Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C Home Insert Draw Page Layout Formulas Data Review AutoSave OFF D 1 BUSINESS PLAN SUMMARY 2 3 4 5 6 7 8 9

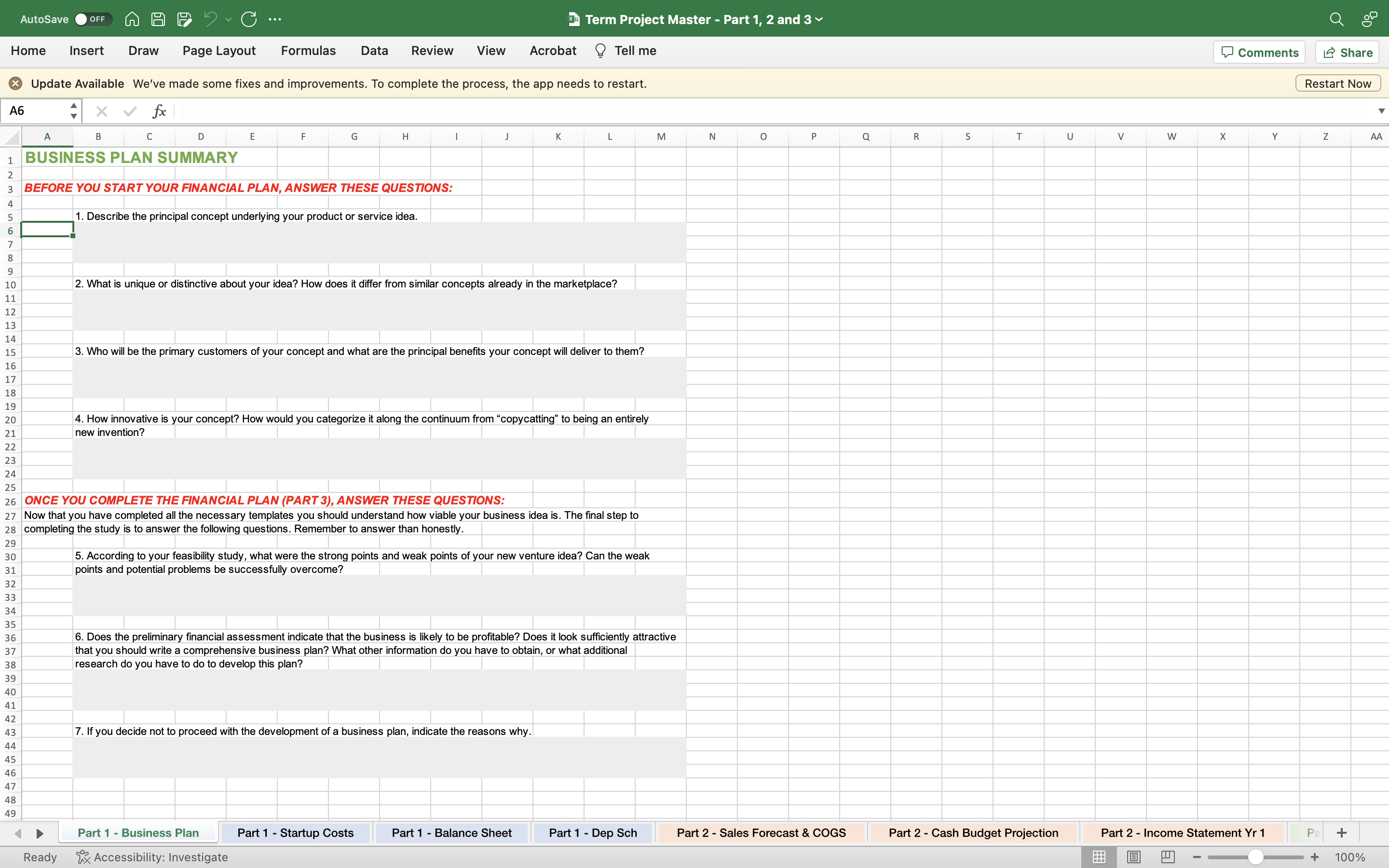

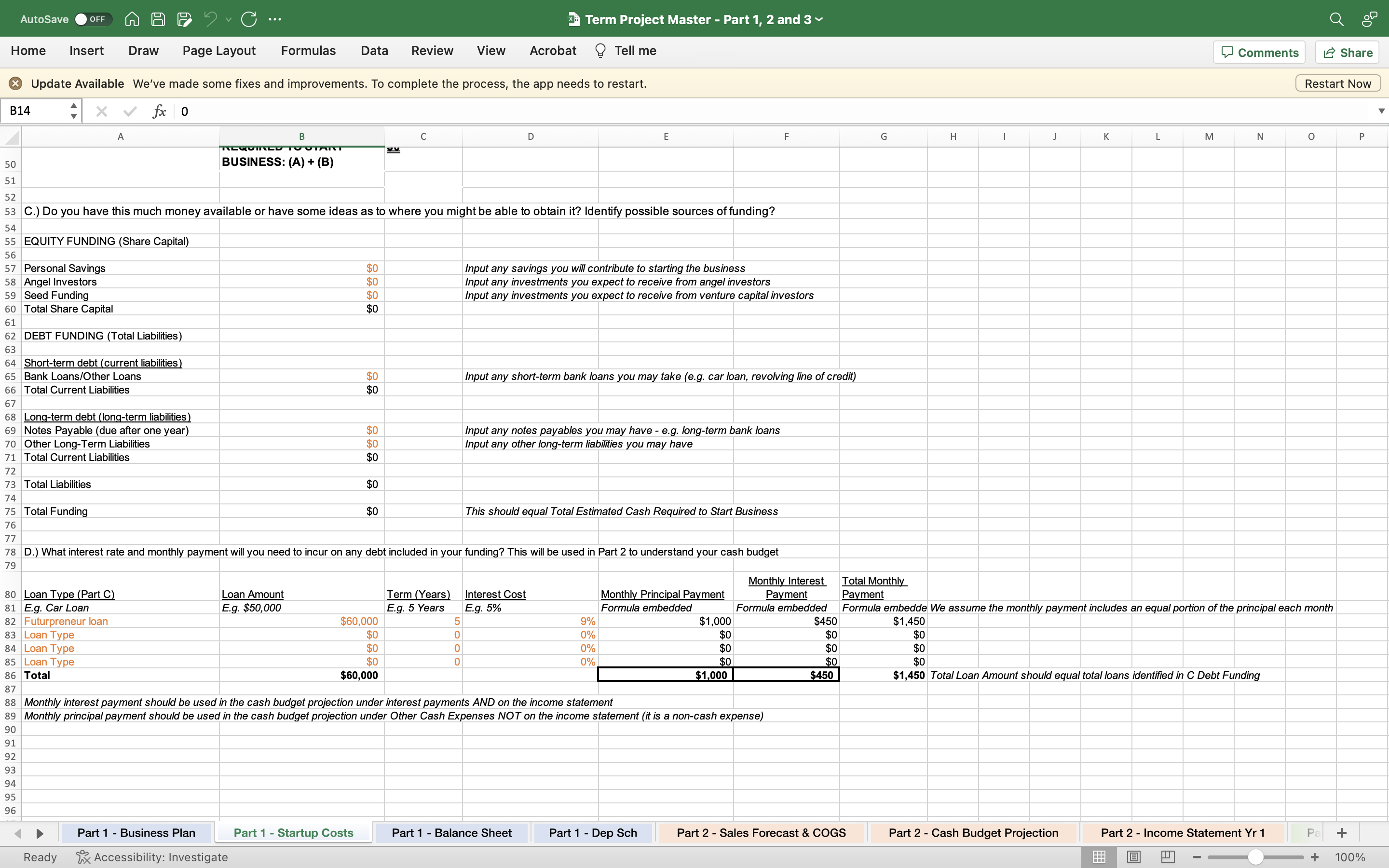

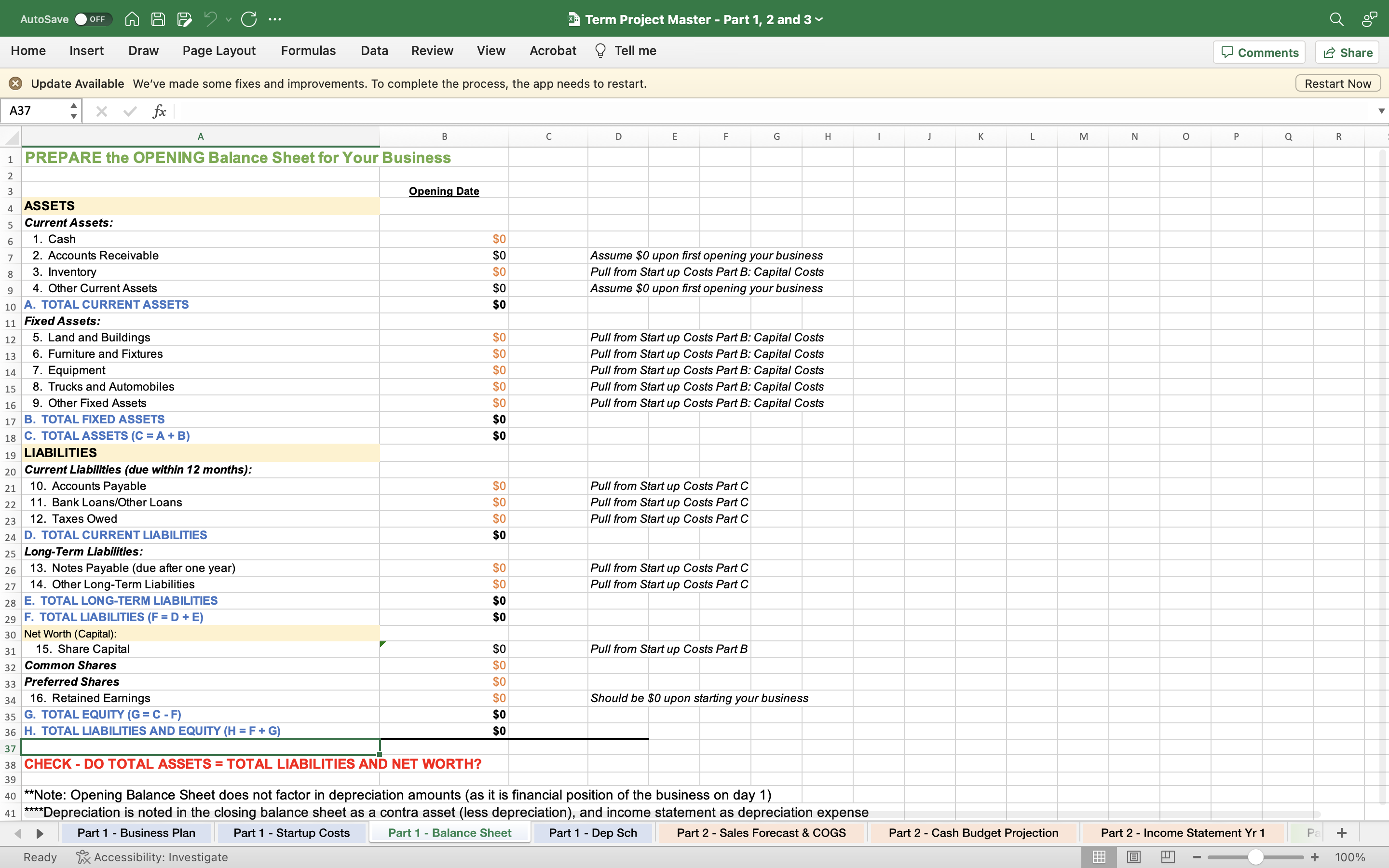

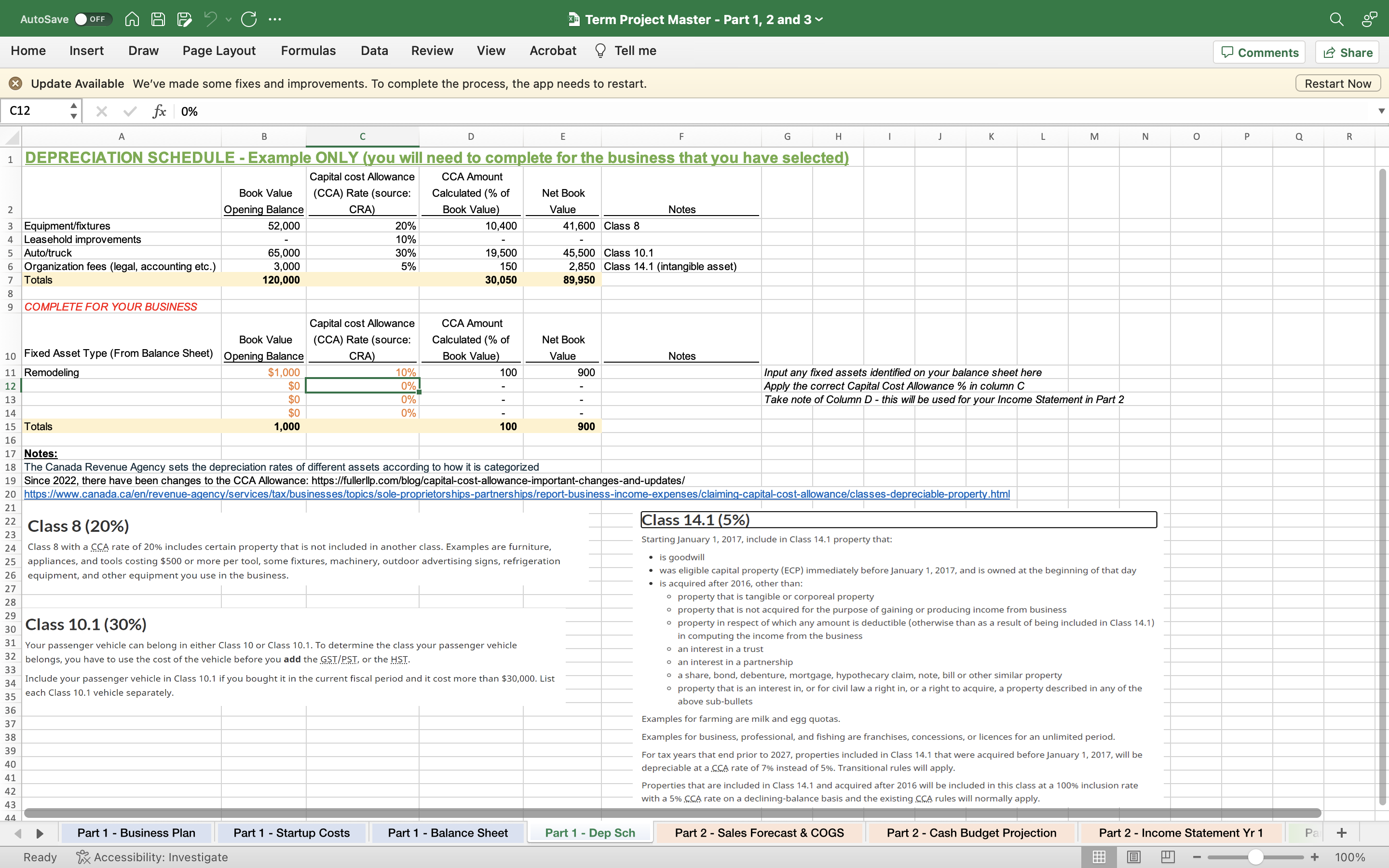

C Home Insert Draw Page Layout Formulas Data Review AutoSave OFF D 1 BUSINESS PLAN SUMMARY 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 X Update Available We've made some fixes and improvements. To complete the process, the app needs to restart. A6 x fx A B C Ready E F BEFORE YOU START YOUR FINANCIAL PLAN, ANSWER THESE QUESTIONS: 1. Describe the principal concept underlying your product or service idea. G H View I Part 1 - Business Plan Accessibility: Investigate J Acrobat 2. What is unique or distinctive about your idea? How does it differ from similar concepts already in the marketplace? Part 1 - Startup Costs Term Project Master - Part 1, 2 and 3 K 3. Who will be the primary customers of your concept and what are the principal benefits your concept will deliver to them? 22 23 24 25 26 ONCE YOU COMPLETE THE FINANCIAL PLAN (PART 3), ANSWER THESE QUESTIONS: 27 Now that you have completed all the necessary templates you should understand how viable your business idea is. The final step to 28 completing the study is to answer the following questions. Remember to answer than honestly. 29 30 31 32 33 34 4. How innovative is your concept? How would you categorize it along the continuum from "copycatting" to being an entirely new invention? 