Question

c. Are these direct costs more than the average for an issue of this size? d. Suppose that on the first day of trading the

c. Are these direct costs more than the average for an issue of this size? d. Suppose that on the first day of trading the price of Hotch Pot stock is $15 a share. What are the total costs of the issue as a percentage of the market price? (Do not round intermediate calculations. Enter your answer as a whole percent.) e. After paying her share of the expenses, how much will the firms president, Emma Lucullus, receive from the sale? (Do not round intermediate calculations. Enter your answer in dollars not millions.) f. What will be the value of the shares that Emma Lucullus retains in the company? (Enter your answer in dollars not millions.)

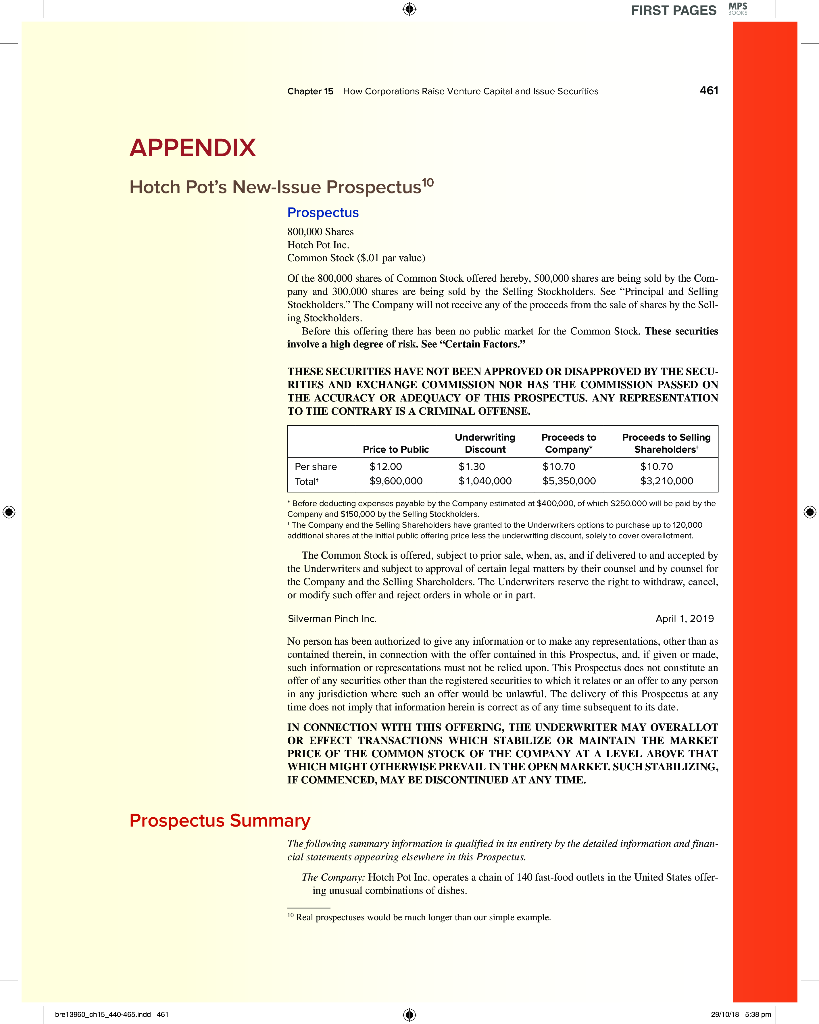

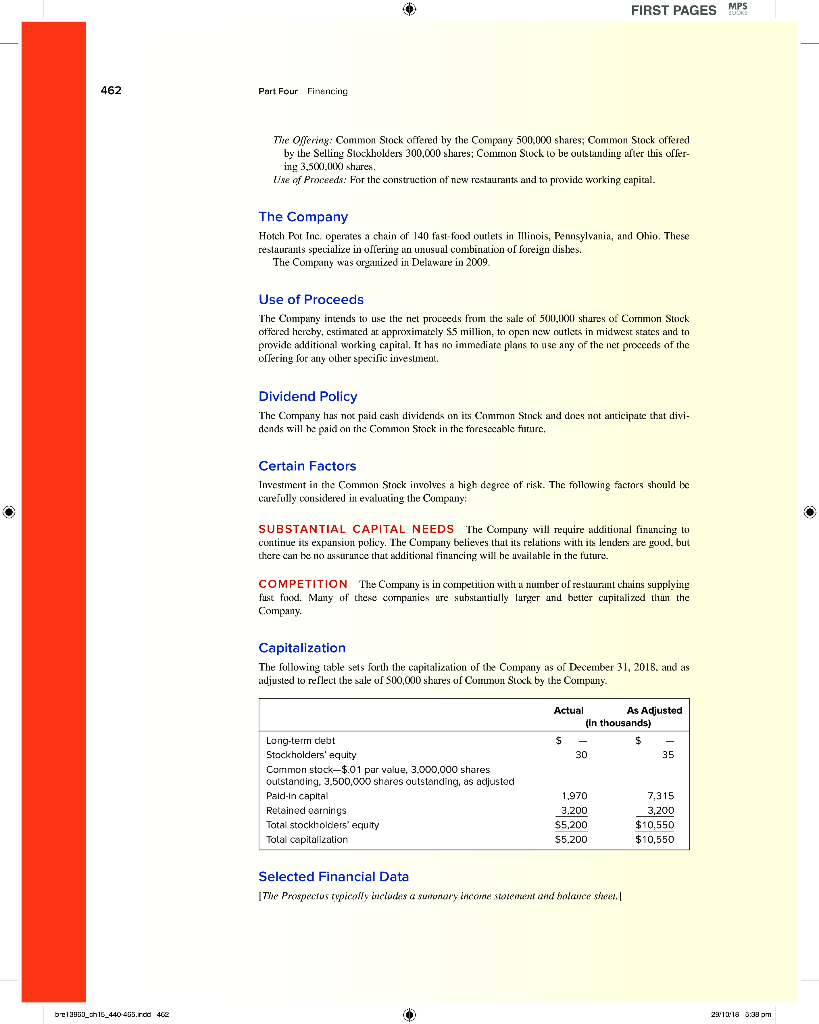

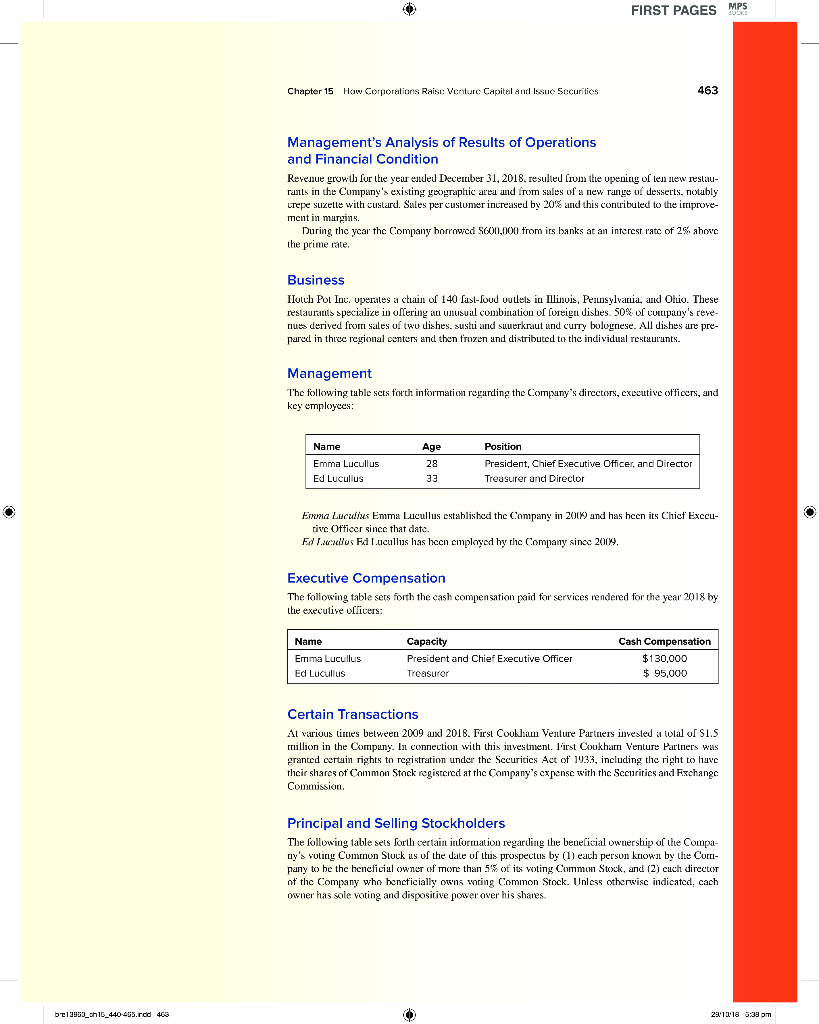

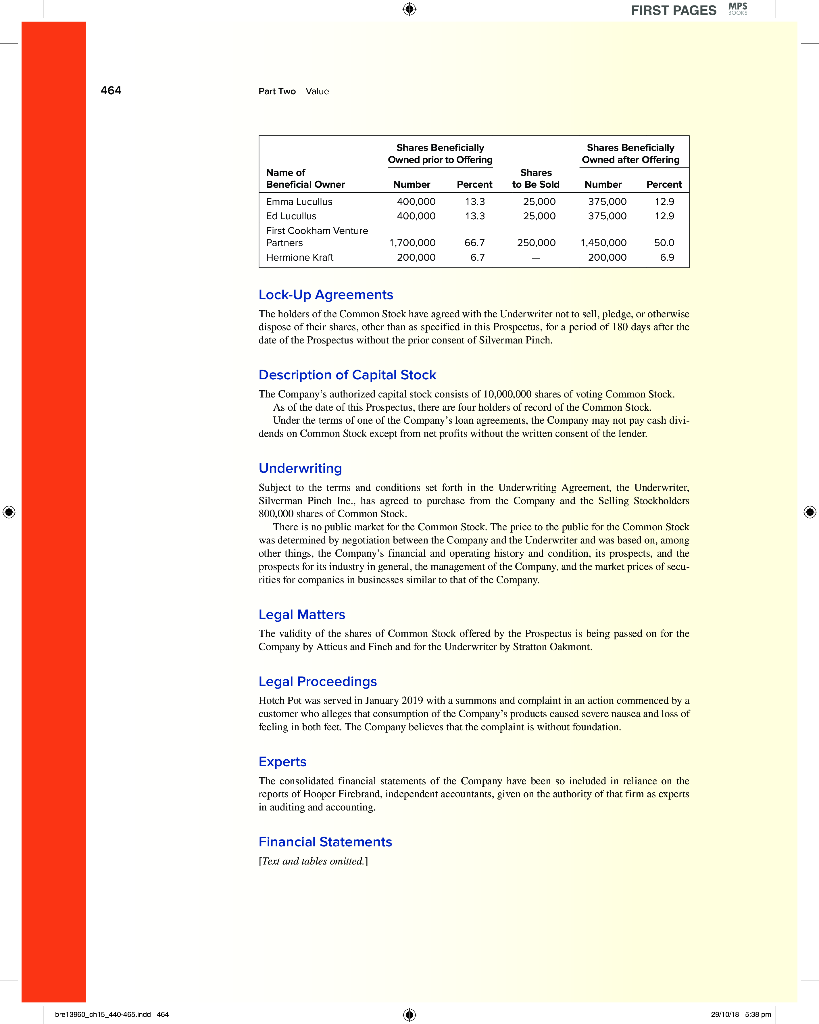

FIRST PAGES MPS Chapter 15 How Corporations Raise Venture Capital and Issuo Securities 461 APPENDIX Hotch Pot's New Issue Prospectus 10 Prospectus XONIX) Shares Horch Por Inc. Common Stock ($.01 par value) Of the 800.000 stares of Comou Sluck offered bereby. 500,000 shares we being sold by the Culti- pany and 300.000 shares are being sold by the Selling Stockholders. See "Principal und Selling Stockholders." The Company will not recive any of the proceeds from the sale of shares hy the Sell- ing Stockholders. Before this offering there has been no public market for the Common Stock. These securities involve a high degree of risk. See "Certain Factors." THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECU- RITIES AND EXCHANGE COMMISSION NOR HAS THE COMMISSION PASSED ON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO TITE CONTRARY IS A CRIMINAL OFTENSE. Underwriting Discount $1.30 $1,040,000 Price to Public $12.00 $9.800,000 Proceeds to Company $10.70 $5,350,000 Proceeds to Selling Shareholders $10.70 $3,210,000 Per share Total Before deducting execres payable by the Company estimated at $400,000, of which S250.0oo will be paid by the Comperry and S150,000 by the Selling Stockholders. 'The Company end the Selling Shareholders have granted to the Underwers options to purchase up to 120,000 additional shares at the initial public offering price less the underwriting discount, solely to cover overaltment The Commun Stock is offered, subject lu prior sale, when as, and i delivered to und accepled by the Underwriters and subject to approval of certain legal matters by their counsel und by counsel for the Company and the Selling Sharcholders. The Underwriters reserve the right to withdraw, cancel, or modify such offer and reject orders in whole or in part. Silverman Pinch Inc. April 1, 2019 No person has been all sorized