Answered step by step

Verified Expert Solution

Question

1 Approved Answer

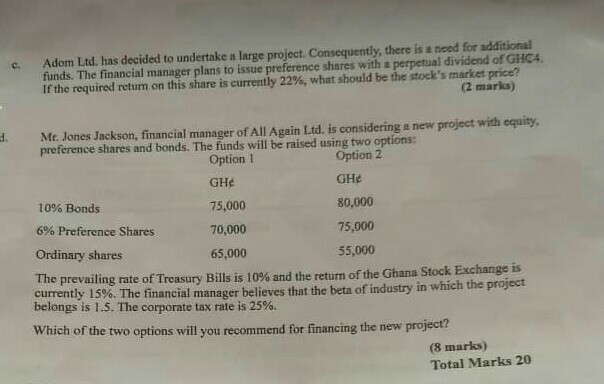

c. Adom Ltd. has decided to undertake a large project. Consequently, there is a need for additional funds. The financial manager plans to issue preference

c. Adom Ltd. has decided to undertake a large project. Consequently, there is a need for additional funds. The financial manager plans to issue preference shares with a perpetual dividend of GHC4. If the required return on this share is currently 22%, what should be the stock's market price? (2 marks) . Mr.Jones Jackson, financial manager of All Again Ltd. is considering a new project with equity preference shares and bonds. The funds will be raised using two options: 10% Bonds 6% Preference Shares Ordinary shares Option 1 GHe 75,000 70,000 65,000 Option 2 GHe 80,000 75,000 55,000 The prevailing rate of Treasury Bills is i0% and the return of the Ghana Stock Exchange is urrently 15%. The financial manager believes that the beta of industry in which the project belongs is 15. The corporate tax rate is 25%. Which of the two options will you recommend for financing the new project? (8 marks) Total Marks 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started