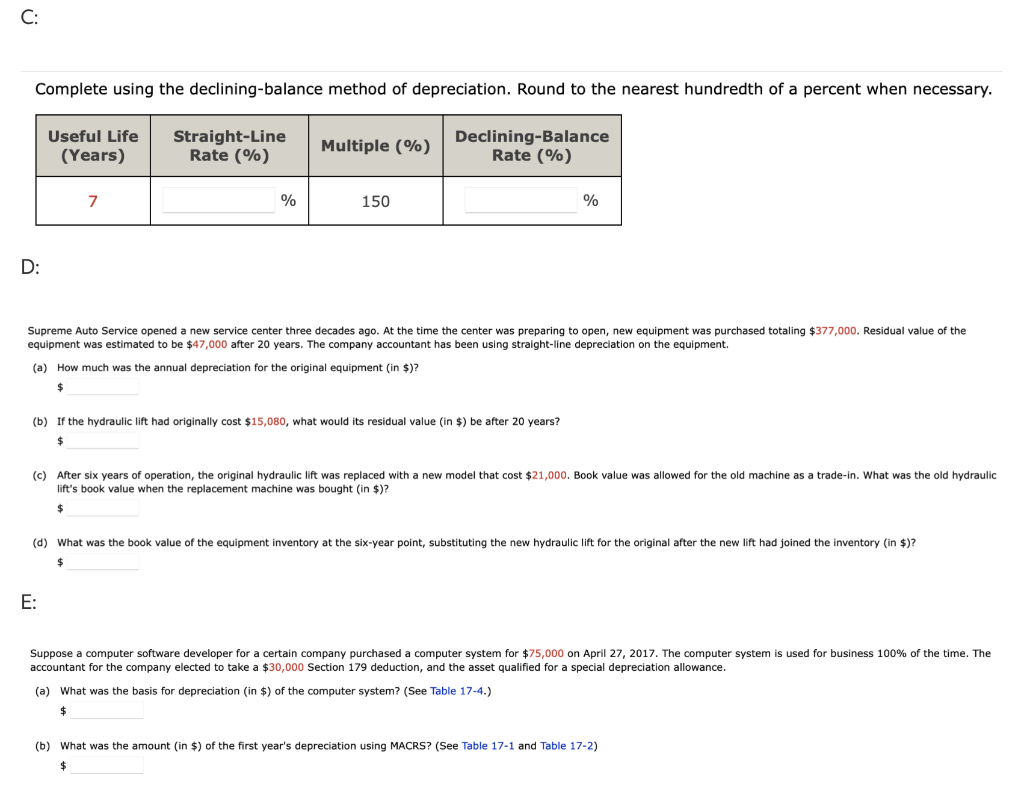

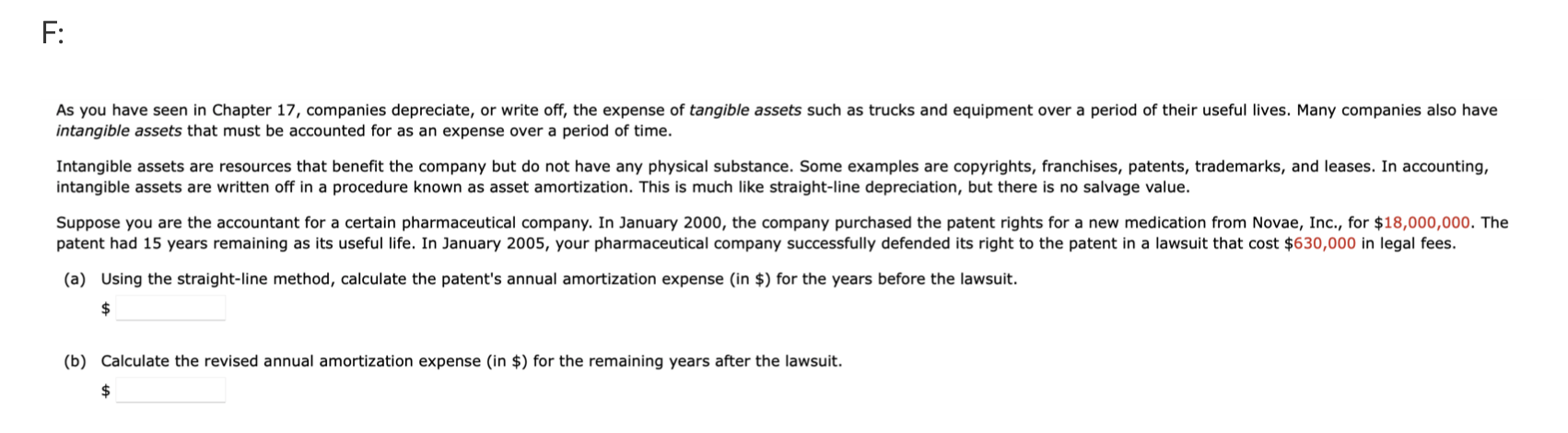

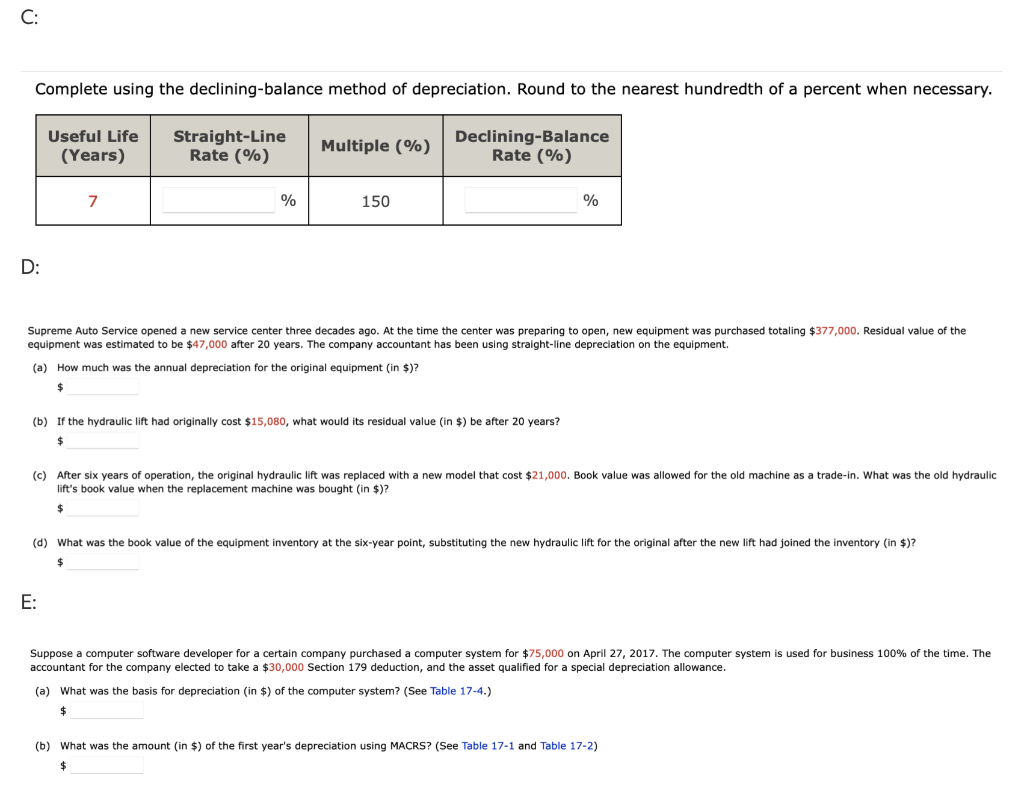

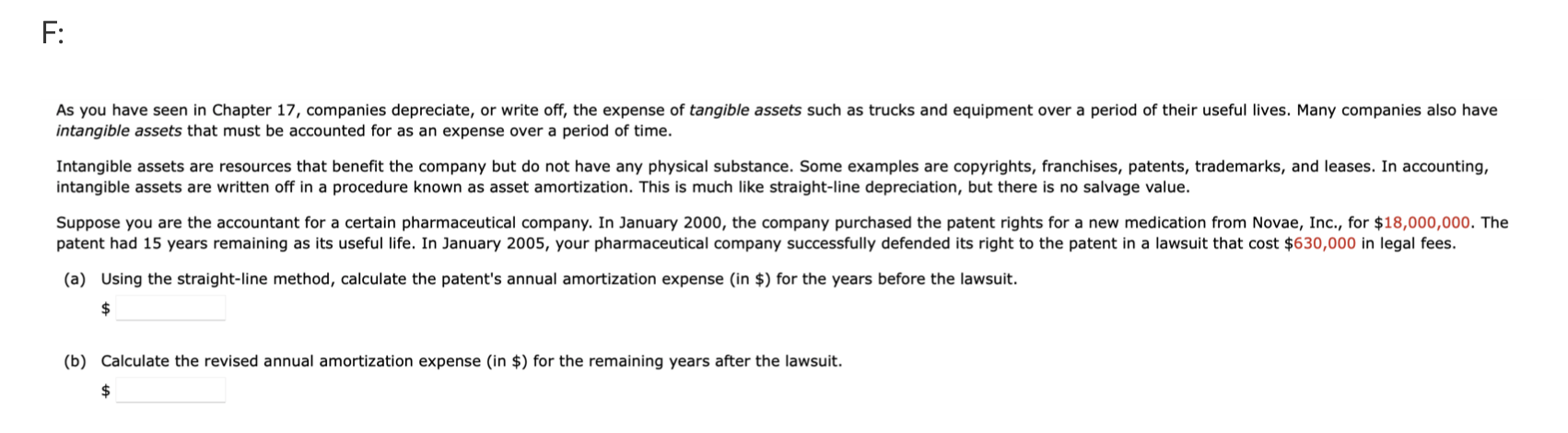

C: Complete using the declining-balance method of depreciation. Round to the nearest hundredth of a percent when necessary. Useful Life (Years) Straight-Line Rate (%) Multiple (%) Declining-Balance Rate (%) 7 % 150 % D: Supreme Auto Service opened a new service center three decades ago. At the time the center was preparing to open, new equipment was purchased totaling $377,000. Residual value of the equipment was estimated to be $47,000 after 20 years. The company accountant has been using straight-line depreciation on the equipment. (a) How much was the annual depreciation for the original equipment (in $)? $ (b) If the hydraulic lift had originally cost $15,080, what would its residual value in $) be after 20 years? $ (c) After six years of operation, the original hydraulic lift was replaced with a new model that cost $21,000. Book value was allowed