to give any information or to make any representations, other thin as contained therein, in connection with the offer contained in this Prospectus, and, if given made, such information or representations must not be relied upon. This Prospectus does not constitute an offer of any securities other than the registered securities to which it relates ar an offer to any person in any jurisdiction where such an offer would be unlawful. The delivery of this Prospectus at any time does not imply that information herein is correct as of any time subsequent to its date. IN CONNECTION WITH THIS OFFERING, THE UNDERWRITER MAY OVERALLOT OR EFFECT TRANSACTIONS WHICH STABILIZE OR MAINTAIN THE MARKET PRICE OF THE COMMON STOCK OF THE COMPANY AT A LEVEL AROVE THAT WHICH MIGHT OTHERWISE PREVAIL IN THE OPEN MARKET. SUCH STABILIZING, IF COMMENCED, MAY BE DISCONTINUED AT ANY TIME. Prospectus Summary The following summary information is qualified in its entirety by the detailed information and finaal- cial surements appearing elsewhere in this Prospectus. The Company: Holch Pol Inc. operates a chain of 140 last-food outlets in the United States offer- ing unusual combinations of dishes. 1 Real prospectuses would be much longer thin cur simple example. be13950_ch15_440-455.rdd 461 O 29/10118 6:00 pm FIRST PAGES MPS 462 Part Four Financing The Offering: Common Stock offered by the Company 500,000 shares; Common Stock offered by the Selling Stockholders 300,000 shues; Common Stuck lo be outstanding alter this offer- ing 3,500,000 shares Lise of Proceeds: For the construction of new restaurants and to provide working capital. The Company Hotch Pot Inc. operates a chain of 140 fast-food outlets in Illinois, Pennsylvania, and Ohio. These restaurants specialize in offering an unusual combination of foreign dishes. The Company was organized in Delaware in 2009 Use of Proceeds The Company intends to use the net proceeds from the sale of 500,000 shares of Common Stock offered hcrchy, cstimated at approximately $5 million, to open new cutlets in midwest states and to provide additional working capital, It has no immediate plans to use any of the net prxceeds of the Offering for any other specific investment. Dividend Policy The Company has not paid cash dividends on its Common Stock and does not anticipate that divi- donds will be paid on the Common Stock in the foreseeable future, Certain Factors Investment in the Common Stock involves a high degree of risk. The following factors should be carefully considered in evaluating the Company SUBSTANTIAL CAPITAL NEEDS The Compuny will require additional financing to continue its expansion policy. The Company believes that its relations with its lenders are good, but there can be no assurance that additional financing will be available in the