Answered step by step

Verified Expert Solution

Question

1 Approved Answer

c and d only: answer and I will give you a good rating. Thanks. 5. Let the utility function of an investor be u(w) =

c and d only: answer and I will give you a good rating. Thanks.

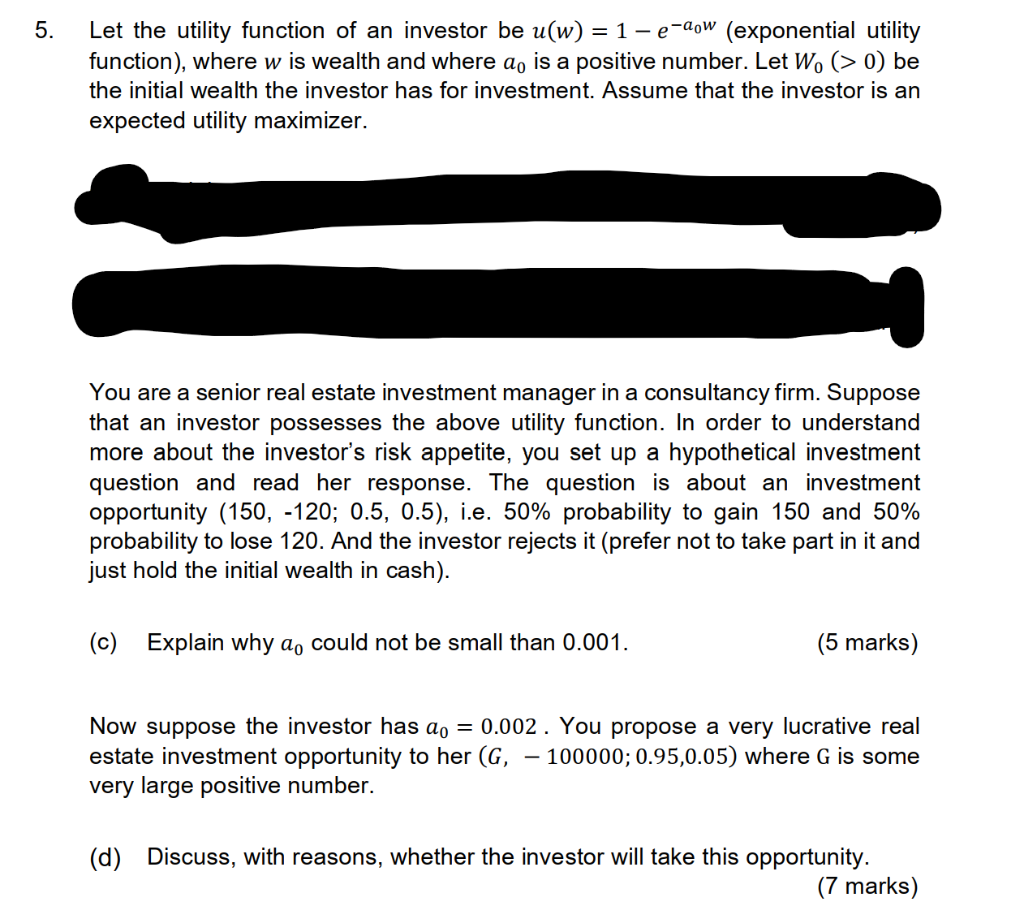

5. Let the utility function of an investor be u(w) = 1 - e-aow (exponential utility function), where w is wealth and where a, is a positive number. Let W. (>0) be the initial wealth the investor has for investment. Assume that the investor is an expected utility maximizer. You are a senior real estate investment manager in a consultancy firm. Suppose that an investor possesses the above utility function. In order to understand more about the investor's risk appetite, you set up a hypothetical investment question and read her response. The question is about an investment opportunity (150, -120; 0.5, 0.5), i.e. 50% probability to gain 150 and 50% probability to lose 120. And the investor rejects it (prefer not to take part in it and just hold the initial wealth in cash). (c) Explain why a, could not be small than 0.001. (5 marks) Now suppose the investor has ao = 0.002. You propose a very lucrative real estate investment opportunity to her (G, 100000; 0.95,0.05) where G is some very large positive number. (d) Discuss, with reasons, whether the investor will take this opportunity. (7 marks) 5. Let the utility function of an investor be u(w) = 1 - e-aow (exponential utility function), where w is wealth and where a, is a positive number. Let W. (>0) be the initial wealth the investor has for investment. Assume that the investor is an expected utility maximizer. You are a senior real estate investment manager in a consultancy firm. Suppose that an investor possesses the above utility function. In order to understand more about the investor's risk appetite, you set up a hypothetical investment question and read her response. The question is about an investment opportunity (150, -120; 0.5, 0.5), i.e. 50% probability to gain 150 and 50% probability to lose 120. And the investor rejects it (prefer not to take part in it and just hold the initial wealth in cash). (c) Explain why a, could not be small than 0.001. (5 marks) Now suppose the investor has ao = 0.002. You propose a very lucrative real estate investment opportunity to her (G, 100000; 0.95,0.05) where G is some very large positive number. (d) Discuss, with reasons, whether the investor will take this opportunity. (7 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started