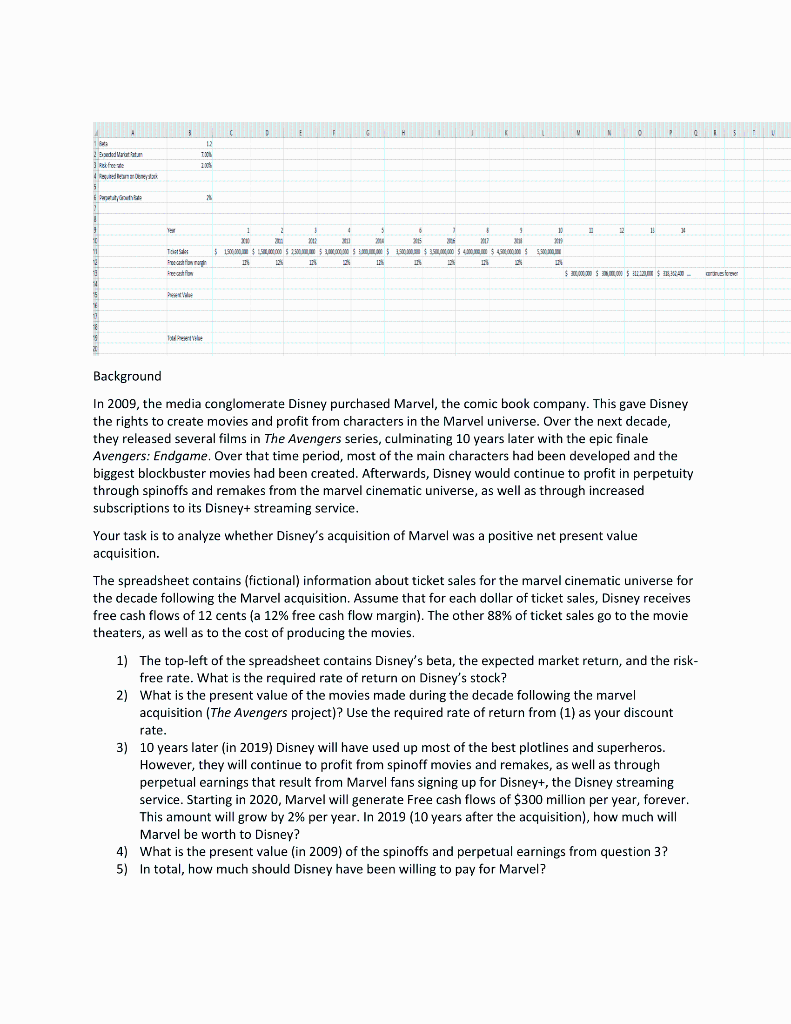

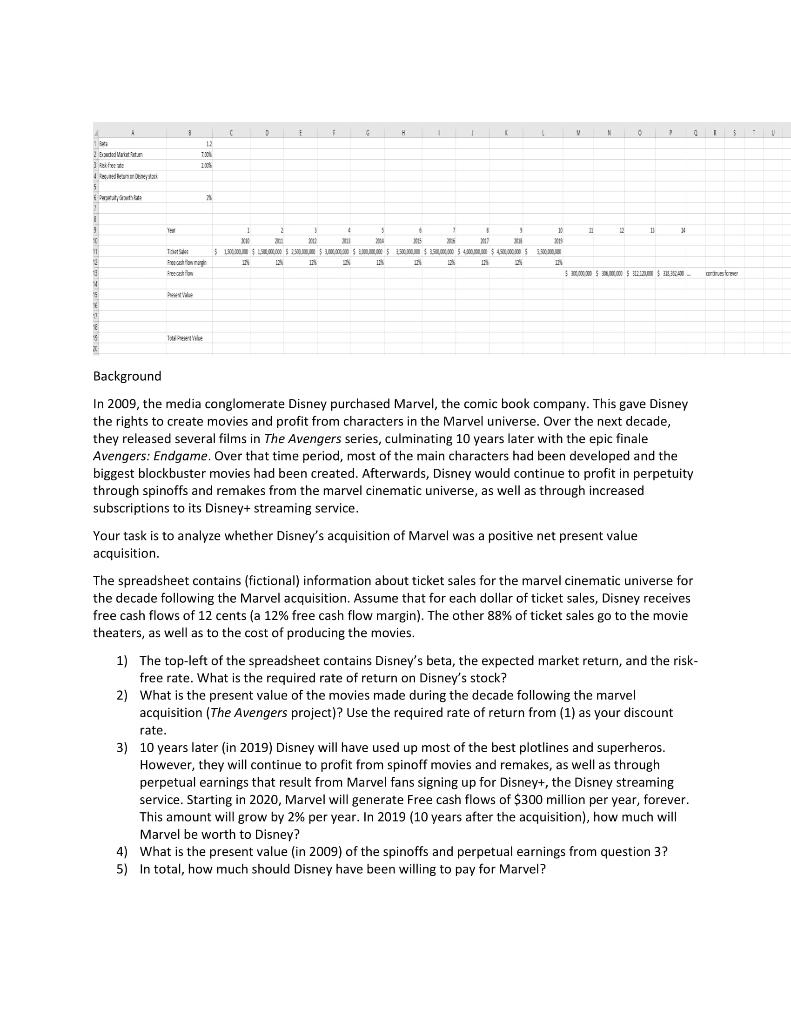

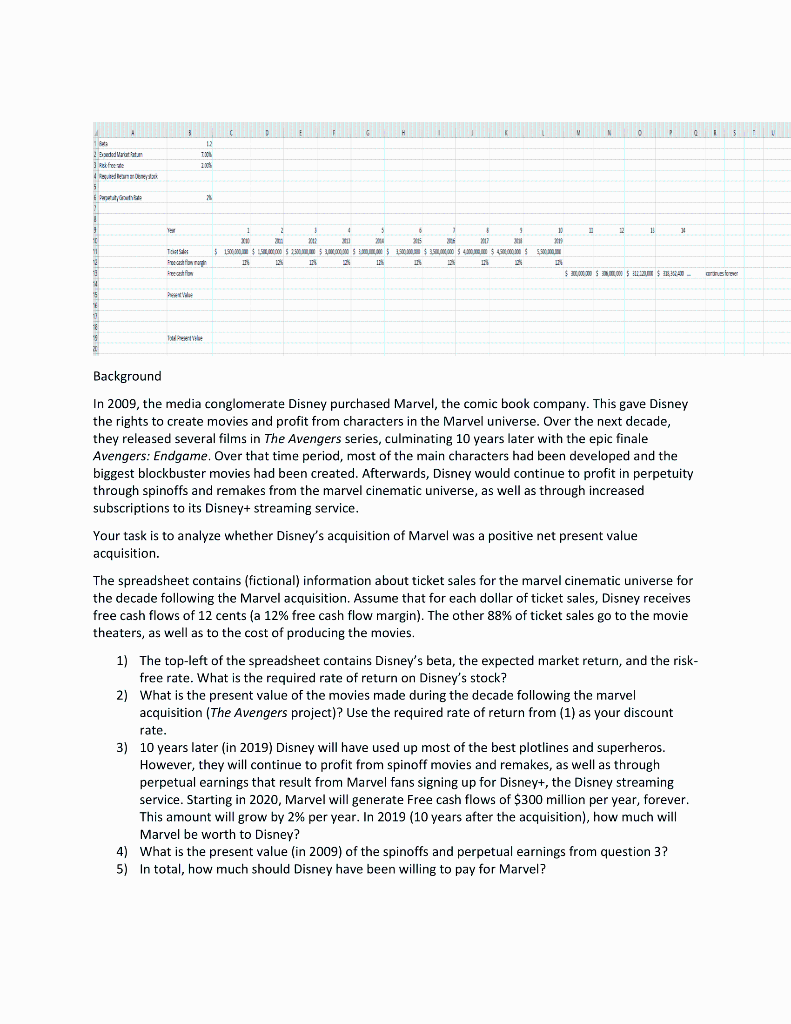

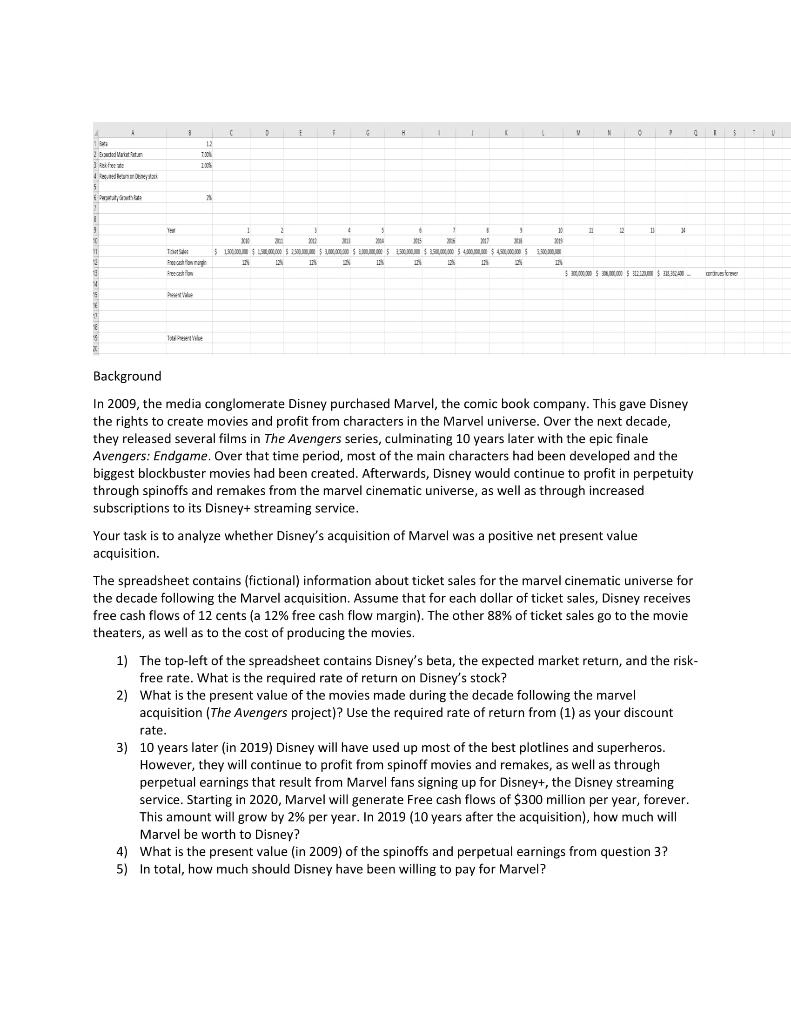

C D F C H v N 5 1 dodara 3 is free dan Demet 12 TX 10 . 12 10 10 2012 1 2 4 5 1 XH 22 25 2 $ 180,00 $ 1.000.000 52.00 52.000 53.00 $ 150.000 $3,000,000 4.000 $ 4.000.000 $ $50 $ IS 11 2 Totale Precho $ 2.000.000 3,000 5 12 12 2 E 0 Background In 2009, the media conglomerate Disney purchased Marvel, the comic book company. This gave Disney the rights to create movies and profit from characters in the Marvel universe. Over the next decade, they released several films in The Avengers series, culminating 10 years later with the epic finale Avengers: Endgame. Over that time period, most of the main characters had been developed and the biggest blockbuster movies had been created. Afterwards, Disney would continue to profit in perpetuity through spinoffs and remakes from the marvel cinematic universe, as well as through increased subscriptions to its Disney+ streaming service. Your task is to analyze whether Disney's acquisition of Marvel was a positive net present value acquisition. The spreadsheet contains (fictional information about ticket sales for the marvel cinematic universe for the decade following the Marvel acquisition. Assume that for each dollar of ticket sales, Disney receives free cash flows of 12 cents (a 12% free cash flow margin). The other 88% of ticket sales go to the movie theaters, as well as to the cost of producing the movies. 1) The top-left of the spreadsheet contains Disney's beta, the expected market return, and the risk- free rate. What is the required rate of return on Disney's stock? 