future. COMPETITION The Company is in competition wilt u nurrber of restaurant chains supplying fust ford. Many of these companies are substantiully lurger and better capitalized than the Company Capitalization The following table sets forts the capitalization of the Company as of December 31, 2018. and as adjusted to reflect the sale of 500,000 shures of Corrumun Stock by the Corripuny. Actual As Adjusted (in thousands) $ $ 30 35 Long-term clebt Stockholders' equity Common stock-$.01 par value, 3.000.000 shares outstanding, 3.500.000 shares outstanding, as adjusted Pald-in capital Retained earnings Total stockholders' equity Total capitalization 1,970 3.200 $5,200 $5,200 7,315 3,200 $10,550 $10,550 Selected Financial Data [The Prospectus typically includes a suonary income sucient and holwice sheet | be12909_ch15_440 405.rad 462 O 29110118 0:00 pm FIRST PAGES MPS Chapter 15 How Corporations Raise Venture Capital and Issue Securities 463 Management's Analysis of Results of Operations and Financial Condition Revenue growth for the year ended December 31, 2018. resulted from the opening of len new restau- rants in the Company's existing yographic area and from sales of a new range of desserts, notably crepe suzette with custard. Sules per customer increased by 20% and this contributed to the improve- ment in margins. During the year the Company borrowed S600,000 from its banks at an interest rate of 25. aborc the prime rate Business Ilolch Pol Inc. operates a chain of 140 fast-food outlets in Illinois, Pernsylvania, and Olio. These restaurants specialize in offering an unusual combination of foreign dishes. S0% of corripany's reve- nues derived from sales of two dishes, susti and suuerkraut und curry bolognese. All dishes are pre- pared in three regional centers and then frozen and distributed to the individual restaurants. Management The following table set forth information regarding the Company's directors, cxecutive officers, and key employees: Name Emma Lucullus Ed Lucullus Age 28 33 Position President, Chief Executive Officer, and Director Treasurer and Director Emma Lucullus Emma Lucullus established the Company in 2014 and has hccn its Chicf Exccu- tive Officer since that date. Ed Lexus Ed Lucullus has been cmployed by the Company since 2009, Executive Compensation The following table sets forth the cash compensation paid for services rendered for the year 2018 by the executive officers: Name Errima Lucullus Ed Lucullus Capacity President and Chief Executive Officer Treasurer Cash Compensation $130,000 $ 95,000 Certain Transactions Al various litres between 2009 ax 2018. First Cooklam Venture Partners invested a lotal of SI.S million in the Company. In connection with this investment. l'irst Coukharn Venture Partners was granted certain rights to registration