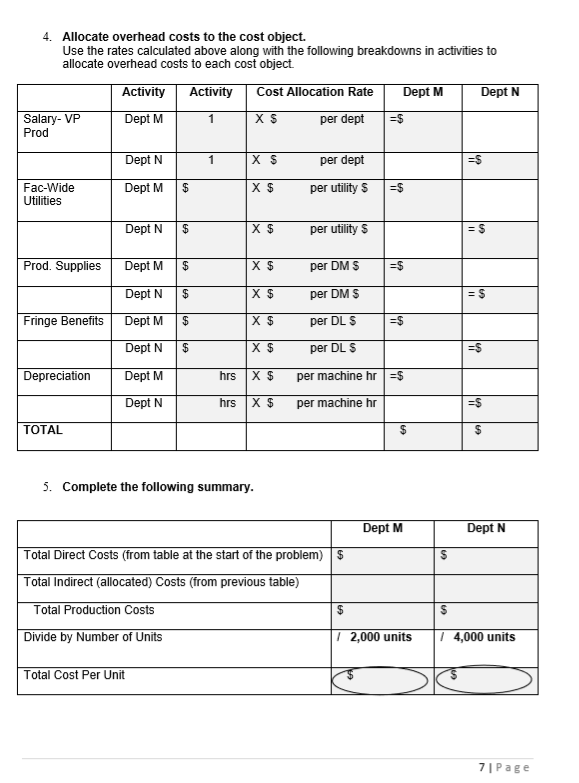

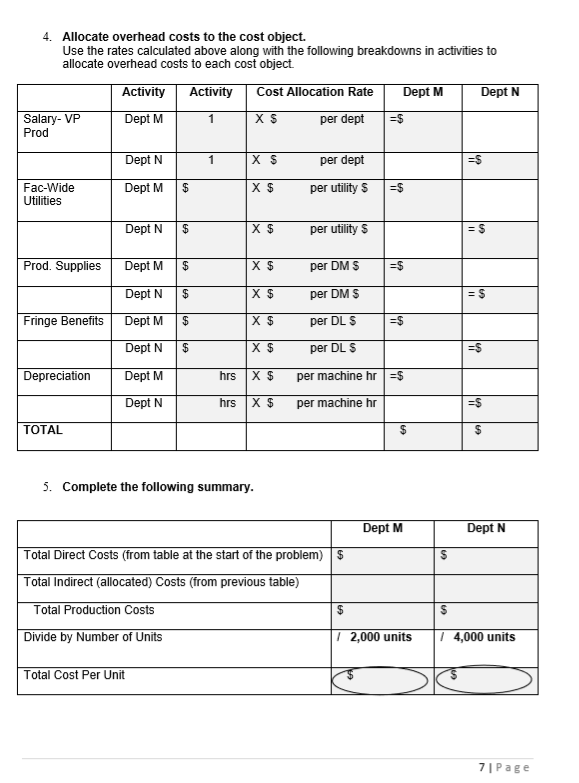

c) Exercise 2: What is the Total Cost per Unit for Dept M (dollars and cents)? See circle on the printed exercise-Last page.

d) Exercise 2: What is the Total Cost per Unit for Dept N (dollars and cents)? See circle on the printed exercise-Last page.

