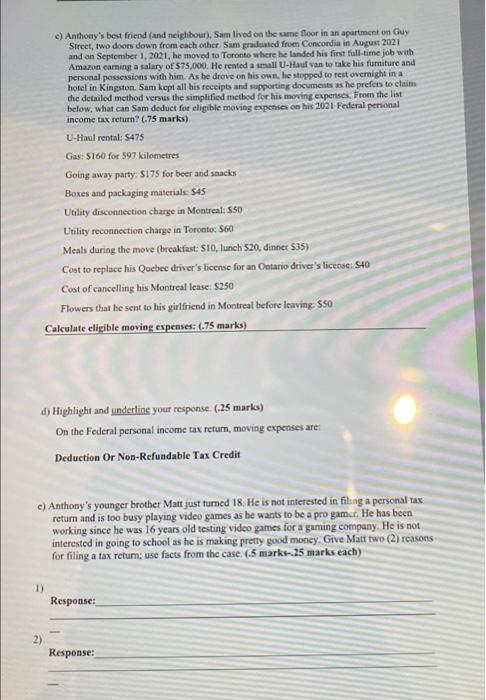

c) Anthony best friend and neighbour). Sam lived on the same floor in an apartment on Guy Street, two doors down from each other. Sam graduated from Concordia in August 2021 and on September 1, 2021, he moved to Toronto where he landed his first full-time job with Amazon carning a salary of 575,000. He rented a small U-Haul van to take his furniture and personal possessions with him. As he drove on his own, he stopped to rest overnight in a hotel in Kingston. Sam kept all his receipts and supporting documents as he prefers to claim the detailed method versus the simplified method for his moving expenses. From the list below, what can Sam deduct for eligible moving expenses on his 2021 Federal personal income tax return? (75 marks) U-Haul rental: 5475 Gas: 5160 for 597 kilometres Going away party: 5175 for beer and snacks Boxes and packaging materiale: 545 Utility disconnection charge in Montreal: 550 Utility reconnection charge in Toronto: S60 Meals during the move (breakfast: 510, lunch 520, dinner 535) Cost to replace his Quebec driver's license for an Ontario driver's license: 540 Cost of cancelling his Montreal lense: 5250 Flowers that he sent to his girlfriend in Montreal before leaving $50 Calculate eligible moving expenses: (.75 marks) d) Highlight and underline your response (,25 marks) On the Federal personal income tax retum, moving expenses are: Deduction Or Non-Refundable Tax Credit c) Anthony's younger brother Matt just turned 18. He is not interested in filing a personal tax return and is too busy playing video games as he wants to be a pro gamer. He has been working since he was 16 years old testing video games for a gaming company. He is not interested in going to school as he is making pretty good money. Give Matt two (2) reasons for filing a tax return; use facts from the case. (-5 marks. 25 marks each) 1) Response: 2) Response: c) Anthony best friend and neighbour). Sam lived on the same floor in an apartment on Guy Street, two doors down from each other. Sam graduated from Concordia in August 2021 and on September 1, 2021, he moved to Toronto where he landed his first full-time job with Amazon carning a salary of 575,000. He rented a small U-Haul van to take his furniture and personal possessions with him. As he drove on his own, he stopped to rest overnight in a hotel in Kingston. Sam kept all his receipts and supporting documents as he prefers to claim the detailed method versus the simplified method for his moving expenses. From the list below, what can Sam deduct for eligible moving expenses on his 2021 Federal personal income tax return? (75 marks) U-Haul rental: 5475 Gas: 5160 for 597 kilometres Going away party: 5175 for beer and snacks Boxes and packaging materiale: 545 Utility disconnection charge in Montreal: 550 Utility reconnection charge in Toronto: S60 Meals during the move (breakfast: 510, lunch 520, dinner 535) Cost to replace his Quebec driver's license for an Ontario driver's license: 540 Cost of cancelling his Montreal lense: 5250 Flowers that he sent to his girlfriend in Montreal before leaving $50 Calculate eligible moving expenses: (.75 marks) d) Highlight and underline your response (,25 marks) On the Federal personal income tax retum, moving expenses are: Deduction Or Non-Refundable Tax Credit c) Anthony's younger brother Matt just turned 18. He is not interested in filing a personal tax return and is too busy playing video games as he wants to be a pro gamer. He has been working since he was 16 years old testing video games for a gaming company. He is not interested in going to school as he is making pretty good money. Give Matt two (2) reasons for filing a tax return; use facts from the case. (-5 marks. 25 marks each) 1) Response: 2) Response