under the Securities Act of 1933, including the right to have their shares of Common Stock registered at the Company's expense with the Securities and Exchange Commission. Principal and Selling Stockholders The following table sets forth certain information regarding the beneficial ownership of the Compa- ny's voting Common Sluck us of the date of ttus prospectus by (1) each person known by the Curri- pany to be the hencficial owner of more than 5% of its witing Commi Stock, and (2) cuch director of the Company who hencficially owns voting Common Stock. Unless otherwise indicated, cach owner has sole voting and dispositive power over his shares be13950_ch15_440-455.rdd 463 O 29/10118 6:00 pm FIRST PAGES MPS 464 Part Two Value Shares Beneficially Owned prior to Offering Shares Beneficially Owned after Offering Number Number Percent Name of Beneficial Owner Emma Lucullus Ed Lucullus First Cookham Venture Partners Hermione Kraft 400,000 400,000 Percent 13.3 13.3 Shares to Be Sold 25,000 25,000 375,000 375,000 12.9 12.9 250,000 1.700,000 200,000 66.7 6.7 1.450,000 200,000 50.0 6.9 Lock-Up Agreements The holders of the Common Stock have agreed with the Underwriter not to sell, pledge, or otherwise dispose of their shares, other than as spocificd in this Prospectus, for a period of 180) days after thc date of the Prospectus without the prior consent of Silverman Pinch. Description of Capital Stock The Company's authorized capital stock consists of 10,000.000 shares of voting Common Stock As of the date of this Pruspectus, there are uur bolders of recont of the Common Stock. Under the terms of one of the Company's loan agreements, the Company may not pay cash divi- dends on Common Stuck except from net profits without the written consent of the lender. Underwriting Subject to the terms and conditions set forth in the Underwriting Agreement, the Underwriter, Silverman Pinch Inc., luas agreed to purchase from the Company and the Selling Stockholders 800,000 shares of Common Stock. There is no public market for the Common Stock. The price to the public for the Common Stock was determined by negotiation between the Company and the Underwriter and was based on, among other things, the Company's linancial and operating history and condition, ils prospects, and the prospects for its industry in general, the management of the Compuny, and the market prices of secu- rities for companies in businesses similar to that of the Company Legal Matters The validity of the shares of Common Stock offered by the Prospectus is being pussed on for the Company by Atticus and Finch and for the Underwriter by Stratton Oakmont. Legal Proceedings Hutch Put was served in January 2019 with a summons and complaint in an action commenced by a customer who alleges that consumption of the Company's