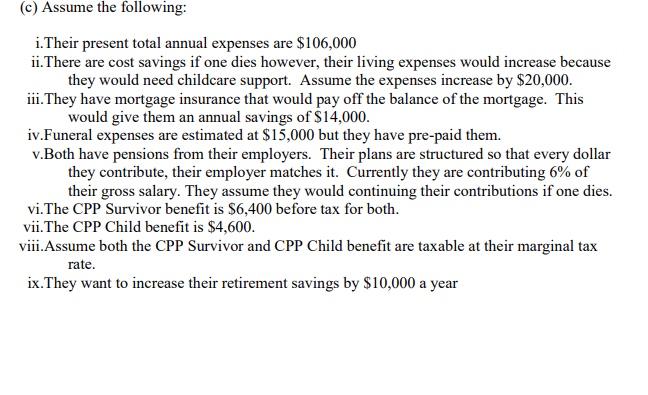

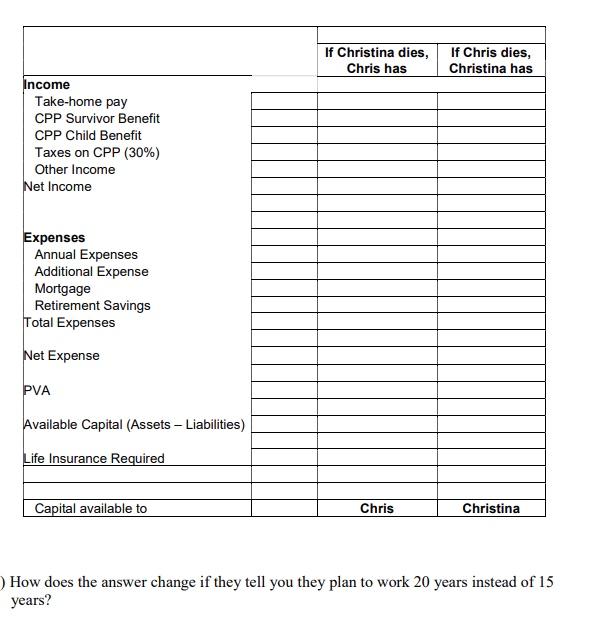

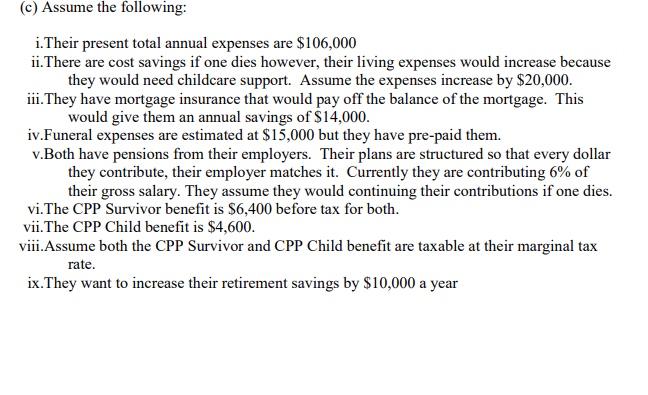

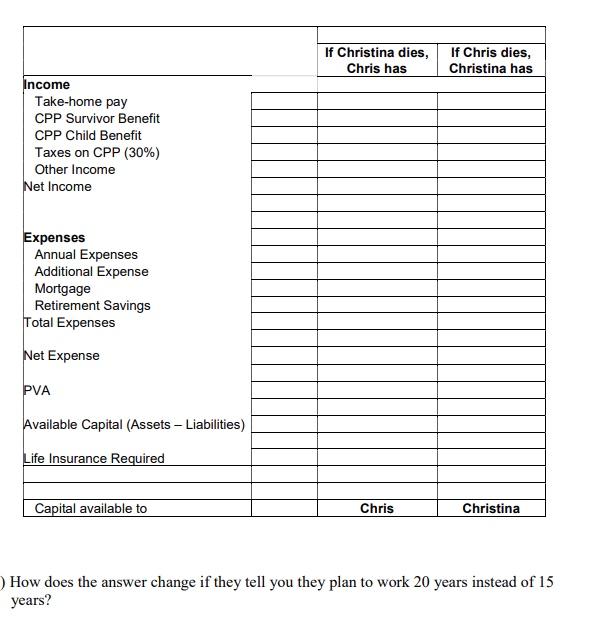

(c) Assume the following: i. Their present total annual expenses are $106,000 ii. There are cost savings if one dies however, their living expenses would increase because they would need childcare support. Assume the expenses increase by $20,000. ii. They have mortgage insurance that would pay off the balance of the mortgage. This would give them an annual savings of $14,000. iv.Funeral expenses are estimated at $15,000 but they have pre-paid them. v.Both have pensions from their employers. Their plans are structured so that every dollar they contribute, their employer matches it. Currently they are contributing 6% of their gross salary. They assume they would continuing their contributions if one dies. vi.The CPP Survivor benefit is $6,400 before tax for both. vii. The CPP Child benefit is $4,600. viii.Assume both the CPP Survivor and CPP Child benefit are taxable at their marginal tax rate. ix.They want to increase their retirement savings by $10,000 a year If Christina dies, Chris has If Chris dies, Christina has Income Take-home pay CPP Survivor Benefit CPP Child Benefit Taxes on CPP (30%) Other Income Net Income Expenses Annual Expenses Additional Expense Mortgage Retirement Savings Total Expenses Net Expense PVA Available Capital (Assets - Liabilities) Life Insurance Required Capital available to Chris Christina How does the answer change if they tell you they plan to work 20 years instead of 15 years? (c) Assume the following: i. Their present total annual expenses are $106,000 ii. There are cost savings if one dies however, their living expenses would increase because they would need childcare support. Assume the expenses increase by $20,000. ii. They have mortgage insurance that would pay off the balance of the mortgage. This would give them an annual savings of $14,000. iv.Funeral expenses are estimated at $15,000 but they have pre-paid them. v.Both have pensions from their employers. Their plans are structured so that every dollar they contribute, their employer matches it. Currently they are contributing 6% of their gross salary. They assume they would continuing their contributions if one dies. vi.The CPP Survivor benefit is $6,400 before tax for both. vii. The CPP Child benefit is $4,600. viii.Assume both the CPP Survivor and CPP Child benefit are taxable at their marginal tax rate. ix.They want to increase their retirement savings by $10,000 a year If Christina dies, Chris has If Chris dies, Christina has Income Take-home pay CPP Survivor Benefit CPP Child Benefit Taxes on CPP (30%) Other Income Net Income Expenses Annual Expenses Additional Expense Mortgage Retirement Savings Total Expenses Net Expense PVA Available Capital (Assets - Liabilities) Life Insurance Required Capital available to Chris Christina How does the answer change if they tell you they plan to work 20 years instead of 15 years