Answered step by step

Verified Expert Solution

Question

1 Approved Answer

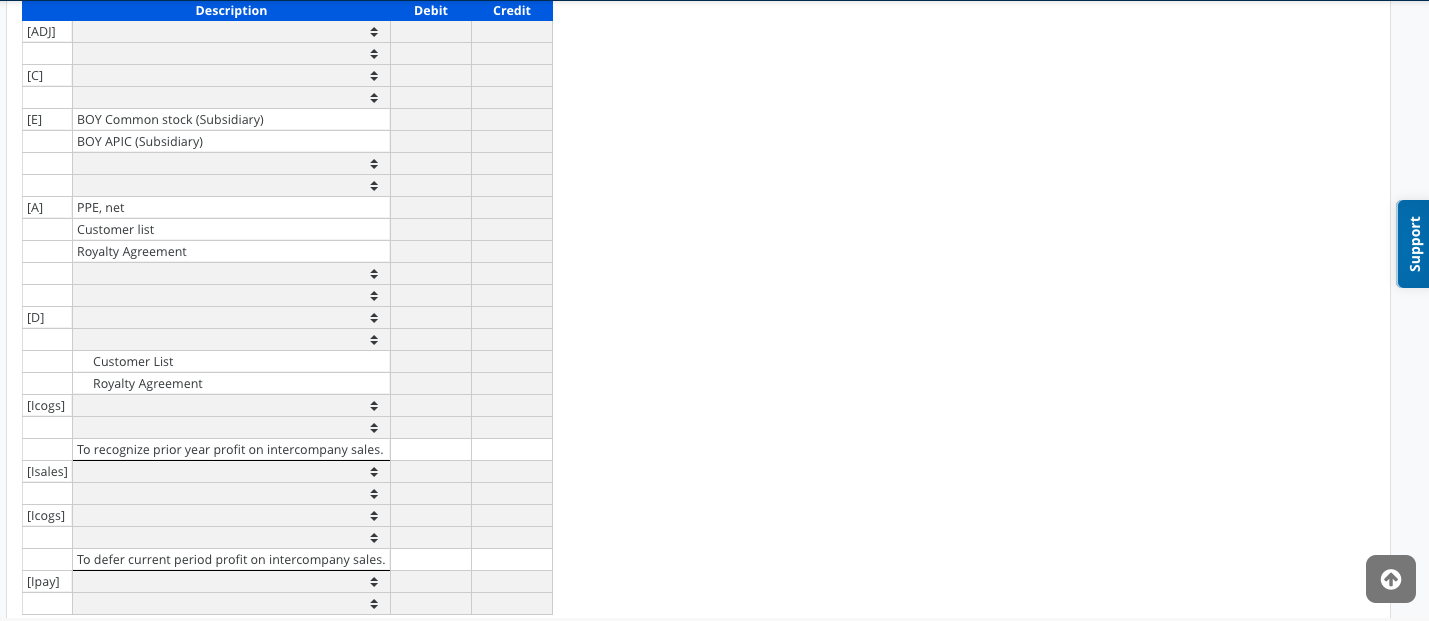

c. Complete the consolidating entries according to the C-E-A-D-I sequence and complete the consolidation worksheet. Use negative signs with answers in the Consolidated column for

c. Complete the consolidating entries according to the C-E-A-D-I sequence and complete the consolidation worksheet.

Use negative signs with answers in the Consolidated column for Cost of goods sold, Operating expenses and Dividends.

| Consolidation Worksheet | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Income statement | Parent | Subsidiary | Debit | Credit | Consolidated | ||||||||

| Sales | $3,045,000 | $560,000 | [Isales] | Answer | Answer | ||||||||

| Cost of goods sold | (2,135,000) | (336,000) | [Icogs] | Answer | Answer | [Icogs] | Answer | ||||||

| Answer | [Isales] | ||||||||||||

| Gross profit | 910,000 | 224,000 | Answer | ||||||||||

| Equity income | 10,500 | - | [C] | Answer | Answer | ||||||||

| Operating expenses | (581,000) | (140,000) | [D] | Answer | Answer | ||||||||

| Net income | $339,500 | $84,000 | Answer | ||||||||||

| Statement of retained earnings | |||||||||||||

| BOY retained earnings | $1,400,000 | $283,500 | [E] | Answer | Answer | [ADJ] | Answer | ||||||

| Net income | 339,500 | 84,000 | Answer | ||||||||||

| Dividends | (87,500) | (10,500) | Answer | [C] | Answer | ||||||||

| Ending retained earnings | $1,652,000 | $357,000 | Answer | ||||||||||

| Balance sheet | |||||||||||||

| Assets | |||||||||||||

| Cash | $455,000 | $175,000 | Answer | ||||||||||

| Accounts receivable | 392,000 | 126,000 | Answer | [Ipay] | Answer | ||||||||

| Inventory | 595,000 | 175,000 | Answer | [Icogs] | Answer | ||||||||

| Equity investment | 560,000 | - | [ADJ] | Answer | Answer | [E] | Answer | ||||||

