Answered step by step

Verified Expert Solution

Question

1 Approved Answer

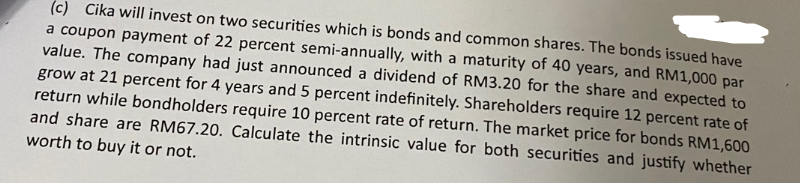

(c) Cika will invest on two securities which is bonds and common shares. The bonds issued have a coupon payment of 22 percent semi-annually, with

(c) Cika will invest on two securities which is bonds and common shares. The bonds issued have a coupon payment of 22 percent semi-annually, with a maturity of 40 years, and RM1,000 par value. The company had just announced a dividend of RM3.20 for the share and expected to grow at 21 percent for 4 years and 5 percent indefinitely. Shareholders require 12 percent rate of return while bondhold.20. Calculate the percent rate of return. The market price for bonds RM1,600 and share are RMG7 the intrinsic value for both securities and justify whether worth to buy it or not. (c) Cika will invest on two securities which is bonds and common shares. The bonds issued have a coupon payment of 22 percent semi-annually, with a maturity of 40 years, and RM1,000 par value. The company had just announced a dividend of RM3.20 for the share and expected to grow at 21 percent for 4 years and 5 percent indefinitely. Shareholders require 12 percent rate of return while bondhold.20. Calculate the percent rate of return. The market price for bonds RM1,600 and share are RMG7 the intrinsic value for both securities and justify whether worth to buy it or not

(c) Cika will invest on two securities which is bonds and common shares. The bonds issued have a coupon payment of 22 percent semi-annually, with a maturity of 40 years, and RM1,000 par value. The company had just announced a dividend of RM3.20 for the share and expected to grow at 21 percent for 4 years and 5 percent indefinitely. Shareholders require 12 percent rate of return while bondhold.20. Calculate the percent rate of return. The market price for bonds RM1,600 and share are RMG7 the intrinsic value for both securities and justify whether worth to buy it or not. (c) Cika will invest on two securities which is bonds and common shares. The bonds issued have a coupon payment of 22 percent semi-annually, with a maturity of 40 years, and RM1,000 par value. The company had just announced a dividend of RM3.20 for the share and expected to grow at 21 percent for 4 years and 5 percent indefinitely. Shareholders require 12 percent rate of return while bondhold.20. Calculate the percent rate of return. The market price for bonds RM1,600 and share are RMG7 the intrinsic value for both securities and justify whether worth to buy it or not Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started