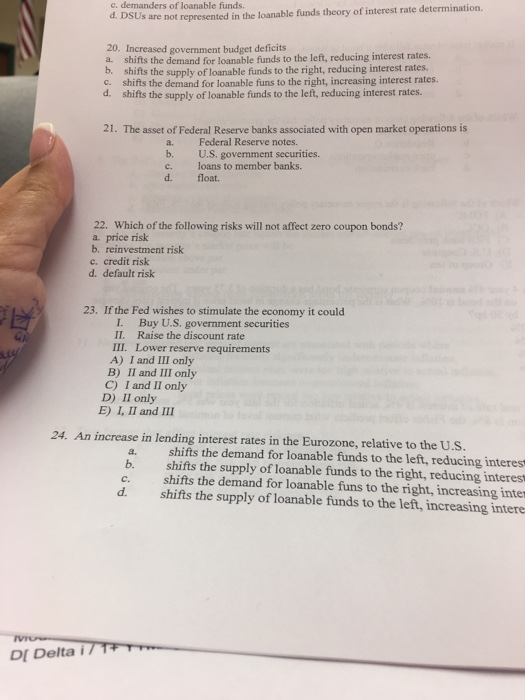

c. demanders of loanable funds. d. DSU s are not represented in the loanable funds theory of interest rate determination 20. Increased government budget deficits a. shifts the demand for loanable funds to the left, reducing interest rates. b shifts the supply of loanable funds to the right, reducing interest rates. c. shifts the demand for loanable funs to the right, increasing interest rates. d. shifts the supply of loanable funds to the left, reducing interest rates. 21. The asset of Federal Reserve banks associated with open market operations is a. Federal Reserve notes. b. U.S. govenment securities. c. loans to member banks. d. float. 22. Which of the following risks will not affect zero coupon bonds? a. price risk b. reinvestment risk c. credit risk d. default risk 23. If the Fed wishes to stimulate the economy it could I. Buy U.S. govermment securities II. Raise the discount rate II. Lower reserve requirements A) I and III only B) II and III only C) I and II only D) II only E) I, II and 24. An increase in lending interest rates in the Eurozone, relative to the U.S. a. shifts the demand for loanable funds to the left, reducing interes b. shifts the supply of loanable funds to the right, reducing interest c. shifts the demand for loanable funs to the right, increasing inte d. shifts the supply of loanable funds to the left, increasing intere DI Delta i7 c. demanders of loanable funds. d. DSU s are not represented in the loanable funds theory of interest rate determination 20. Increased government budget deficits a. shifts the demand for loanable funds to the left, reducing interest rates. b shifts the supply of loanable funds to the right, reducing interest rates. c. shifts the demand for loanable funs to the right, increasing interest rates. d. shifts the supply of loanable funds to the left, reducing interest rates. 21. The asset of Federal Reserve banks associated with open market operations is a. Federal Reserve notes. b. U.S. govenment securities. c. loans to member banks. d. float. 22. Which of the following risks will not affect zero coupon bonds? a. price risk b. reinvestment risk c. credit risk d. default risk 23. If the Fed wishes to stimulate the economy it could I. Buy U.S. govermment securities II. Raise the discount rate II. Lower reserve requirements A) I and III only B) II and III only C) I and II only D) II only E) I, II and 24. An increase in lending interest rates in the Eurozone, relative to the U.S. a. shifts the demand for loanable funds to the left, reducing interes b. shifts the supply of loanable funds to the right, reducing interest c. shifts the demand for loanable funs to the right, increasing inte d. shifts the supply of loanable funds to the left, increasing intere DI Delta i7