| [Icogs] | Answer | Answer | [A] | ||||||||||

| PPE, net | 2,800,000 | 294,000 | [A] | Answer | Answer | [D] | Answer | ||||||

| Customer List | [A] | Answer | Answer | [D] | Answer | ||||||||

| Royalty Agreement | [A] | Answer | Answer | [D] | Answer | ||||||||

| Goodwill | [A] | Answer | Answer | ||||||||||

| $4,802,000 | $770,000 | Answer | |||||||||||

| Liabilities and equity | |||||||||||||

| Accounts payable | $245,000 | $70,000 | [Ipay] | Answer | Answer | ||||||||

| Other currentliabilities | 280,000 | 87,500 | Answer | ||||||||||

| Long-term liabilities | 1,750,000 | 182,000 | Answer | ||||||||||

| Common stock | 490,000 | 35,000 | [E] | Answer | Answer | ||||||||

| APIC | 385,000 | 38,500 | [E] | Answer | Answer | ||||||||

| Retained earnings | 1,652,000 | 357,000 | - | - | Answer | ||||||||

| $4,802,000 | $770,000 | Answer | Answer | Answer | |||||||||

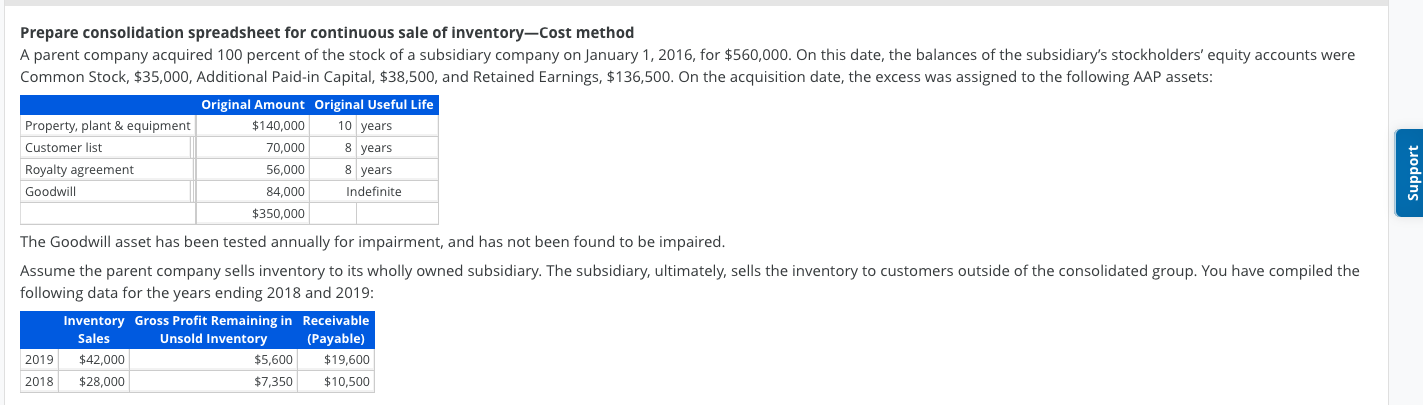

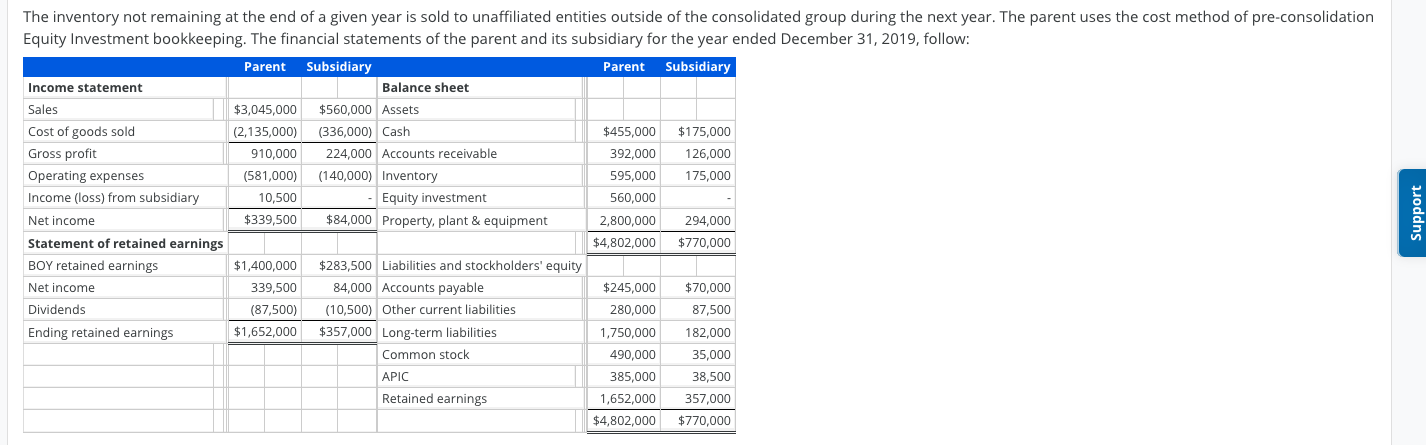

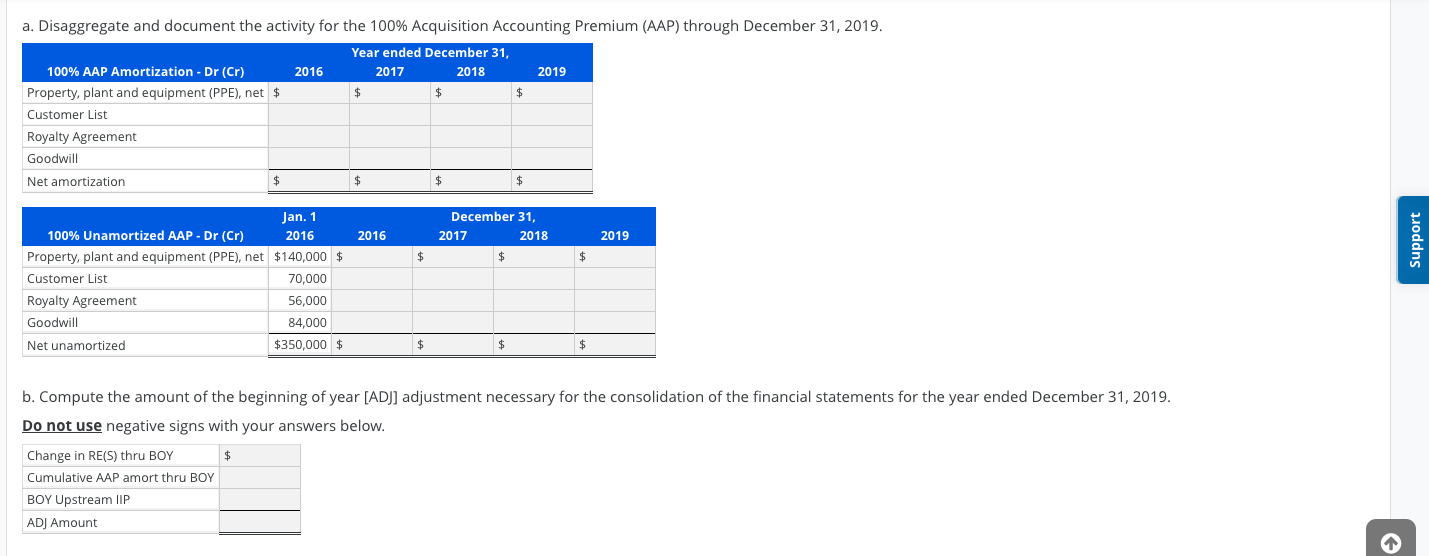

The inventory not remaining at the end of a given year is sold to unaffiliated entities outside of the consolidated group during the next year. The parent uses the cost method of pre-consolidation Equity Investment bookkeeping. The financial statements of the parent and its subsidiary for the year ended December 31, 2019, follow: Parent Subsidiary Parent Subsidiary Income statement Balance sheet Sales $3,045,000 $560,000 Assets Cost of goods sold (2,135,000) (336,000) Cash $455,000 $175,000 Gross profit 910,000 224,000 Accounts receivable 392,000 126,000 Operating expenses (581,000) (140,000) Inventory 595,000 175,000 Income (loss) from subsidiary 10,500 Equity investment 560,000 Net