7. If you decide not to proceed with the development of a business plan, indicate the reasons why. Tell me L 5. According to your feasibility study, what were the strong points and weak points of your new venture idea? Can the weak points and potential problems be successfully overcome? Part 1 - Balance Sheet 6. Does the preliminary financial assessment indicate that the business is likely to be profitable? Does it look sufficiently attractive that you should write a comprehensive business plan? What other information do you have to obtain, or what additional research do you have to do to develop this plan? M Part 1 - Dep Sch N O P Part 2 - Sales Forecast & COGS Q R S T Part 2 - Cash Budget Projection U V 1888 W O Part 2 - Income Statement Yr 1 X II Comments Y Share Restart Now Z Pa + + 100% AA C Home Insert Draw Page Layout Formulas Data Review View AutoSave OFF > Update Available We've made some fixes and improvements. To complete the process, the app needs to restart. B14 fx 0 57 Personal Savings 58 Angel Investors 59 Seed Funding 60 Total Share Capital 61 62 DEBT FUNDING (Total Liabilities) 63 64 Short-term debt (current liabilities) 65 Bank Loans/Other Loans 66 Total Current Liabilities 67 68 Long-term debt (long-term liabilities) 69 Notes Payable (due after one year) 70 Other Long-Term Liabilities 71 Total Current Liabilities 72 73 Total Liabilities 74 75 Total Funding 76 A 80 Loan Type (Part C) 81 E.g. Car Loan 82 Futurpreneur loan 83 Loan Type 84 Loan Type 85 Loan Type 86 Total 92 93 94 95 96 Ready TECOINED TO OTANT BUSINESS: (A) + (B) B Part 1 - Business Plan 50 51 52 53 C.) Do you have this much money available or have some ideas as to where you might be able to obtain it? Identify possible sources of funding? 