2) What is the present value of the movies made during the decade following the marvel acquisition (The Avengers project)? Use the required rate of return from (1) as your discount rate. 3) 10 years later (in 2019) Disney will have used up most of the best plotlines and superheros. However, they will continue to profit from spinoff movies and remakes, as well as through perpetual earnings that result from Marvel fans signing up for Disney+, the Disney streaming service. Starting in 2020, Marvel will generate Free cash flows of $300 million per year, forever. This amount will grow by 2% per year. In 2019 (10 years after the acquisition), how much will Marvel be worth to Disney? 4) What is the present value (in 2009) of the spinoffs and perpetual earnings from question 3? 5) In total, how much should Disney have been willing to pay for Marvel? 9 C 1 V M 0 1 1 2ded Vaata ke cuted 12 T301 2005 2 3 11 Taste 1 2 + 5 . 1 1 3 13 11 12 II YO 1 31.370.00 $0.00 $ 2500 $ 20.02.2015 15:00 $ 2.000.000 54300.00 $ 4.000.000 $ 5500 IN 1 IN 12 IN $ 2.000.000 53.000.000 $ $ 35 re 9 4 5 Background In 2009, the media conglomerate Disney purchased Marvel, the comic book company. This gave Disney the rights to create movies and profit from characters in the Marvel universe. Over the next decade, they released several films in The Avengers series, culminating 10 years later with the epic finale Avengers: Endgame. Over that time period, most of the main characters had been developed and the biggest blockbuster movies had been created. Afterwards, Disney would continue to profit in perpetuity