Answered step by step

Verified Expert Solution

Question

1 Approved Answer

c. Daniel Awuah is married to Sophia Boadu an amputee for ten years with 3 children. All their 3 children attend approved school in Ghana.

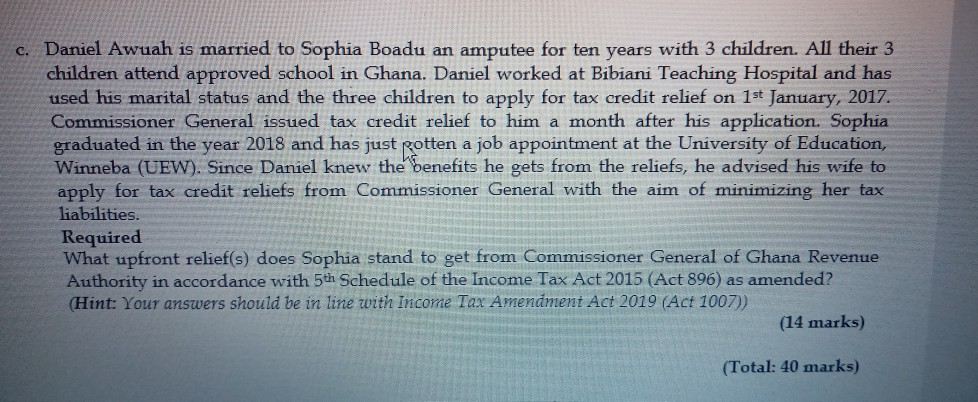

c. Daniel Awuah is married to Sophia Boadu an amputee for ten years with 3 children. All their 3 children attend approved school in Ghana. Daniel worked at Bibiani Teaching Hospital and has used his marital status and the three children to apply for tax credit relief on 1st January, 2017. Commissioner General issued tax credit relief to him a month after his application. Sophia graduated in the year 2018 and has just potten a job appointment at the University of Education, Winneba (UEW). Since Daniel knew the benefits he gets from the reliefs, he advised his wife to apply for tax credit reliefs from Commissioner General with the aim of minimizing her tax liabilities. Required What upfront relief(s) does Sophia stand to get from Commissioner General of Ghana Revenue Authority in accordance with 5th Schedule of the Income Tax Act 2015 (Act 896) as amended? (Hint: Your answers should be in line with Income Tax Amendment Act 2019 (Act 1007)) (14 marks) (Total: 40 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started