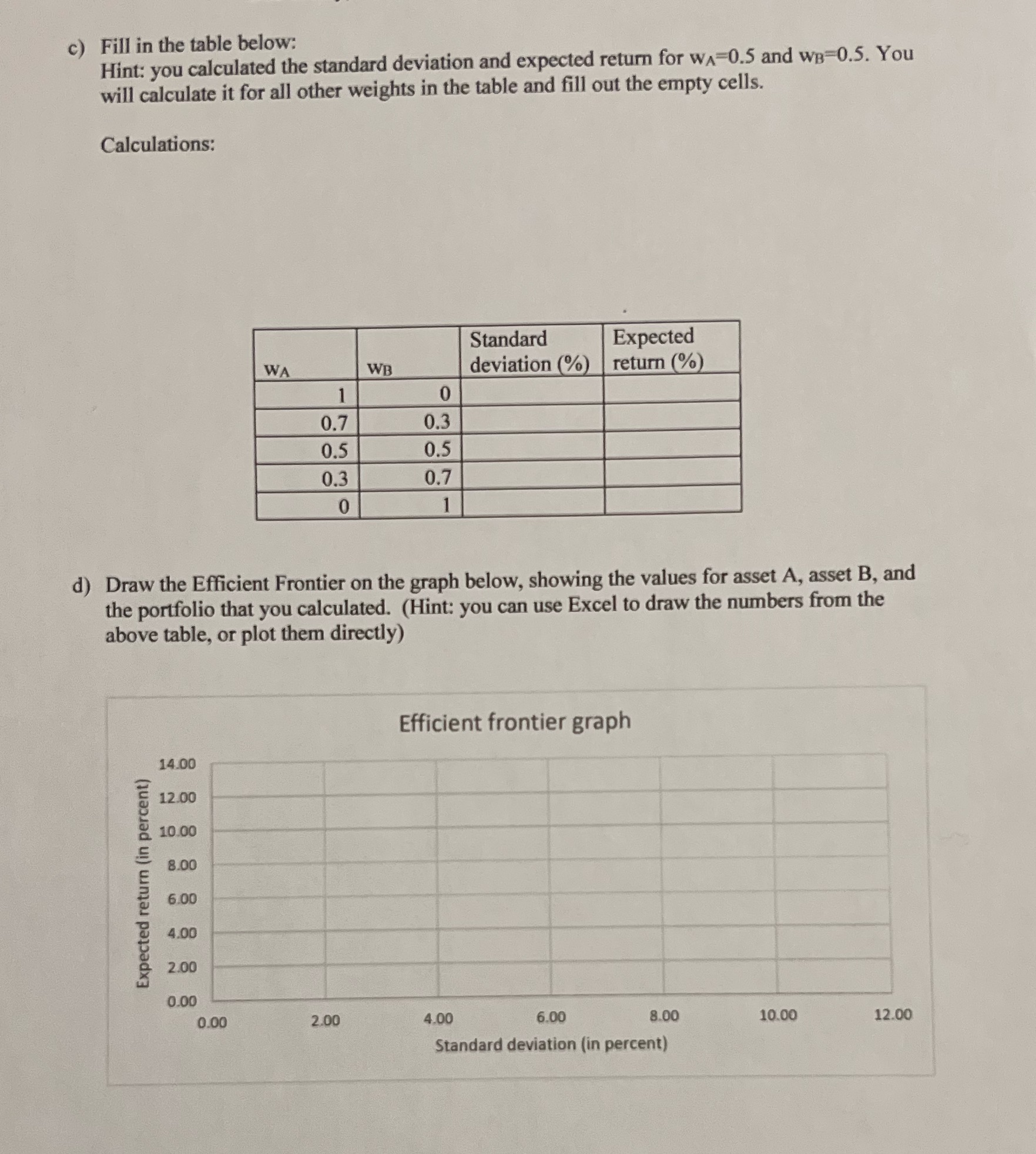

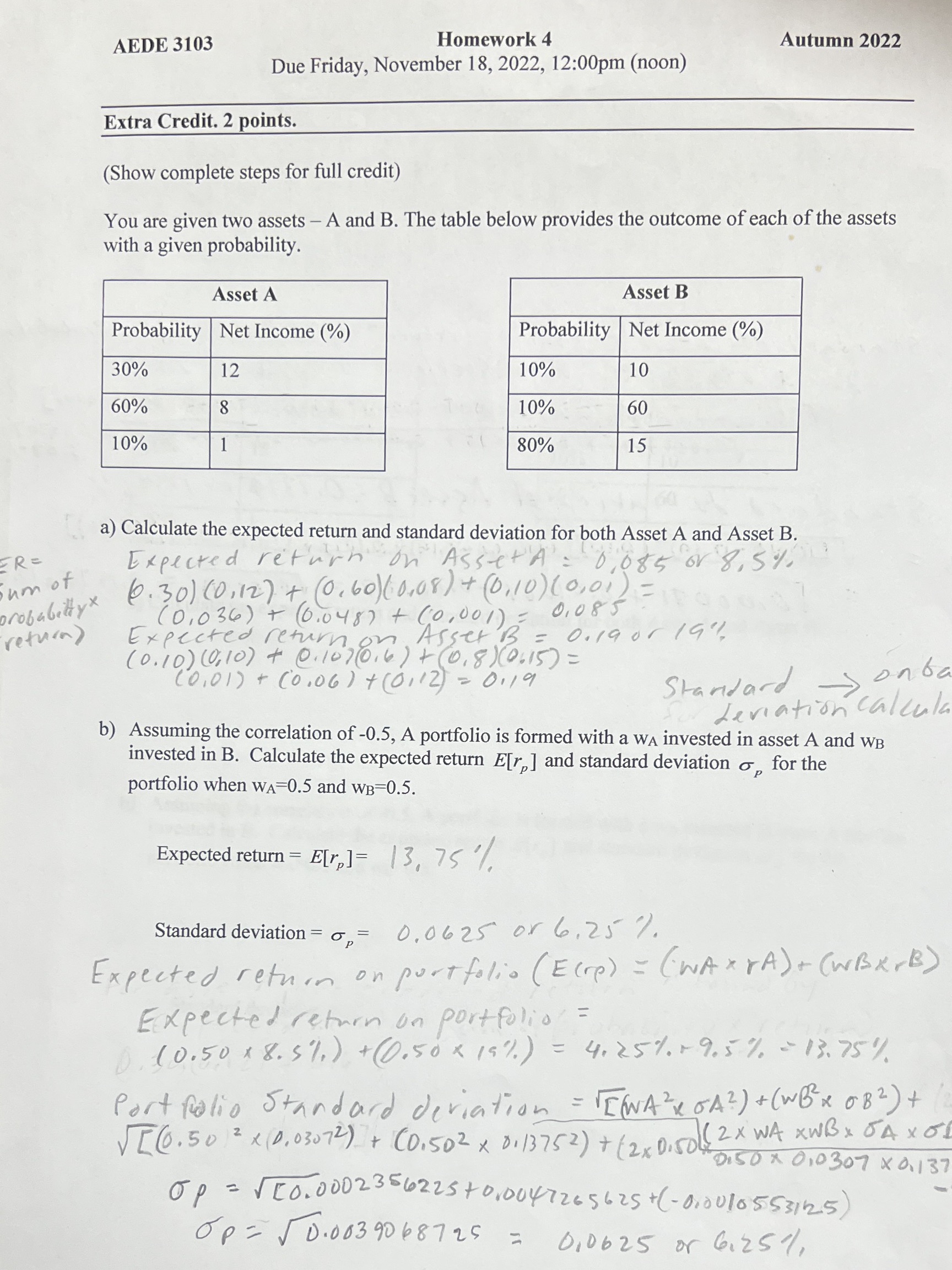

c) Fill in the table below: Hint: you calculated the standard deviation and expected return for WA=0.5 and WB=0.5. You will calculate it for all other weights in the table and fill out the empty cells. Calculations: Standard Expected WA WB deviation (%) return (%) 1 0 0.7 0.3 0.5 0.5 0.3 0.7 0 d) Draw the Efficient Frontier on the graph below, showing the values for asset A, asset B, and the portfolio that you calculated. (Hint: you can use Excel to draw the numbers from the above table, or plot them directly) Efficient frontier graph 14.00 12.00 10.00 8.00 Expected return (in percent) 6.00 4.00 2.00 0.00 0.00 2.00 4.00 6.00 8.00 10.00 12.00 Standard deviation (in percent)AEDE 3103 Homework 4 Autumn 2022 Due Friday, November 18, 2022, 12:00pm (noon) Extra Credit. 2 points. (Show complete steps for full credit) You are given two assets - A and B. The table below provides the outcome of each of the assets with a given probability. Asset A Asset B Probability Net Income (%) Probability Net Income (%) 30% 12 10% 10 60% 8 10% 60 10% 80% 15 a) Calculate the expected return and standard deviation for both Asset A and Asset B. ERE Expected return on Asset A = 0 085 or 8,5% um of 60 . 