54 55 EQUITY FUNDING (Share Capital) 56 Loan Amount E.g. $50,000 Accessibility: Investigate $0 $0 $0 $0 $0 $0 $0 $0 $0 Part 1 - Startup Costs $0 $0 "V $60,000 $0 $0 $0 $60,000 C Term (Years) E.g. 5 Years Acrobat 77 78 D.) What interest rate and monthly payment will you need to incur on any debt included in your funding? This will be used in Part 2 to understand your cash budget 79 5 0 0 0 Term Project Master D Tell me Interest Cost E.g. 5% E Input any savings you will contribute to starting the business Input any investments you expect to receive from angel investors Input any investments you expect to receive from venture capital investors Part 1 - Balance Sheet Part 1, 2 and 3 Input any short-term bank loans you may take (e.g. car loan, revolving line of credit) Input any notes payables you may have - e.g. long-term bank loans Input any other long-term liabilities you may have This should equal Total Estimated Cash Required to Start Business 9% 0% 0% 0% 87 88 Monthly interest payment should be used in the cash budget projection under interest payments AND on the income statement 89 Monthly principal payment should be used in the cash budget projection under Other Cash Expenses NOT on the income statement (it is a non-cash expense) 90 91 Monthly Principal Payment Formula embedded Part 1 - Dep Sch $1,000 $0 $0 $0 F $1,000 Monthly Interest Payment Formula embedded $450 $0 $0 $0 $450 G Part 2 - Sales Forecast & COGS H I J K Part 2 - Cash Budget Projection L 8 M Total Monthly Payment Formula embedde We assume the monthly payment includes an equal portion of the principal each month $1,450 $0 $0 $0 $1,450 Total Loan Amount should equal total loans identified in C Debt Funding Comments