Answered step by step

Verified Expert Solution

Question

1 Approved Answer

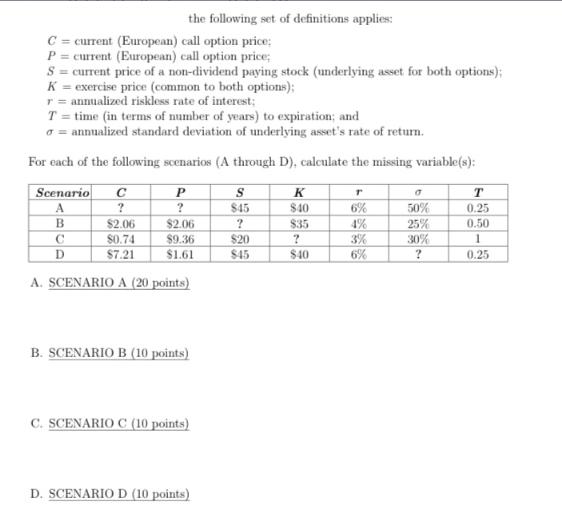

C = current (European) call option price: P= current (European) call option price; S = current price of a non-dividend paying stock (underlying asset

C = current (European) call option price: P= current (European) call option price; S = current price of a non-dividend paying stock (underlying asset for both options); K= exercise price (common to both options); r = annualized riskless rate of interest; the following set of definitions applies: T = time (in terms of number of years) to expiration; and a = annualized standard deviation of underlying asset's rate of return. For each of the following scenarios (A through D), calculate the missing variable(s): Scenario A B C ? C D P ? $2.06 $0.74 $7.21 A. SCENARIO A (20 points) $2.06 $9.36 $1.61 B. SCENARIO B (10 points) C. SCENARIO C (10 points) D. SCENARIO D (10 points) S $45 ? $20 $45 K $40 $35 ? $40 T 6% 4% 3% 6% 0 50% 25% 30% ? T 0.25 0.50 1 0.25

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

It seems youve presented a scenario where were dealing with four cases A B C and D related to the pricing of European call options Since the BlackScholes model is not explicitly mentioned although the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started