Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20) In determining the scope and nature of services to be performed in public practice, a CPA firm should: A) Only perform accounting related

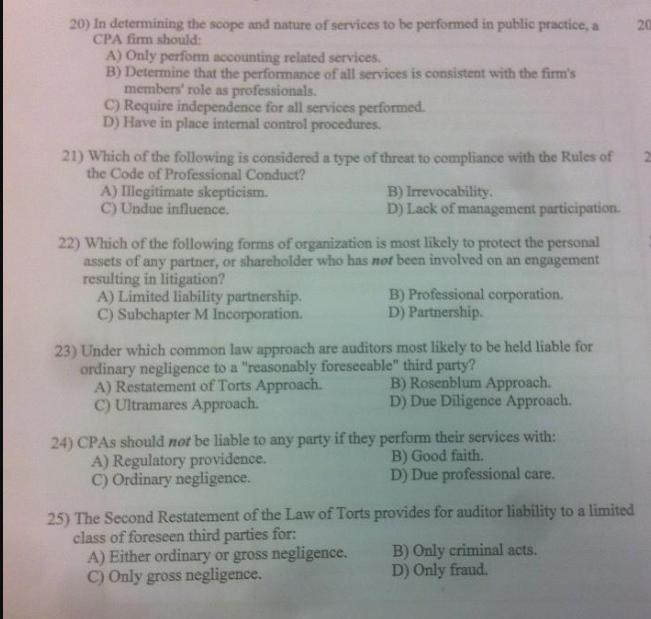

20) In determining the scope and nature of services to be performed in public practice, a CPA firm should: A) Only perform accounting related services. B) Determine that the performance of all services is consistent with the firm's members' role as professionals. C) Require independence for all services performed. D) Have in place internal control procedures. 21) Which of the following is considered a type of threat to compliance with the Rules of the Code of Professional Conduct? A) Illegitimate skepticism. C) Undue influence. B) Irrevocability. D) Lack of management participation. 22) Which of the following forms of organization is most likely to protect the personal assets of any partner, or shareholder who has not been involved on an engagement resulting in litigation? A) Limited liability partnership. C) Subchapter M Incorporation. B) Professional corporation. D) Partnership. 23) Under which common law approach are auditors most likely to be held liable for ordinary negligence to a "reasonably foreseeable" third party? A) Restatement of Torts Approach. C) Ultramares Approach. B) Rosenblum Approach. D) Due Diligence Approach. 24) CPAs should not be liable to any party if they perform their services with: A) Regulatory providence. C) Ordinary negligence. B) Good faith. D) Due professional care. 25) The Second Restatement of the Law of Torts provides for auditor liability to a limited class of foreseen third parties for: A) Either ordinary or gross negligence. C) Only gross negligence. B) Only criminal acts. D) Only fraud. 20 20) In determining the scope and nature of services to be performed in public practice, a CPA firm should: A) Only perform accounting related services. B) Determine that the performance of all services is consistent with the firm's members' role as professionals. C) Require independence for all services performed. D) Have in place internal control procedures. 21) Which of the following is considered a type of threat to compliance with the Rules of the Code of Professional Conduct? A) Illegitimate skepticism. C) Undue influence. B) Irrevocability. D) Lack of management participation. 22) Which of the following forms of organization is most likely to protect the personal assets of any partner, or shareholder who has not been involved on an engagement resulting in litigation? A) Limited liability partnership. C) Subchapter M Incorporation. B) Professional corporation. D) Partnership. 23) Under which common law approach are auditors most likely to be held liable for ordinary negligence to a "reasonably foreseeable" third party? A) Restatement of Torts Approach. C) Ultramares Approach. B) Rosenblum Approach. D) Due Diligence Approach. 24) CPAs should not be liable to any party if they perform their services with: A) Regulatory providence. C) Ordinary negligence. B) Good faith. D) Due professional care. 25) The Second Restatement of the Law of Torts provides for auditor liability to a limited class of foreseen third parties for: A) Either ordinary or gross negligence. C) Only gross negligence. B) Only criminal acts. D) Only fraud. 20

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

20 In determining the scope and nature of services to be performed in public practice a CPA firm should A Only perform accounting related services B Determine that the performance of all services is c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started