Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C H 9 H W ( i ) Help Save 2 5 points Skipped eBook Print References On January 1 of this year, Skamania Company

i

Help

Save

points

Skipped

eBook

Print

References

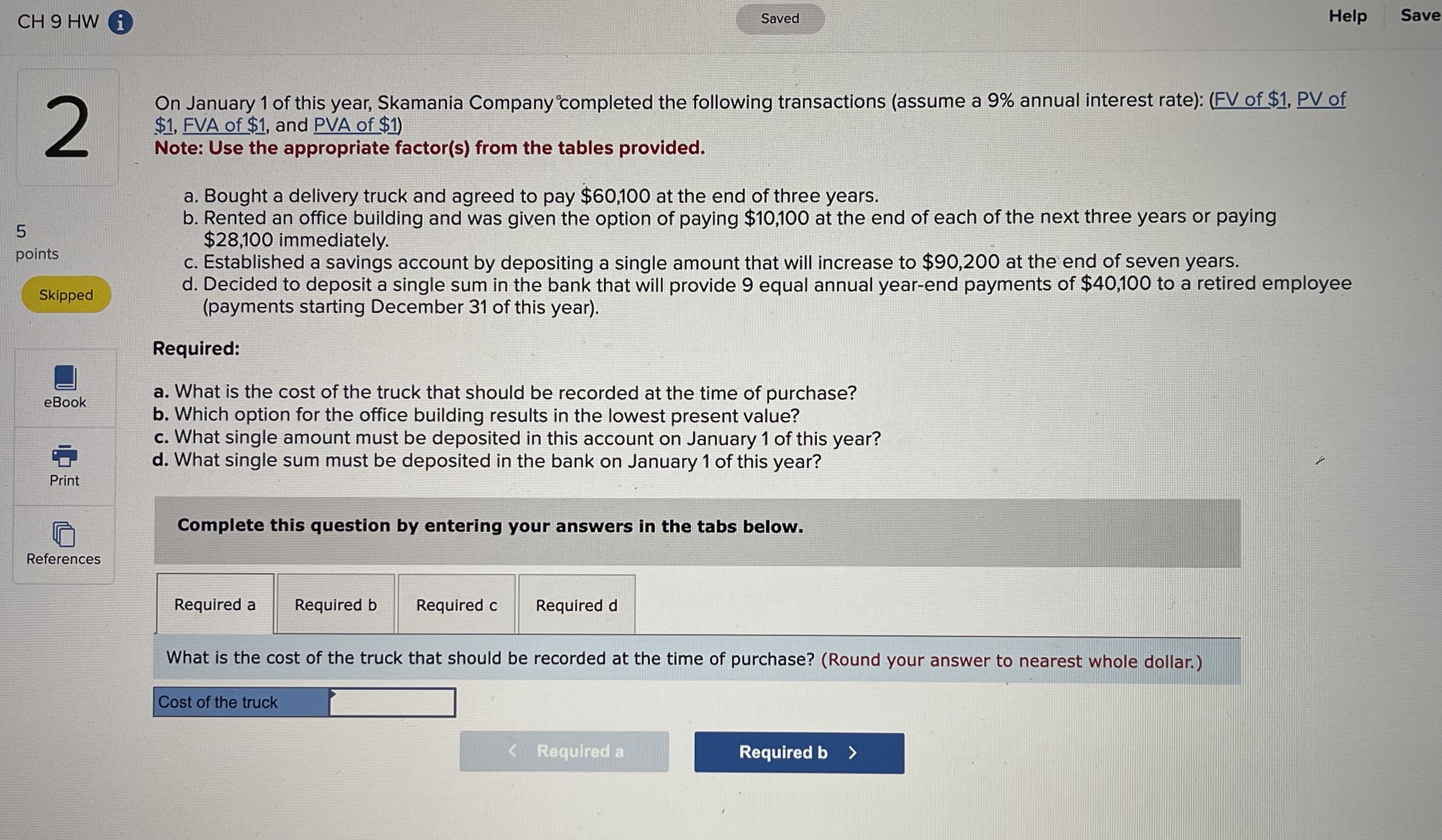

On January of this year, Skamania Company completed the following transactions assume a annual interest rate: FV of $ PV of $ FVA of $ and PVA of $

Note: Use the appropriate factors from the tables provided.

a Bought a delivery truck and agreed to pay $ at the end of three years.

b Rented an office building and was given the option of paying $ at the end of each of the next three years or paying $ immediately.

c Established a savings account by depositing a single amount that will increase to $ at the end of seven years.

d Decided to deposit a single sum in the bank that will provide equal annual yearend payments of $ to a retired employee payments starting December of this year

Required:

a What is the cost of the truck that should be recorded at the time of purchase?

b Which option for the office building results in the lowest present value?

c What single amount must be deposited in this account on January of this year?

d What single sum must be deposited in the bank on January of this year?

Complete this question by entering your answers in the tabs below.

Required a

Required b

Required c

Required d

What is the cost of the truck that should be recorded at the time of purchase? Round your answer to nearest whole dollar.

Cost of the truck

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started