Question: c) d) Below is the information relating to the intangible assets of Yehia Bhd. for the year ended 31 December 2021. a) b) On

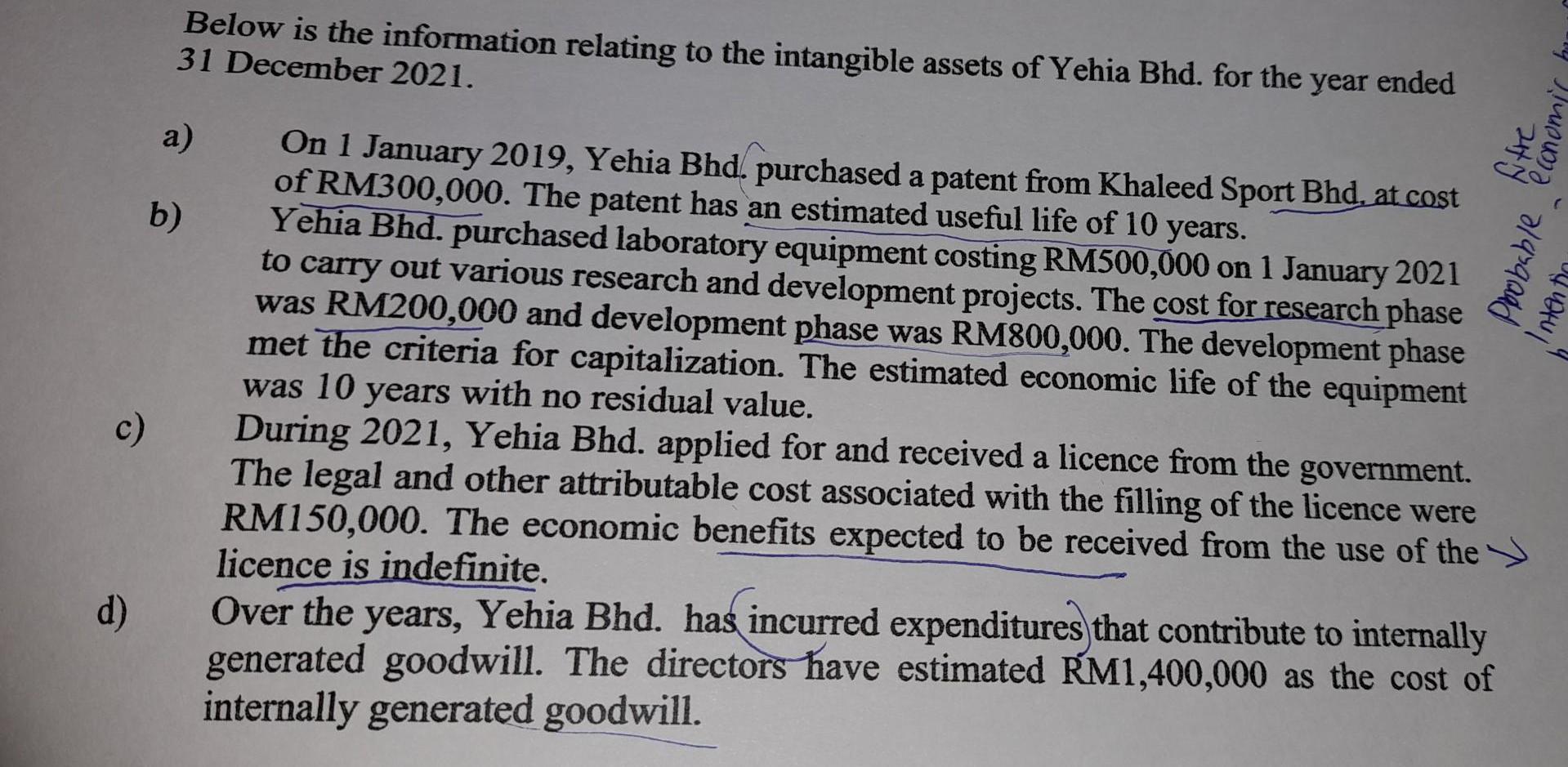

c) d) Below is the information relating to the intangible assets of Yehia Bhd. for the year ended 31 December 2021. a) b) On 1 January 2019, Yehia Bhd. purchased a patent from Khaleed Sport Bhd, at cost of RM300,000. The patent has an estimated useful life of 10 years. Yehia Bhd. purchased laboratory equipment costing RM500,000 on 1 January 2021 to carry out various research and development projects. The cost for research phase was RM200,000 and development phase was RM800,000. The development phase met the criteria for capitalization. The estimated economic life of the equipment was 10 years with no residual value. During 2021, Yehia Bhd. applied for and received a licence from the government. The legal and other attributable cost associated with the filling of the licence were RM150,000. The economic benefits expected to be received from the use of the licence is indefinite. Over the years, Yehia Bhd. has incurred expenditures that contribute to internally generated goodwill. The directors have estimated RM1,400,000 as the cost of internally generated goodwill. fitre Probable economic Intentin AND RE 15 FEBRUARY 2023 Required: Illustrate the accounting treatment for each of the above transactions in accordance with MFRS 138 Intangible Asset. (10 marks) Cost model DRIP >m rish zm

Step by Step Solution

There are 3 Steps involved in it

Lets illustrate the accounting treatment for each of the transactions relating to intangible assets in accordance with MFRS 138 Intangible Asset a Pat... View full answer

Get step-by-step solutions from verified subject matter experts