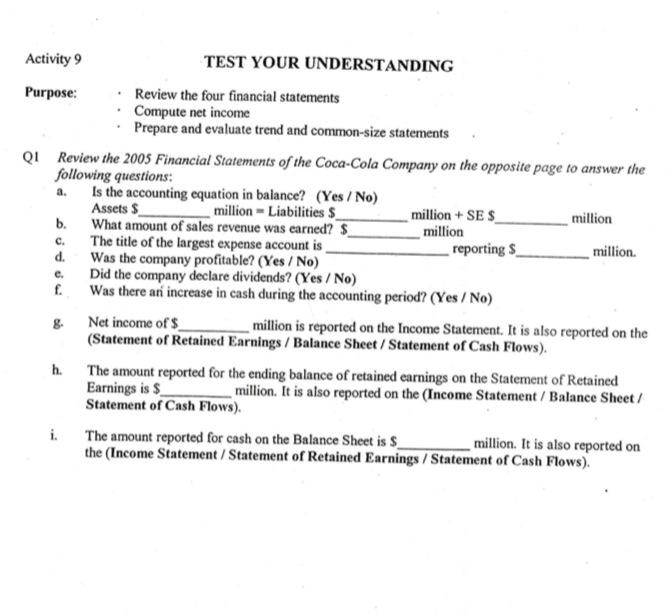

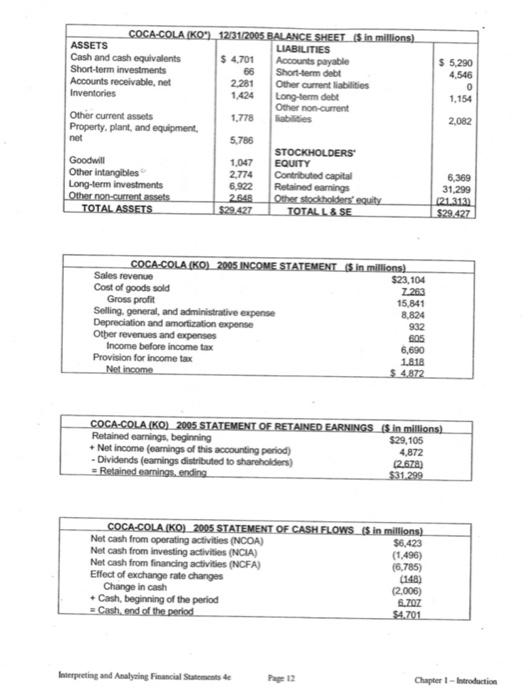

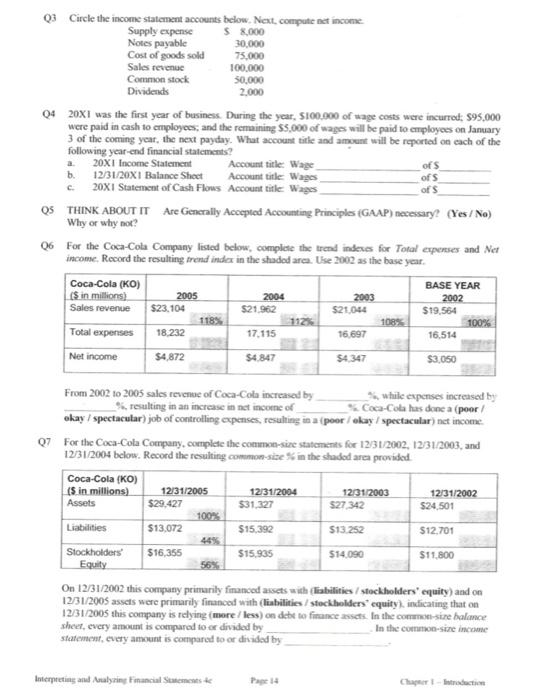

c. Activity 9 TEST YOUR UNDERSTANDING Purpose: Review the four financial statements Compute net income Prepare and evaluate trend and common-size statements QIReview the 2005 Financial Statements of the Coca-Cola Company on the opposite page to answer the following questions: a Is the accounting equation in balance? (Yes/No) Assets million - Liabilities $ million + SES million b. What amount of sales revenue was earned? $ million The title of the largest expense account is reporting $ million d. Was the company profitable? (Yes/No) e. Did the company declare dividends? (Yes/No) f. Was there an increase in cash during the accounting period? (Yes/No) 8. Net income of $ million is reported on the Income Statement. It is also reported on the (Statement of Retained Earnings / Balance Sheet / Statement of Cash Flows). The amount reported for the ending balance of retained earnings on the Statement of Retained Earnings is $ million. It is also reported on the (Income Statement / Balance Sheet/ Statement of Cash Flows). i. The amount reported for cash on the Balance Sheet is $ million. It is also reported on the (Income Statement / Statement of Retained Earnings / Statement of Cash Flows). $ 5,290 4,546 0 1,154 COCA-COLA (KO") 12/31/2005 BALANCE SHEET IS in millions) ASSETS LIABILITIES Cash and cash equivalents $ 4.701 Accounts payable Short-term investments 66 Short-term debt Accounts receivable, nel 2.281 Other current liabilities Inventories 1.424 Long-term debt Other non-current Other current assets 1,778 liabilities Property, plant, and equipment, net 5.786 STOCKHOLDERS Goodwill 1.047 EQUITY Other intangibles 2.774 Contributed capital Long-term investments 6.922 Retained earnings Other non-current tassets 2645 Other stockholders equity TOTAL ASSETS $29427 TOTALL & SE 2,082 6,369 31,299 121.313) $29.427 COCA-COLA (KOJ 2005 INCOME STATEMENT Sin millions) Sales revenue $23,104 Cost of goods sold Z 283 Gross profit 15,841 Selling general, and administrative expense 8.824 Depreciation and amortization expense 932 Other revenues and expenses 605 Income before income tax 6,690 Provision for Income tax 1.818 Net income $ 4872 COCA-COLA (KO) 2005 STATEMENT OF RETAINED EARNINGS (Sin millions) Retained earnings, beginning $29,105 + Net income (earnings of this accounting period) 4,872 -Dividends (earnings distributed to shareholders 12.672) = Retained earnings, ending $31.299 COCA-COLA (KO) 2005 STATEMENT OF CASH FLOWS (5 in millions) Net cash from operating activities (NCOA) $6,423 