Question

(c) For a rapidly growing Japanese company, the growth rate is projected to be 20% for the next two years and 10% for the

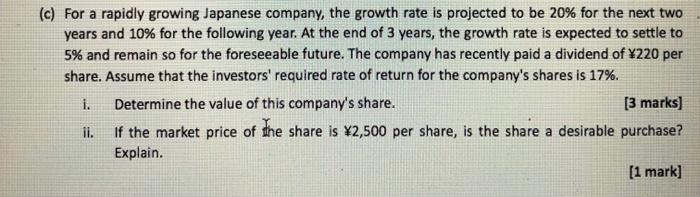

(c) For a rapidly growing Japanese company, the growth rate is projected to be 20% for the next two years and 10% for the following year. At the end of 3 years, the growth rate is expected to settle to 5% and remain so for the foreseeable future. The company has recently paid a dividend of 220 per share. Assume that the investors' required rate of return for the company's shares is 17%. i. ii. Determine the value of this company's share. [3 marks] If the market price of the share is 2,500 per share, is the share a desirable purchase? Explain. [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To determine the value of the companys share we can use the dividend discount model DDM form...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Karen W. Braun, Wendy M. Tietz

4th edition

978-0133428469, 013342846X, 133428370, 978-0133428377

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App