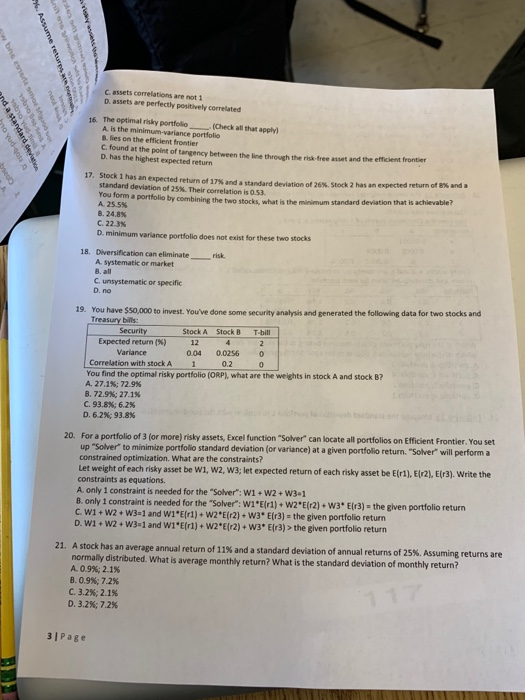

C assets correlations are not 1 D. assets are perfectly positively correlated 16 The optimal risky portfollio(Check all that apply) A is the minimum-variance portfolio B lies on the efficient frontier C found at the point of tangency between the line through the risk-free asset and the efficient D. has the highest expected return Stock 1 has an expected return of 17% and a standard de ation of 2es. Stock 2ha, in expected standard deviation of 25%. Their correlation is 0.53. You form a portfolio by combining the two stocks, what is the minimum A. 25.5% B. 24.8% C. 22.3% D. minimum variance portfolio does not exist for these two 17. return of 8% and a standard deviation that is achievable? stocks 18. Diversification can eliminaterisk A. systematic or market B. all C unsystematic or specific D. no 19. You have $50,000 to invest. You've done some security analysis and generated the following data for two stocks and bils: Security Stock A Stock B T-bill Expected return (%) 12 0.04 0.0256 0 0.2 Variance Correlation with stockA 1 You find the optimal risky portfolio (ORP), what are the weights in stock A and stock B? A, 27.1%; 72.9% B. 72.9%; 27.1% C. 93.8%; 6.2% D. 62%; 93.8% 20. For a portfolio of 3 (or more) risky assets, Excel function "Solver" can locate all portfolios on Efficient Frontier. You set up "Sover" to minimize portfolio standard deviation (or variance) at a given portfolio return. "Solver" will perform a constrained optimization. What are the constraints? Let weight of each risky asset be WI, w2, w3; let expected return of each risky asset be E(r1), Elr2), E(r3). Write the constraints as equations. A. only 1 constraint is needed for the "Solver": w1 + W2+ W3-i 8. only 1 constraint is needed for the "Solver: w1'Elrl)+ w2 Etr2) w3* E(r3) - the given portfolio return c. w1+w2+w3-1 and W1*E(r)+w2E(r2)+ W3 E(r3)- the given portfolio return D w1+w2 W3 1 and W1'Efr1)+ W2rE(r2)+ w3* Elr3)>the given portfolio return 21. Astockhas an average annual return of 11% and a standard deviation of annual returns of 25%. Assuming returns are normally distributed. What is average monthly return? What is the standard deviation of monthly return? A. 05% 2.1% B. 0.9%; 7.2% C. 3.2%,2.1% D. 3.2%,7.2% 31Page