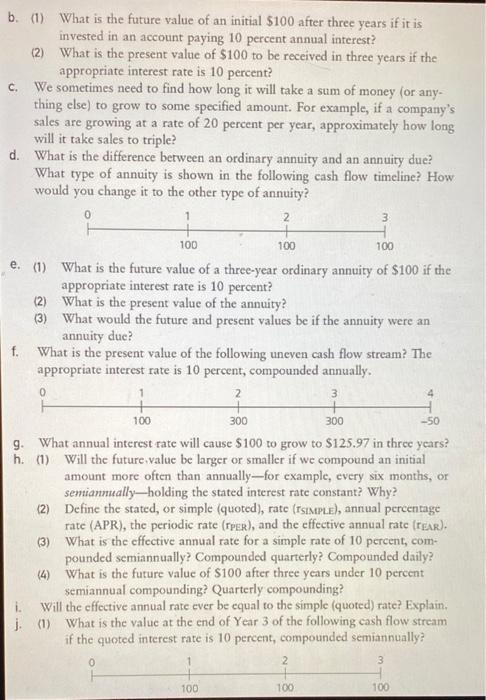

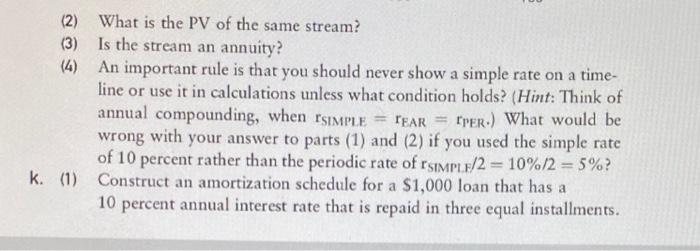

C. b. (1) What is the future value of an initial $100 after three years if it is invested in an account paying 10 percent annual interest? (2) What is the present value of $100 to be received in three years if the appropriate interest rate is 10 percent? We sometimes need to find how long it will take a sum of money (or any- thing else) to grow to some specified amount. For example, if a company's sales are growing at a rate of 20 percent per year, approximately how long will it take sales to triple? d. What is the difference between an ordinary annuity and an annuity due? What type of annuity is shown in the following cash flow timeline? How would you change it to the other type of annuity? 2 + + 100 e. (1) What is the future value of a three-year ordinary annuity of $100 if the appropriate interest rate is 10 percent? (2) What is the present value of the annuity? (3) What would the future and present values be if the annuity were an annuity duc? f. What is the present value of the following uneven cash flow stream? The appropriate interest rate is 10 percent, compounded annually. 2 + H 0 3 100 100 0 3 4 100 300 300 -50 g. What annual interest rate will cause $100 to grow to $125.97 in three years? h (1) Will the future value be larger or smaller if we compound an initial amount more often than annually-for example, every six months, or semiannually-holding the stated interest rate constant? Why? (2) Define the stated, or simple (quoted), rate (simple), annual percentage rate (APR), the periodic rate (per), and the effective annual rate (rear). (3) What is the effective annual rate for a simple rate of 10 percent, com- pounded semiannually? Compounded quarterly? Compounded daily? (4) What is the future value of S100 after three years under 10 percent semiannual compounding? Quarterly compounding? i. Will the effective annual rate ever be equal to the simple (quoted) rate? Explain, j (1) What is the value at the end of Year 3 of the following cash flow stream if the quoted interest rate is 10 percent, compounded semiannually 1 2 3 100 100 100 (2) What is the PV of the same stream? (3) Is the stream an annuity? (4) An important rule is that you should never show a simple rate on a time- line or use it in calculations unless what condition holds? (Hint: Think of annual compounding, when simple = fear rrer.) What would be wrong with your answer to parts (1) and (2) if you used the simple rate of 10 percent rather than the periodic rate of rsimple/2 = 10%/2 = 5%? k. (1) Construct an amortization schedule for a $1,000 loan that has a 10 percent annual interest rate that is repaid in three equal installments