Answered step by step

Verified Expert Solution

Question

1 Approved Answer

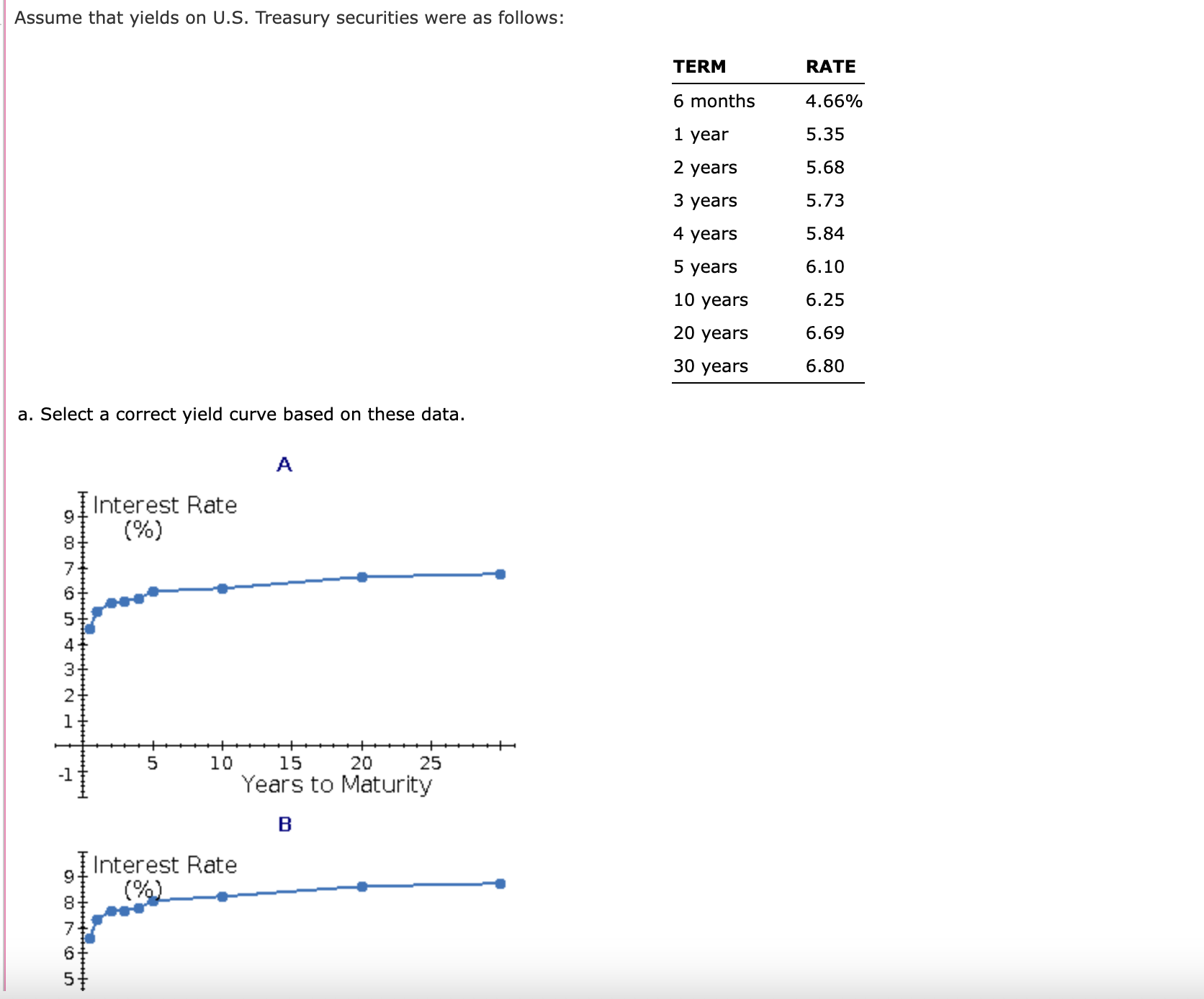

C D The correct yield curve is b . What type of yield curve is shown? b . What type of yield curve is shown?

C

D

The correct yield curve is

b What type of yield curve is shown? b What type of yield curve is shown?

c What information does this graph tell you

Select

d Based on this yield curve, if you needed to borrow money for longer than year, would it make sense for you to borrow short term and renew the loan or borrow long

term? Explain.

I. Even though the borrower reinvests in increasing shortterm rates, those rates are still below the longterm rate, but what makes the higher longterm rate attractive

is the rollover risk that may possibly occur if the shortterm rates go even higher than the longterm rate and that could be for a long time!

II Generally, it would make sense to borrow shortterm because each year the loan is renewed the interest rate would be higher.

III. Generally, it would make sense to borrow shortterm because each year the loan is renewed the interest rate would be lower.

IV Generally, it would make sense to borrow longterm because each year the loan is renewed the interest rate would be lower.

V Differences in yields that may exist between the shortterm and longterm cannot be explained by the forces of supply and demand in each market.Assume that yields on US Treasury securities were as follows:

a Select a correct yield curve based on these data.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started