A N Part 2 - Income Statement Yr 1 II Restart Now O Share Pa + + P 100% C Home Insert Draw Page Layout Formulas Data Review View AutoSave OFF ASSETS Current Assets: X Update Available We've made some fixes and improvements. To complete the process, the app needs to restart. A37 fx 1 PREPARE the OPENING Balance Sheet for Your Business 2 3 4 5 6 7 8 9 10 A. TOTAL CURRENT ASSETS 1. Cash 2. Accounts Receivable 3. Inventory 4. Other Current Assets 11 Fixed Assets: 12 13 14 15 5. Land and Buildings 6. Furniture and Fixtures 7. Equipment 8. Trucks and Automobiles 16 9. Other Fixed Assets B. TOTAL FIXED ASSETS 18 C. TOTAL ASSETS (C = A + B) 19 LIABILITIES 20 Current Liabilities (due within 12 months): 21 10. Accounts Payable 22 23 24 D. TOTAL CURRENT LIABILITIES 25 Long-Term Liabilities: 26 13. Notes Payable (due after one year) 27 14. Other Long-Term Liabilities 28 E. TOTAL LONG-TERM LIABILITIES 29 F. TOTAL LIABILITIES (F = D + E) 30 Net Worth (Capital): 11. Bank Loans/Other Loans 12. Taxes Owed A 31 15. Share Capital 32 Common Shares 33 Preferred Shares 34 16. Retained Earnings 35 G. TOTAL EQUITY (G=C-F) 36 H. TOTAL LIABILITIES AND EQUITY (H = F + G) B Ready 37 38 CHECK-DO TOTAL ASSETS = TOTAL LIABILITIES AND NET WORTH? Opening Date Accessibility: Investigate $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 XTerm Project Master - Part 1, 2 and 3 Acrobat C Tell me D E F Assume $0 upon first opening your business Pull from Start up Costs Part B: Capital Costs Assume $0 upon first opening your business Pull from Start up Costs Part B: Capital Costs Pull from Start up Costs Part B: Capital Costs Pull from Start up Costs Part B: Capital Costs Pull from Start up