income $339,500 $84,000 Property, plant & equipment 2,800,000 294,000 Statement of retained earnings $4,802,000 $770,000 BOY retained earnings $1,400,000 $283,500 Liabilities and stockholders' equity Net income 339,500 84,000 Accounts payable $245,000 $70,000 Dividends (87,500) (10,500) Other current liabilities 280,000 87,500 Ending retained earnings $1,652,000 $357,000 Long-term liabilities 1,750,000 182,000 Common stock 490,000 35,000 APIC 385,000 38,500 Retained earnings 1,652,000 357,000 $4,802,000 $770,000 Support a. Disaggregate and document the activity for the 100% Acquisition Accounting Premium (AAP) through December 31, 2019. 2016 Year ended December 31, 2017 2018 2019 100% AAP Amortization - Dr (Cr) Property, plant and equipment (PPE), net $ Customer List Royalty Agreement Goodwill Net amortization December 31, 2017 2018 2016 2016 2019 Support Jan. 1 100% Unamortized AAP - Dr (Cr) Property, plant and equipment (PPE), net $140,000 $ Customer List 70,000 Royalty Agreement 56,000 Goodwill 84,000 Net unamortized $350,000 $ b. Compute the amount of the beginning of year [AD]] adjustment necessary for the consolidation of the financial statements for the year ended December 31, 2019. Do not use negative signs with your answers below. Change in RE(S) thru BOY Cumulative AAP amort thru BOY BOY Upstream IIP ADJ Amount Description Debit Credit [AD] [C] [E] BOY Common stock (Subsidiary) BOY APIC (Subsidiary) [A] PPE, net Customer list Royalty Agreement Support Customer List Royalty Agreement [lcogs] To recognize prior year profit on intercompany sales. [lsales] [lcogs] To defer current period profit on intercompany sales. [lpay]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started