products caused severc nausca and loss of fecling in both fect. The Company believes that the complaint is without foundation. Experts The consolidated financial statements of the Company have been so included in reliance on the reports of Honser Firebrand, independent accountants, given on the authority of that firm as experts in auditing and accounting, Financial Statements [Tew and tables onued. be12909_ch15_440 405.ro 464 29110118 0:00 pm FIRST PAGES MPS Chapter 15 How Corporations Raise Venture Capital and Issuo Securities 461 APPENDIX Hotch Pot's New Issue Prospectus 10 Prospectus XONIX) Shares Horch Por Inc. Common Stock ($.01 par value) Of the 800.000 stares of Comou Sluck offered bereby. 500,000 shares we being sold by the Culti- pany and 300.000 shares are being sold by the Selling Stockholders. See "Principal und Selling Stockholders." The Company will not recive any of the proceeds from the sale of shares hy the Sell- ing Stockholders. Before this offering there has been no public market for the Common Stock. These securities involve a high degree of risk. See "Certain Factors." THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECU- RITIES AND EXCHANGE COMMISSION NOR HAS THE COMMISSION PASSED ON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO TITE CONTRARY IS A CRIMINAL OFTENSE. Underwriting Discount $1.30 $1,040,000 Price to Public $12.00 $9.800,000 Proceeds to Company $10.70 $5,350,000 Proceeds to Selling Shareholders $10.70 $3,210,000 Per share Total Before deducting execres payable by the Company estimated at $400,000, of which S250.0oo will be paid by the Comperry and S150,000 by the Selling Stockholders. 'The Company end the Selling Shareholders have granted to the Underwers options to purchase up to 120,000 additional shares at the initial public offering price less the underwriting discount, solely to cover overaltment The Commun Stock is offered, subject lu prior sale, when as, and i delivered to und accepled by the Underwriters and subject to approval of certain legal matters by their counsel und by counsel for the Company and the Selling Sharcholders. The Underwriters reserve the right to withdraw, cancel, or modify such offer and reject orders in whole or in part. Silverman Pinch Inc. April 1, 2019 No person has been all sorized to give any information or to make any representations, other thin as contained therein, in connection with the offer contained in this Prospectus, and, if given made, such information or representations must not be relied upon. This Prospectus does not constitute an offer of any securities other than the registered securities to which it relates ar an offer to any person in any jurisdiction where such an offer would be unlawful. The delivery of this Prospectus at any time does not imply that information