for the old machine as a trade-in. What was the old hydraulic lift's book value when the replacement machine was bought (in $)? (d) What was the book value of the equipment inventory at the six-year point, substituting the new hydraulic lift for the original after the new lift had joined the inventory (in $)? $ E: Suppose a computer software developer for a certain company purchased a computer system for $75,000 on April 27, 2017. The computer system is used for business 100% of the time. The accountant for the company elected to take a $30,000 Section 179 deduction, and the asset qualified for a special depreciation allowance. (a) What was the basis for depreciation (in $) of the computer system? (See Table 17-4.) $ (b) What was the amount (in $) of the first year's depreciation using MACRS? (See Table 17-1 and Table 17-2) $ F: F: As you have seen in Chapter 17, companies depreciate, or write off, the expense of tangible assets such as trucks and equipment over a period of their useful lives. Many companies also have intangible assets that must be accounted for as an expense over a period of time. Intangible assets are resources that benefit the company but do not have any physical substance. Some examples are copyrights, franchises, patents, trademarks, and leases. In accounting, intangible assets are written off in a procedure known as asset amortization. This is much like straight-line depreciation, but there is no salvage value. Suppose you are the accountant for a certain pharmaceutical company. In January 2000, the company purchased the patent rights for a new medication from Novae, Inc., for $18,000,000. The patent had 15 years remaining as its useful life. In January 2005, your pharmaceutical company successfully defended its right to the patent in a lawsuit that cost $630,000 in legal fees. (a) Using the straight-line method, calculate the patent's annual amortization expense (in $) for the years before the lawsuit. $ (b) Calculate the revised annual amortization expense (in $) for the remaining years after the lawsuit. $