through spinoffs and remakes from the marvel cinematic universe, as well as through increased subscriptions to its Disney+ streaming service. Your task is to analyze whether Disney's acquisition of Marvel was a positive net present value acquisition The spreadsheet contains (fictional information about ticket sales for the marvel cinematic universe for the decade following the Marvel acquisition. Assume that for each dollar of ticket sales, Disney receives free cash flows of 12 cents (a 12% free cash flow margin). The other 88% of ticket sales go to the movie theaters, as well as to the cost of producing the movies. 1) The top-left of the spreadsheet contains Disney's beta, the expected market return, and the risk- free rate. What is the required rate of return on Disney's stock? 2) What is the present value of the movies made during the decade following the marvel acquisition (The Avengers project)? Use the required rate of return from (1) as your discount rate. 3) 10 years later (in 2019) Disney will have used up most of the best plotlines and superheros. However, they will continue to profit from spinoff movies and remakes, as well as through perpetual earnings that result from Marvel fans signing up for Disney+, the Disney streaming service. Starting in 2020, Marvel will generate Free cash flows of $300 million per year, forever. This amount will grow by 2% per year. In 2019 (10 years after the acquisition), how much will Marvel be worth to Disney? 4) What is the present value (in 2009) of the spinoffs and perpetual earnings from question 3? 5) In total, how much should Disney have been willing to pay for Marvel