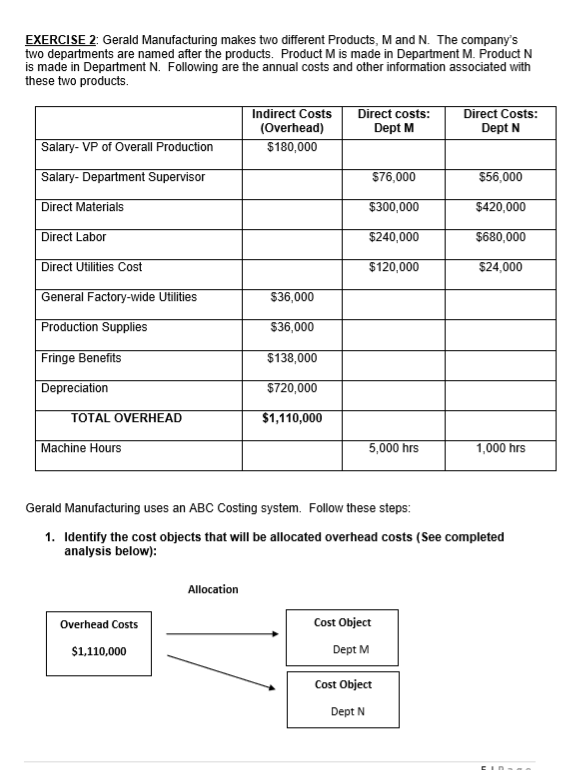

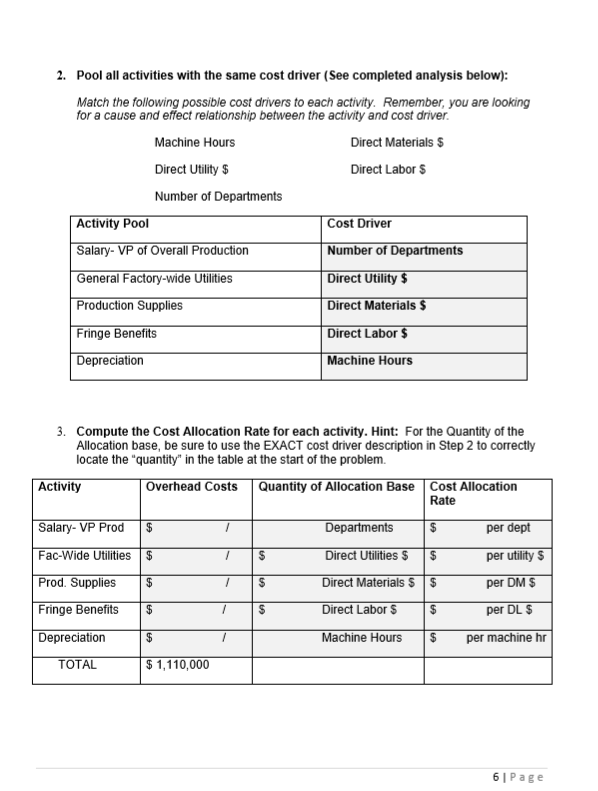

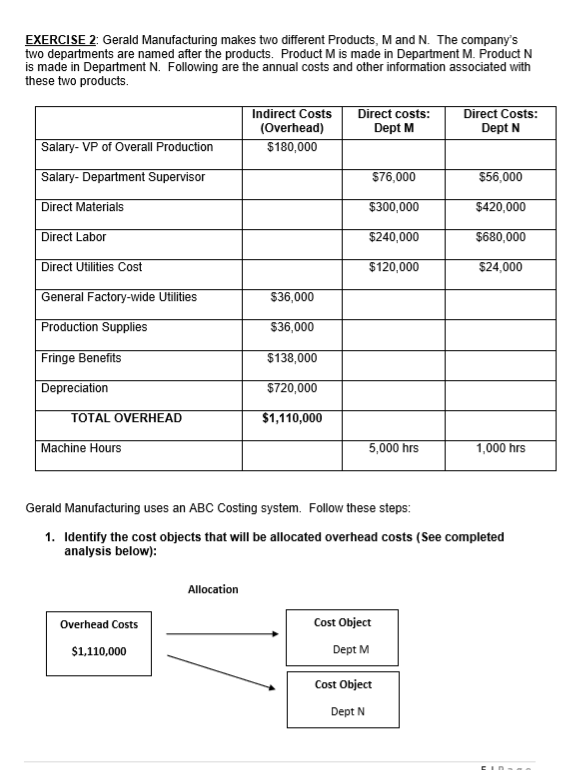

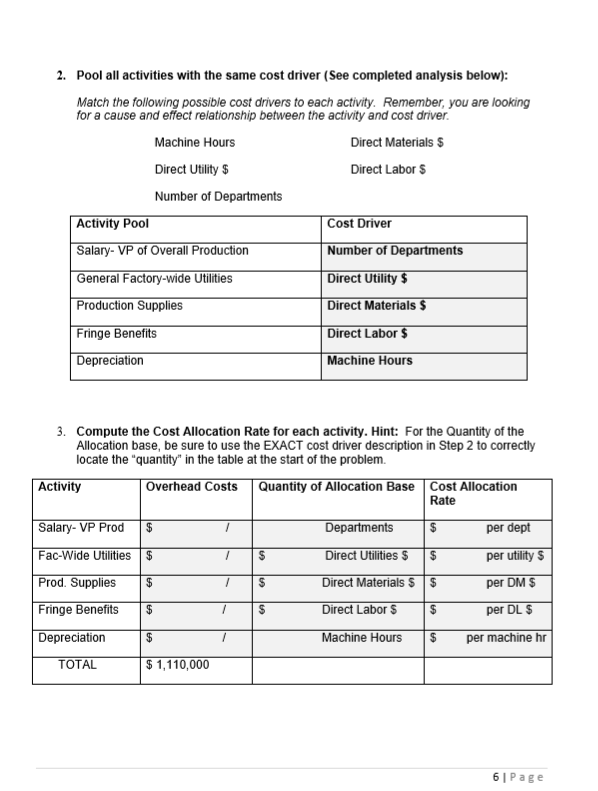

EXERCISE 2: Gerald Manufacturing makes two different Products, M and N. The company's two departments are named after the products. Product M is made in Department M. Product N is made in Department N. Following are the annual costs and other information associated with these two products. Direct costs: Dept M Direct Costs: Dept N Indirect Costs (Overhead) $180,000 Salary- VP of Overall Production Salary- Department Supervisor $76,000 $56,000 $300,000 $420,000 Direct Materials $240,000 $680,000 Direct Labor $120,000 $24,000 Direct Utilities Cost $36,000 General Factory-wide Utilities $36,000 Production Supplies $138,000 Fringe Benefits Depreciation $720,000 $1,110,000 TOTAL OVERHEAD 5,000 hrs 1,000 hrs Machine Hours Gerald Manufacturing uses an ABC Costing system. Follow these steps: 1. Identify the cost objects that will be allocated overhead costs (See completed analysis below): Allocation Cost Object Overhead Costs Dept M $1,110,000 Cost Object Dept N 2. Pool all activities with the same cost driver (See completed analysis below): Match the following possible cost drivers to each activity. Remember, you are looking for a cause and effect relationship between the activity and cost driver Machine Hours Direct Materials $ Direct Labor $ Direct Utility $ Number of Departments Activity Pool Cost Driver Number of Departments Salary- VP of