Costs Part B: Capital Costs Pull from Start up Costs Part B: Capital Costs Pull from Start up Costs Part C Pull from Start up Costs Part C Pull from Start up Costs Part C G Pull from Start up Costs Part C Pull from Start up Costs Part C Pull from Start up Costs Part B Should be $0 upon starting your business 39 40 **Note: Opening Balance Sheet does not factor in depreciation amounts (as it is financial position of the business on day 1) 41 ****Depreciation is noted in the closing balance sheet as a contra asset (less depreciation), and income statement as depreciation expense Part 1 - Startup Costs Part 1 Balance Sheet Part 1 - Business Plan Part 1 - Dep Sch Part 2 - Sales Forecast & COGS H I J K L Part 2 - Cash Budget Projection M N A O II Comments Part 2 - Income Statement Yr 1 P Q Share Restart Now R Pa + + 100% C Home Insert Draw Page Layout Formulas Data Review AutoSave OFF 234567 00 3 Equipment/fixtures Update Available We've made some fixes and improvements. To complete the process, the app needs to restart. C12 x fx 0% D E F 1 DEPRECIATION SCHEDULE - Example ONLY (you will need to complete for the business that you have selected) Capital cost Allowance (CCA) Rate (source: CRA) CCA Amount Calculated (% of Book Value) 10,400 Leasehold improvements Auto/truck 6 Organization fees (legal, accounting etc.) Totals A 8 9 COMPLETE FOR YOUR BUSINESS 22 Class 8 (20%) 23 35 36 37 38 39 40 41 42 43 44 B Book Value Opening Balance 52,000 Ready 65,000 3,000 120,000 Part 1- Business Plan Accessibility: Investigate 20% 10% 30% 5% Capital cost Allowance (CCA) Rate (source: CRA) View 10% 0% 0% 0% Part 1 - Startup Costs 19,500 150 30,050 CCA Amount Calculated (% of Book