herein is correct as of any time subsequent to its date. IN CONNECTION WITH THIS OFFERING, THE UNDERWRITER MAY OVERALLOT OR EFFECT TRANSACTIONS WHICH STABILIZE OR MAINTAIN THE MARKET PRICE OF THE COMMON STOCK OF THE COMPANY AT A LEVEL AROVE THAT WHICH MIGHT OTHERWISE PREVAIL IN THE OPEN MARKET. SUCH STABILIZING, IF COMMENCED, MAY BE DISCONTINUED AT ANY TIME. Prospectus Summary The following summary information is qualified in its entirety by the detailed information and finaal- cial surements appearing elsewhere in this Prospectus. The Company: Holch Pol Inc. operates a chain of 140 last-food outlets in the United States offer- ing unusual combinations of dishes. 1 Real prospectuses would be much longer thin cur simple example. be13950_ch15_440-455.rdd 461 O 29/10118 6:00 pm FIRST PAGES MPS 462 Part Four Financing The Offering: Common Stock offered by the Company 500,000 shares; Common Stock offered by the Selling Stockholders 300,000 shues; Common Stuck lo be outstanding alter this offer- ing 3,500,000 shares Lise of Proceeds: For the construction of new restaurants and to provide working capital. The Company Hotch Pot Inc. operates a chain of 140 fast-food outlets in Illinois, Pennsylvania, and Ohio. These restaurants specialize in offering an unusual combination of foreign dishes. The Company was organized in Delaware in 2009 Use of Proceeds The Company intends to use the net proceeds from the sale of 500,000 shares of Common Stock offered hcrchy, cstimated at approximately $5 million, to open new cutlets in midwest states and to provide additional working capital, It has no immediate plans to use any of the net prxceeds of the Offering for any other specific investment. Dividend Policy The Company has not paid cash dividends on its Common Stock and does not anticipate that divi- donds will be paid on the Common Stock in the foreseeable future, Certain Factors Investment in the Common Stock involves a high degree of risk. The following factors should be carefully considered in evaluating the Company SUBSTANTIAL CAPITAL NEEDS The Compuny will require additional financing to continue its expansion policy. The Company believes that its relations with its lenders are good, but there can be no assurance that additional financing will be available in the future. COMPETITION The Company is in competition wilt u nurrber of restaurant chains supplying fust ford. Many of these companies are substantiully lurger and better capitalized than the Company Capitalization The following table sets forts the capitalization of the Company as of December 31, 2018. and as adjusted to reflect the sale of 500,000 shures of Corrumun Stock by the Corripuny. Actual As Adjusted (in thousands) $ $ 30 35 Long-term clebt Stockholders' equity Common stock-$.01 par value, 3.000.000 shares