Overall Production Direct Utility$ General Factory-wide Utilities Direct Materials $ Production Supplies Fringe Benefits Direct Labor $ Depreciation Machine Hours 3. Compute the Cost Allocation Rate for each activity. Hint: For the Quantity of the Allocation base, be sure to use the EXACT cost driver description in Step 2 to correctly locate the "quantity" in the table at the start of the problem. Quantity of Allocation Base Cost Allocation Activity Overhead Costs Rate Salary- VP Prod Departments per dept Fac-Wide Utilities per utility $ Direct Utilities $ Prod. Supplies per DM $ Direct Materials $ Fringe Benefits Direct Labor $ per DL $ Depreciation per machine hr Machine Hours $1,110,000 TTAL 6I Page 4. Allocate overhead costs to the cost object. Use the rates calculated above along with the following breakdowns in activities to allocate overhead costs to each cost object Activity Activity Dept M Dept N Cost Allocation Rate Salary- VP Prod Dept M 1 X S per dept Dept N 1 X S per dept Fac-Wide Utilities Dept M $ X $ per utility$ Dept N X $ per utility$ Prod. Supplies Dept M $ X $ per DM S Dept N X $ per DM $ Dept M Fringe Benefits X $ per DL S Dept N $ X $ per DL S Depreciation Dept M hrs X $ per machine hr Dept N hrs per machine hr TOTAL Complete the following summary 5. Dept M Dept N Total Direct Costs (from table at the start of the problem) $ Total Indirect (allocated) Costs (from previous table) Total Production Costs $ 4,000 units 2,000 units Divide by Number of Units Total Cost Per Unit 7 | Page US 'S