Net cash from investing activities (NCIA) (1,496) Net cash from financing activities (NCFA) (6.785) Effect of exchange rate changes Change in cash (2006) Cash, beginning of the period 6.ZOZ - Cash end of the te period $4.701 Interpreting and Analyzing Financial Statements de Chapter 1 - Introduction Q3 Circle the income statement accounts below. Next, compute net income Supply expense $ 8.000 Notes payable 30,000 Cost of goods sold 75,000 Sales revenue 100,000 Common stock 50.000 Dividends 2.000 Q4 2021 was the first year of business. During the year, 5100.000 of wage costs were incurred: 895,000 were paid in cash to employees, and the remaining $5,000 of wages will be paid to employees on January 3 of the coming year, the next payday. What account title and amount will be reported on cach of the following year-end financial statements? 2OXI Income Statement Account title: Wage of b 12/31/20X1 Balance Sheet Account title Wages ofs 20X1 Statement of Cash Flows Account title: Wages ofs Q5 THINK ABOUT IT Are Generally Accepted Accounting Principles (GAAP) necessary? (Yes/No) Why or why not? 06 For the Coca-Cola Company listed below, complete the trend indexes for Total expenses and Net income. Record the resulting trend index in the shaded area: Use 2002 as the base year. Coca-Cola (KO) BASE YEAR ($ in millions) 2005 2004 2003 2002 Sales revenue $23.104 $21.962 $21.044 $19,564 118% 108% 100% Total expenses 18.232 17.115 16697 16,514 Net income $4,872 54.847 54.347 $3,050 From 2002 to 2005 sales revenue of Coca-Cola increased by while expenses increased by _%, resulting in an increase in net income of Coca-Cola has done a (poor okay / spectacular) job of controlling expenses, resulting in a poor / okay / spectacular) net income Q7 For the Coca-Cola Company, complete the common-size statements for 12/31/2002, 12/31/2003, and 12/31/2004 below. Record the resulting common-se in the shadod arca provided Coca-Cola (KO) (5. in millions) 12/31/2005 12/31/2004 12/31/2003 12/31/2002 Assets $29.427 $31327 527 342 $24.501 100% Liabilities $13.072 $15.392 $13.252 $12.701 Stockholders $16,355 $15.935 $14090 $11.800 Equity On 12/31/2002 this company primarily financed assets with liabilities / stockholders' equity) and on 12/31/2005 assets were primarily financed with liabilities/stockholders' equity), indicating that on 12/31/2005 this company is relying (more/less) on debt to finance assets in the comme size balance sheet, every amount is compared to or divided by In the common size income statement, every amount is compared to or divided by Interpreting and lyring Financial Semests Page 1 Chart - Induction