Ccomplete the Ratio Analysis for Nike, Inc. using the information provided in the Balance Sheets and/or Statements of Income.

Balance Sheets for Nike, Inc. Fill in the blanks on the table below. Amounts do not need the dollar sign ($), whole numbers only, no decimals needed. (example 0000) Percentages should be two decimal places and no percentage sign (%) is needed. (example 00.00)

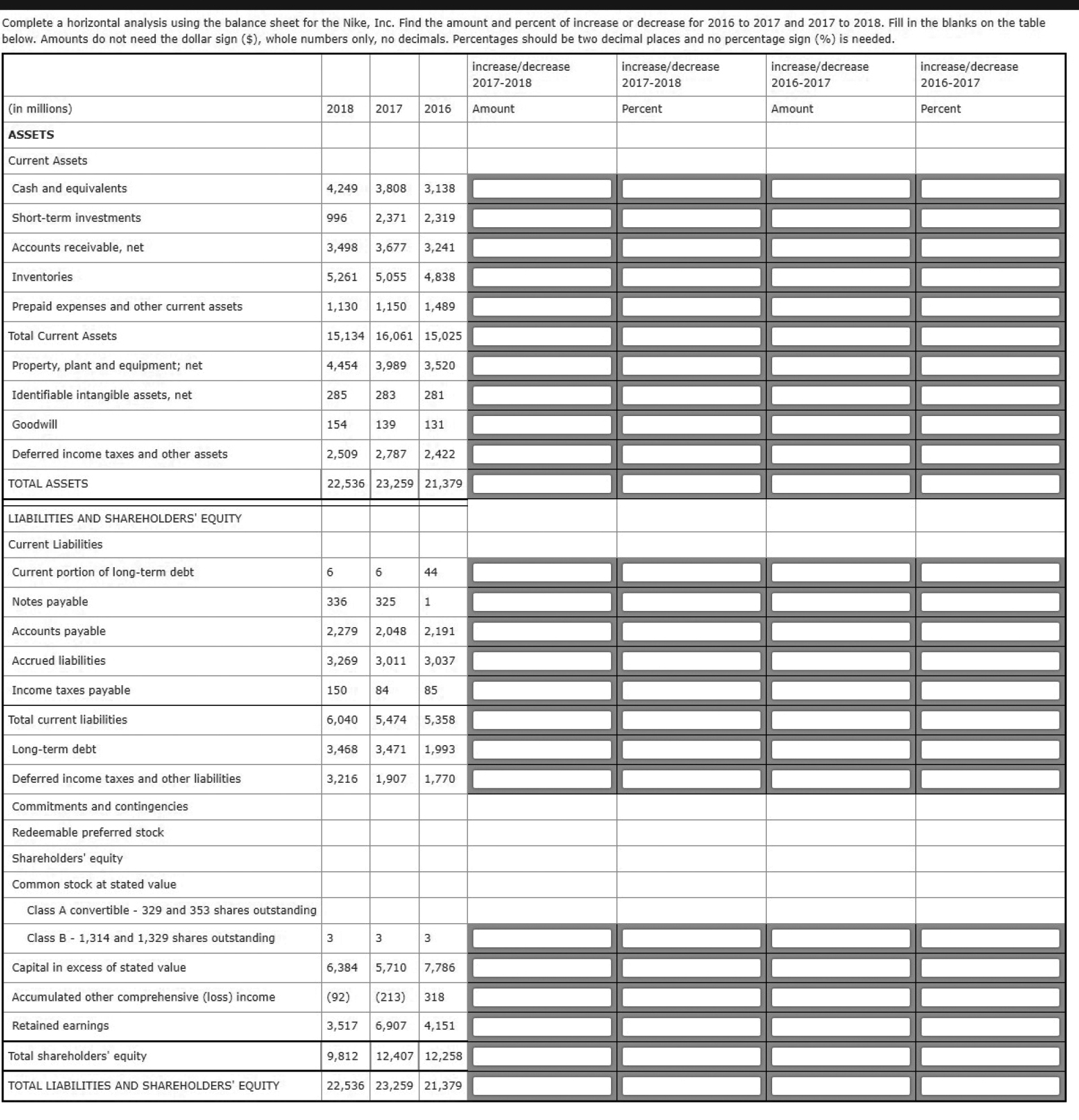

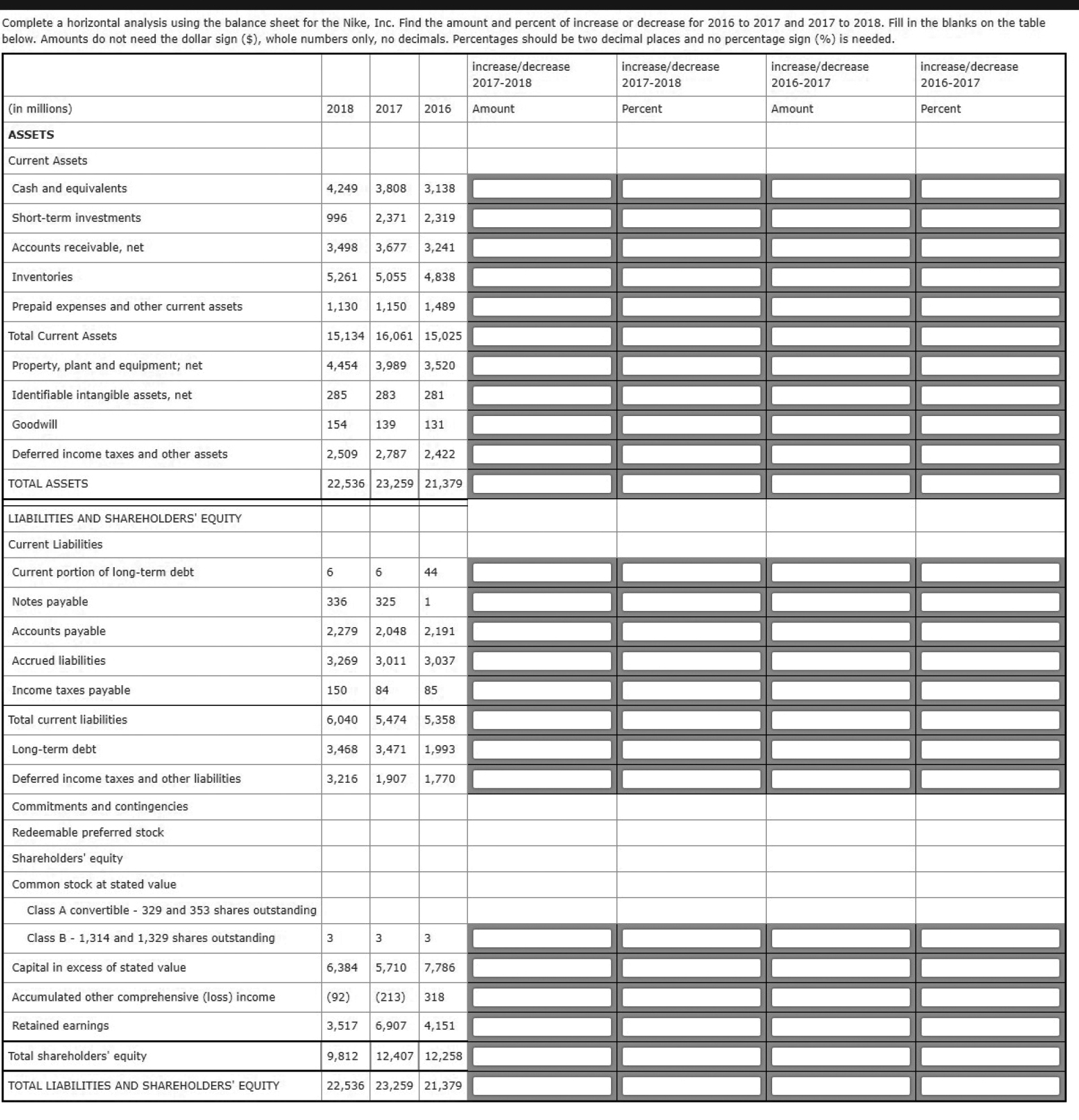

below. Amounts do not need the dollar sign (\$), whole numbers only, no decimals. Percentages should be two decimal places and no percentage sign (\%) is needed. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & & & & \begin{tabular}{l} increase/decrease \\ 20172018 \end{tabular} & \begin{tabular}{l} increase/decrease \\ 20172018 \end{tabular} & \begin{tabular}{l} increase/decrease \\ 20162017 \end{tabular} & \begin{tabular}{l} increase/decrease \\ 20162017 \end{tabular} \\ \hline (in millions) & 2018 & 2017 & 2016 & Amount & Percent & Amount & Percent \\ \hline \multicolumn{8}{|l|}{ ASSETS } \\ \hline \multicolumn{8}{|l|}{ Current Assets } \\ \hline Cash and equivalents & 4,249 & 3,808 & 3,138 & & & & \\ \hline Short-term investments & 996 & 2,371 & 2,319 & & & & \\ \hline Accounts receivable, net & 3,498 & 3,677 & 3,241 & & & & \\ \hline Inventories & 5,261 & 5,055 & 4,838 & & & & \\ \hline Prepaid expenses and other current assets & 1,130 & 1,150 & 1,489 & & & & \\ \hline Total Current Assets & 15,134 & 16,061 & 15,025 & & & & \\ \hline Property, plant and equipment; net & 4,454 & 3,989 & 3,520 & & & & \\ \hline Identifiable intangible assets, net & 285 & 283 & 281 & & & & \\ \hline Goodwill & 154 & 139 & 131 & & & & \\ \hline Deferred income taxes and other assets & 2,509 & 2,787 & 2,422 & & & & \\ \hline TOTAL ASSETS & 22,536 & 23,259 & 21,379 & & & & \\ \hline \multicolumn{8}{|l|}{ LIABILITIES AND SHAREHOLDERS' EQUITY } \\ \hline \multicolumn{8}{|l|}{ Current Liabilities } \\ \hline Current portion of long-term debt & 6 & 6 & 44 & & & & \\ \hline Notes payable & 336 & 325 & 1 & & & & \\ \hline Accounts payable & 2,279 & 2,048 & 2,191 & & & & \\ \hline Accrued liabilities & 3,269 & 3,011 & 3,037 & & & & \\ \hline Income taxes payable & 150 & 84 & 85 & & & & \\ \hline Total current liabilities & 6,040 & 5,474 & 5,358 & & & & \\ \hline Long-term debt & 3,468 & 3,471 & 1,993 & & & & \\ \hline Deferred income taxes and other liabilities & 3,216 & 1,907 & 1,770 & & & & \\ \hline \multicolumn{8}{|l|}{ Commitments and contingencies } \\ \hline \multicolumn{8}{|l|}{ Redeemable preferred stock } \\ \hline \multicolumn{8}{|l|}{ Shareholders' equity } \\ \hline \multicolumn{8}{|l|}{ Common stock at stated value } \\ \hline \multicolumn{8}{|c|}{ Class A convertible - 329 and 353 shares outstanding } \\ \hline Class B - 1,314 and 1,329 shares outstanding & 3 & 3 & 3 & & & & \\ \hline Capital in excess of stated value & 6,384 & 5,710 & 7,786 & & & & \\ \hline Accumulated other comprehensive (loss) income & (92) & (213) & 318 & & & & \\ \hline Retained earnings & 3,517 & 6,907 & 4,151 & & & & \\ \hline Total shareholders' equity & 9,812 & 12,407 & 12,258 & & & & \\ \hline TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY & 22,536 & 23,259 & 21,379 & & & & \\ \hline \end{tabular} below. Amounts do not need the dollar sign (\$), whole numbers only, no decimals. Percentages should be two decimal places and no percentage sign (\%) is needed. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & & & & \begin{tabular}{l} increase/decrease \\ 20172018 \end{tabular} & \begin{tabular}{l} increase/decrease \\ 20172018 \end{tabular} & \begin{tabular}{l} increase/decrease \\ 20162017 \end{tabular} & \begin{tabular}{l} increase/decrease \\ 20162017 \end{tabular} \\ \hline (in millions) & 2018 & 2017 & 2016 & Amount & Percent & Amount & Percent \\ \hline \multicolumn{8}{|l|}{ ASSETS } \\ \hline \multicolumn{8}{|l|}{ Current Assets } \\ \hline Cash and equivalents & 4,249 & 3,808 & 3,138 & & & & \\ \hline Short-term investments & 996 & 2,371 & 2,319 & & & & \\ \hline Accounts receivable, net & 3,498 & 3,677 & 3,241 & & & & \\ \hline Inventories & 5,261 & 5,055 & 4,838 & & & & \\ \hline Prepaid expenses and other current assets & 1,130 & 1,150 & 1,489 & & & & \\ \hline Total Current Assets & 15,134 & 16,061 & 15,025 & & & & \\ \hline Property, plant and equipment; net & 4,454 & 3,989 & 3,520 & & & & \\ \hline Identifiable intangible assets, net & 285 & 283 & 281 & & & & \\ \hline Goodwill & 154 & 139 & 131 & & & & \\ \hline Deferred income taxes and other assets & 2,509 & 2,787 & 2,422 & & & & \\ \hline TOTAL ASSETS & 22,536 & 23,259 & 21,379 & & & & \\ \hline \multicolumn{8}{|l|}{ LIABILITIES AND SHAREHOLDERS' EQUITY } \\ \hline \multicolumn{8}{|l|}{ Current Liabilities } \\ \hline Current portion of long-term debt & 6 & 6 & 44 & & & & \\ \hline Notes payable & 336 & 325 & 1 & & & & \\ \hline Accounts payable & 2,279 & 2,048 & 2,191 & & & & \\ \hline Accrued liabilities & 3,269 & 3,011 & 3,037 & & & & \\ \hline Income taxes payable & 150 & 84 & 85 & & & & \\ \hline Total current liabilities & 6,040 & 5,474 & 5,358 & & & & \\ \hline Long-term debt & 3,468 & 3,471 & 1,993 & & & & \\ \hline Deferred income taxes and other liabilities & 3,216 & 1,907 & 1,770 & & & & \\ \hline \multicolumn{8}{|l|}{ Commitments and contingencies } \\ \hline \multicolumn{8}{|l|}{ Redeemable preferred stock } \\ \hline \multicolumn{8}{|l|}{ Shareholders' equity } \\ \hline \multicolumn{8}{|l|}{ Common stock at stated value } \\ \hline \multicolumn{8}{|c|}{ Class A convertible - 329 and 353 shares outstanding } \\ \hline Class B - 1,314 and 1,329 shares outstanding & 3 & 3 & 3 & & & & \\ \hline Capital in excess of stated value & 6,384 & 5,710 & 7,786 & & & & \\ \hline Accumulated other comprehensive (loss) income & (92) & (213) & 318 & & & & \\ \hline Retained earnings & 3,517 & 6,907 & 4,151 & & & & \\ \hline Total shareholders' equity & 9,812 & 12,407 & 12,258 & & & & \\ \hline TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY & 22,536 & 23,259 & 21,379 & & & & \\ \hline \end{tabular}