Value) Class 10.1 (30%) 31 Your passenger vehicle can belong in either Class 10 or Class 10.1. To determine the class your passenger vehicle 32 belongs, you have to use the cost of the vehicle before you add the GST/PST, or the HST. 33 34 100 - 24 Class 8 with a CCA rate of 20% includes certain property that is not included in another class. Examples are furniture, 25 appliances, and tools costing $500 or more per tool, some fixtures, machinery, outdoor advertising signs, refrigeration equipment, and other equipment you use in the business. 26 27 28 29 30 100 Acrobat XTerm Project Master - Part 1, 2 and 3 Book Value 10 Fixed Asset Type (From Balance Sheet) Opening Balance 11 Remodeling $1,000 12 $0 13 $0 14 $0 15 Totals 1,000 16 17 Notes: 18 The Canada Revenue Agency sets the depreciation rates of different assets according to how it is categorized 19 Since 2022, there have been changes to the CCA Allowance: https://fullerllp.com/blog/capital-cost-allowance-important-changes-and-updates/ 20 https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/sole-proprietorships-partnerships/report-business-income-expenses/claiming-capital-cost-allowance/classes-depreciable-property.html 21 Include your passenger vehicle in Class 10.1 if you bought it in the current fiscal period and it cost more than $30,000. List each Class 10.1 vehicle separately. Net Book Value Part 1 - Balance Sheet 41,600 Class 8 Net Book Value Tell me 45,500 Class 10.1 2,850 Class 14.1 (intangible asset) 89,950 900 - 900 Part 1 - Dep Sch Notes G Notes H I J K L Class 14.1 (5%) Starting January 1, 2017, include in Class 14.1 property that: is goodwill was eligible capital property (ECP) immediately