Question

C. Areful is a CPA and owner of Careful Accounting Services. If Mr. Areful prepares the annual financial statements of Careful Accounting Services then such

C. Areful is a CPA and owner of Careful Accounting Services. If Mr. Areful prepares the annual financial statements of Careful Accounting Services then such statements are of the same quality and reliability as externally prepared financial statements when performing a technical and/or interpretative analysis.

Do you agree or disagree with the conclusion? Justify your position and as part of your response be sure to make a distinction between internally prepared and externally prepared financial statements, as well as a distinction between a technical and interpretative analysis.

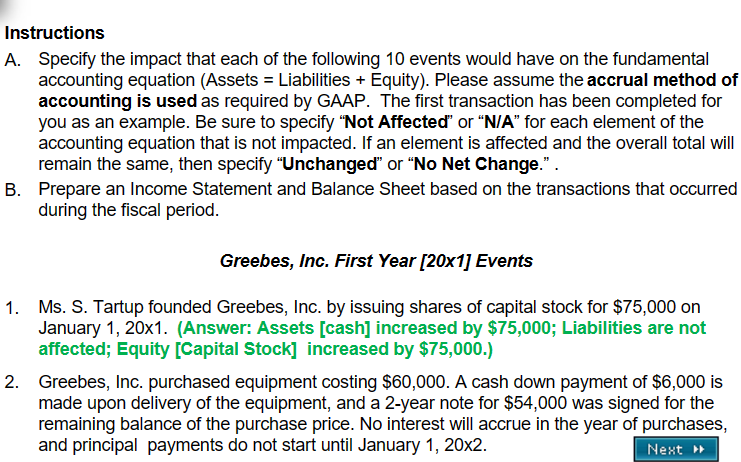

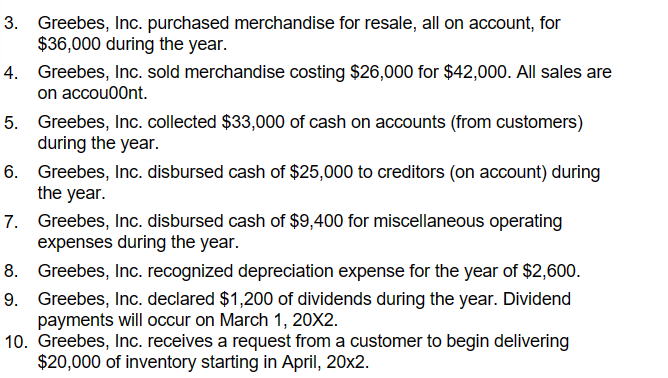

Instructions A. Specify the impact that each of the following 10 events would have on the fundamental accounting equation (Assets = Liabilities + Equity). Please assume the accrual method of accounting is used as required by GAAP. The first transaction has been completed for you as an example. Be sure to specify "Not Affected" or "N/A" for each element of the accounting equation that is not impacted. If an element is affected and the overall total will remain the same, then specify "Unchanged" or "No Net Change." . B. Prepare an Income Statement and Balance Sheet based on the transactions that occurred during the fiscal period. Greebes, Inc. First Year [20x1] Events 1. Ms. S. Tartup founded Greebes, Inc. by issuing shares of capital stock for $75,000 on January 1, 20x1. (Answer: Assets [cash] increased by $75,000; Liabilities are not affected; Equity [Capital Stock] increased by $75,000.) 2. Greebes, Inc. purchased equipment costing $60,000. A cash down payment of $6,000 is made upon delivery of the equipment, and a 2-year note for $54,000 was signed for the remaining balance of the purchase price. No interest will accrue in the year of purchases, and principal payments do not start until January 1, 20x2. Next Instructions A. Specify the impact that each of the following 10 events would have on the fundamental accounting equation (Assets = Liabilities + Equity). Please assume the accrual method of accounting is used as required by GAAP. The first transaction has been completed for you as an example. Be sure to specify "Not Affected" or "N/A" for each element of the accounting equation that is not impacted. If an element is affected and the overall total will remain the same, then specify "Unchanged" or "No Net Change." . B. Prepare an Income Statement and Balance Sheet based on the transactions that occurred during the fiscal period. Greebes, Inc. First Year [20x1] Events 1. Ms. S. Tartup founded Greebes, Inc. by issuing shares of capital stock for $75,000 on January 1, 20x1. (Answer: Assets [cash] increased by $75,000; Liabilities are not affected; Equity [Capital Stock] increased by $75,000.) 2. Greebes, Inc. purchased equipment costing $60,000. A cash down payment of $6,000 is made upon delivery of the equipment, and a 2-year note for $54,000 was signed for the remaining balance of the purchase price. No interest will accrue in the year of purchases, and principal payments do not start until January 1, 20x2. Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Regarding the conclusion that the financial statements prepared by Mr Areful of Careful Accounting Services are of the same quality and reliability as externally prepared financial statements when per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started