Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C Corps, Partnerships and S Corps Any guidance /solutions would be greatly appreciated! (100 points) In 2016, A.J. and Eoin form a new business entity

C Corps, Partnerships and S Corps

Any guidance /solutions would be greatly appreciated!

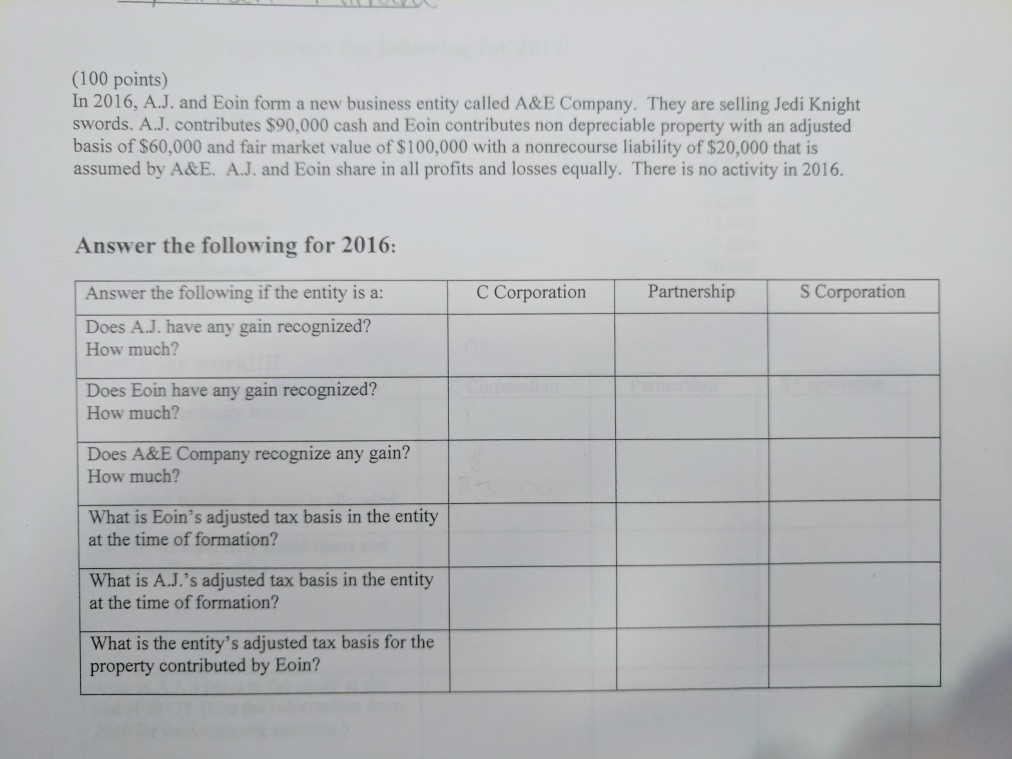

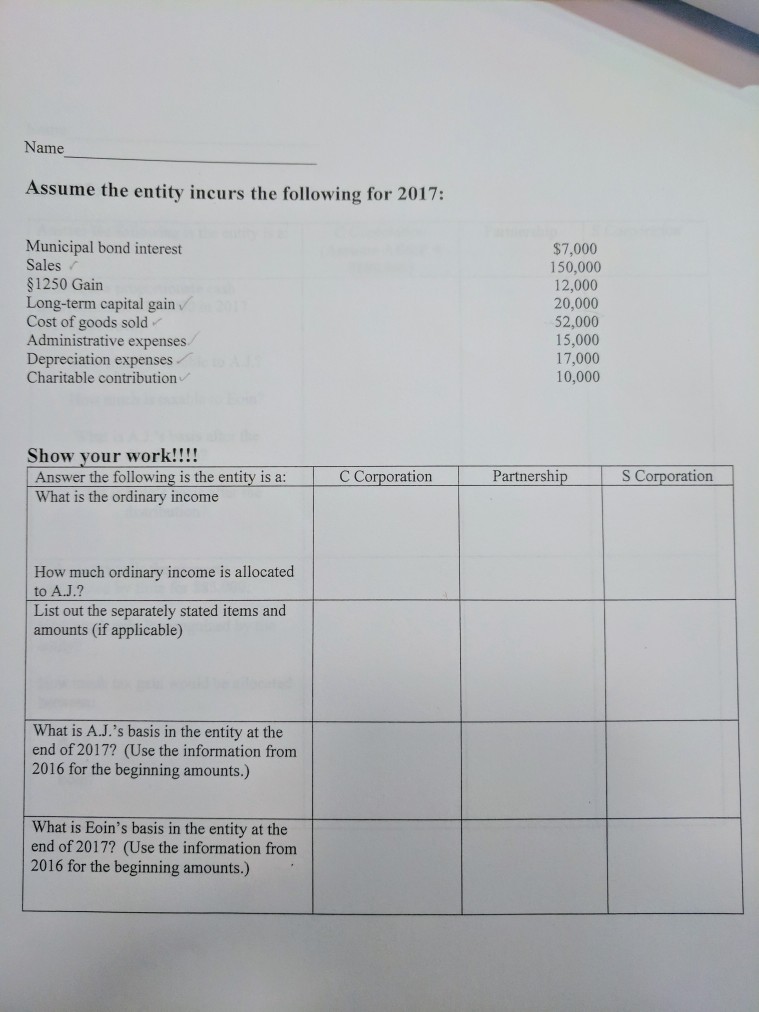

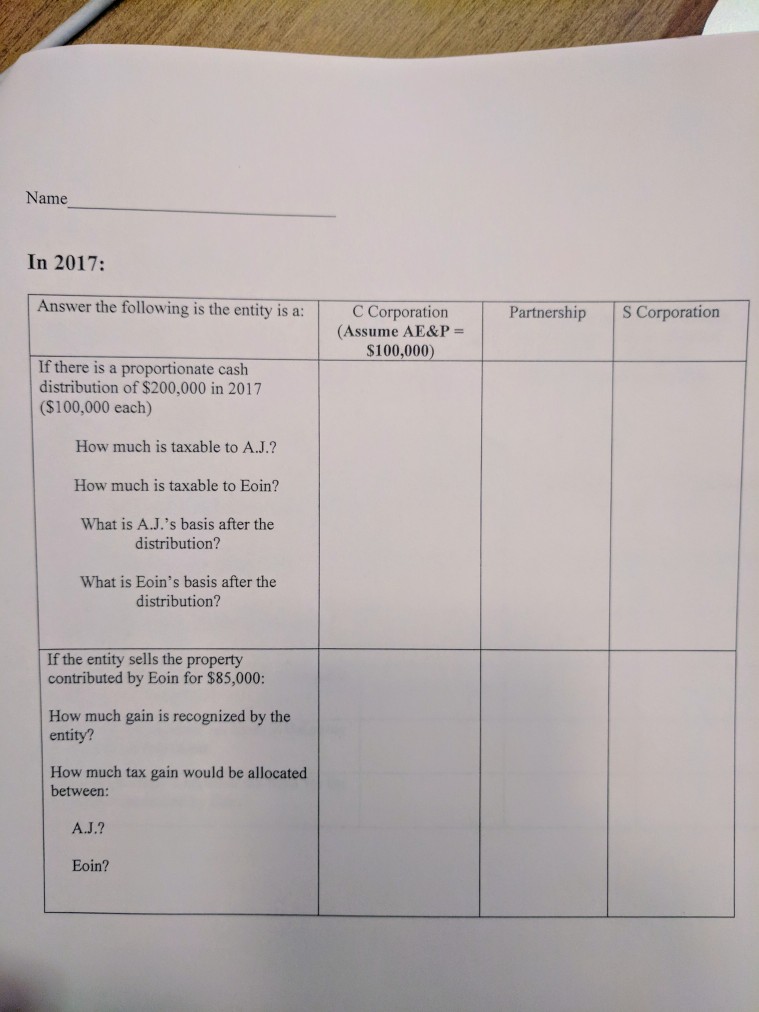

(100 points) In 2016, A.J. and Eoin form a new business entity called A&E Company. They are selling Jedi Knight swords. A.J. contributes $90,000 cash and Eoin contributes non depreciable property with an adjusted basis of $60,000 and fair market value of $100,000 with a nonrecourse liability of $20,000 that is assumed by A&E. A.J. and Eoin share in all profits and losses equally. There is no activity in 2016. Answer the following for 2016: Answer the following if the entity is a: C Corporation Partnership S Corporation Does A.J. have any gain recognized? How much? Does Eoin have any gain recognized? How much? Does A&E Company recognize any gain? How much? What is Eoin's adjusted tax basis in the entity at the time of formation? What is A.J.'s adjusted tax basis in the entity at the time of formation? What is the entity's adjusted tax basis for the property contributed by Eoin? (100 points) In 2016, A.J. and Eoin form a new business entity called A&E Company. They are selling Jedi Knight swords. A.J. contributes $90,000 cash and Eoin contributes non depreciable property with an adjusted basis of $60,000 and fair market value of $100,000 with a nonrecourse liability of $20,000 that is assumed by A&E. A.J. and Eoin share in all profits and losses equally. There is no activity in 2016. Answer the following for 2016: Answer the following if the entity is a: C Corporation Partnership S Corporation Does A.J. have any gain recognized? How much? Does Eoin have any gain recognized? How much? Does A&E Company recognize any gain? How much? What is Eoin's adjusted tax basis in the entity at the time of formation? What is A.J.'s adjusted tax basis in the entity at the time of formation? What is the entity's adjusted tax basis for the property contributed by EoinStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started