before January 1, 2017, and is owned at the beginning of that day is acquired after 2016, other than: Input any fixed assets identified on your balance sheet here Apply the correct Capital Cost Allowance % in column C Take note of Column D - this will be used for your Income Statement in Part 2 Part 2 - Sales Forecast & COGS M o property that is tangible or corporeal property o property that is not acquired for the purpose of gaining or producing income from business o property in respect of which any amount is deductible (otherwise than as a result of being included in Class 14.1) in computing the income from the business o an interest in a trust o an interest in a partnership O a share, bond, debenture, mortgage, hypothecary claim, note, bill or other similar property o property that is an interest in, or for civil law a right in, or a right to acquire, a property described in any of the above sub-bullets Examples for farming are milk and egg quotas. Examples for business, professional, and fishing are franchises, concessions, or licences for an unlimited period. For tax years that end prior to 2027, properties included in Class 14.1 that were acquired before January 1, 2017, will be depreciable at a CCA rate of 7% instead of 5%. Transitional rules will apply. Properties that are included in Class 14.1 and acquired after 2016 will be included in this class at a 100% inclusion rate with a 5% CCA rate on a declining-balance basis and the existing CCA rules will normally apply. Part 2 - Cash Budget Projection N 1888 O II Comments Part 2 - Income Statement Yr 1 P Q Restart Now Pa Share + R + 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started