30 ) ( 0 , 12 ) + (0 , 60 ) ( 0,08 ) + ( 0, 10 ) (0, 01 ) = probablyx ( 0 1 0 3 6 ) + ( 6 . 04 8 7 + (0 , 00 1 ) = 01085 return) Expected return of Asset B 13 = 0. 19 01 19% ( 0 . 10 ) ( 0 , 10 ) + 0 . 10 7 ( 0 , 6 ) + (0 , 8 ) ( 0. 15 ) = ( 0 1 0 1 ) + ( 0 . 06 ) + ( 0 1 12) = 0.19 Standard -> on ba deviation calcula b) Assuming the correlation of -0.5, A portfolio is formed with a WA invested in asset A and WB invested in B. Calculate the expected return E[r, ] and standard deviation o for the portfolio when WA=0.5 and WB=0.5. Expected return = E[r]= 13, 75 / Standard deviation = 6, = 0.0625 or 6.25 7. Expected return on portfolio ( E ( re) = ( WA X r A ) + (WBKrB ) Expected return on portfolio = 1 1 0 . 5 0 x 8 . 5 %, ) + ( 0. 5 0 x 19 % ) = 4:25%%+9. 5 % - 13. 75% Portfolio Standard deviation = [(Asx oA ? ) + ( WB x OB 2 ) + JT 6 . 5 0 1 2 x ( 0 , 03 0 7 2 ) + ( 0 , 5 0 2 x 0 , 13 75 2 ) + 1 2x Di50 ( 2 x WA XWB x 54 x0. " D150 1 010 307 x 0. 137 O P = VIO . 0 0 0 2 3 5 6 2 2 5 + 0 , 0 0 4 7 2 6 5 6 25 + ( - 0, 0 0 10 5 5 3 / 25) Op = 50 . 0 03 90 687 25 = 01 06 25 or 6125 %