outstanding, 3.500.000 shares outstanding, as adjusted Pald-in capital Retained earnings Total stockholders' equity Total capitalization 1,970 3.200 $5,200 $5,200 7,315 3,200 $10,550 $10,550 Selected Financial Data [The Prospectus typically includes a suonary income sucient and holwice sheet | be12909_ch15_440 405.rad 462 O 29110118 0:00 pm FIRST PAGES MPS Chapter 15 How Corporations Raise Venture Capital and Issue Securities 463 Management's Analysis of Results of Operations and Financial Condition Revenue growth for the year ended December 31, 2018. resulted from the opening of len new restau- rants in the Company's existing yographic area and from sales of a new range of desserts, notably crepe suzette with custard. Sules per customer increased by 20% and this contributed to the improve- ment in margins. During the year the Company borrowed S600,000 from its banks at an interest rate of 25. aborc the prime rate Business Ilolch Pol Inc. operates a chain of 140 fast-food outlets in Illinois, Pernsylvania, and Olio. These restaurants specialize in offering an unusual combination of foreign dishes. S0% of corripany's reve- nues derived from sales of two dishes, susti and suuerkraut und curry bolognese. All dishes are pre- pared in three regional centers and then frozen and distributed to the individual restaurants. Management The following table set forth information regarding the Company's directors, cxecutive officers, and key employees: Name Emma Lucullus Ed Lucullus Age 28 33 Position President, Chief Executive Officer, and Director Treasurer and Director Emma Lucullus Emma Lucullus established the Company in 2014 and has hccn its Chicf Exccu- tive Officer since that date. Ed Lexus Ed Lucullus has been cmployed by the Company since 2009, Executive Compensation The following table sets forth the cash compensation paid for services rendered for the year 2018 by the executive officers: Name Errima Lucullus Ed Lucullus Capacity President and Chief Executive Officer Treasurer Cash Compensation $130,000 $ 95,000 Certain Transactions Al various litres between 2009 ax 2018. First Cooklam Venture Partners invested a lotal of SI.S million in the Company. In connection with this investment. l'irst Coukharn Venture Partners was granted certain rights to registration under the Securities Act of 1933, including the right to have their shares of Common Stock registered at the Company's expense with the Securities and Exchange Commission. Principal and Selling Stockholders The following table sets forth certain information regarding the beneficial ownership of the Compa- ny's voting Common Sluck us of the date of ttus prospectus by (1) each person known by the Curri- pany to be the hencficial owner of more than 5% of its witing Commi Stock, and (2) cuch director of the Company who hencficially owns voting Common Stock. Unless otherwise indicated, cach owner has sole voting and dispositive power over his shares be13950_ch15_440-455.rdd 463 O 29/10118 6:00 pm FIRST PAGES MPS 464 Part Two Value Shares Beneficially Owned prior to Offering Shares Beneficially Owned after Offering Number Number Percent Name of Beneficial Owner Emma Lucullus Ed Lucullus First Cookham Venture Partners Hermione Kraft 400,000 400,000 Percent 13.3 13.3 Shares to Be Sold 25,000 25,000 375,000 375,000 12.9 12.9 250,000 1.700,000 200,000 66.7 6.7 1.450,000 200,000 50.0 6.9 Lock-Up Agreements The holders of the Common Stock have agreed with the Underwriter not to sell, pledge, or otherwise dispose of their shares, other than as spocificd in this Prospectus, for a period of 180) days after thc date of the Prospectus without the prior consent of Silverman Pinch. Description of Capital Stock The Company's authorized capital stock consists of 10,000.000 shares of voting Common Stock As of the date of this Pruspectus, there are uur bolders of recont of the Common Stock. Under the terms of one of the Company's loan agreements, the Company may not pay cash divi- dends on Common Stuck except from net profits without the written consent of the lender. Underwriting Subject to the terms and conditions set forth in the Underwriting Agreement, the Underwriter, Silverman Pinch Inc., luas agreed to purchase from the Company and the Selling Stockholders 800,000 shares of Common Stock. There is no public market for the Common Stock. The price to the public for the Common Stock was determined by negotiation between the Company and the Underwriter and was based on, among other things, the Company's linancial and operating history and condition, ils prospects, and the prospects for its industry in general, the management of the Compuny, and the market prices of secu- rities for companies in businesses similar to that of the Company Legal Matters The validity of the shares of Common Stock offered by the Prospectus is being pussed on for the Company by Atticus and Finch and for the Underwriter by Stratton Oakmont. Legal Proceedings Hutch Put was served in January 2019 with a summons and complaint in an action commenced by a customer who alleges that consumption of the Company's products caused severc nausca and loss of fecling in both fect. The Company believes that the complaint is without foundation. Experts The consolidated financial statements of the Company have been so included in reliance on the reports of Honser Firebrand, independent accountants, given on the authority of that firm as experts in auditing and accounting, Financial Statements [Tew and tables onued. be12909_ch15_440 405.ro 464 29110118 0:00 pmStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started