Question: C If interest rates were to decrease by 25 basis points, (i) what percentage change in price would you expect for the bond? (ii)

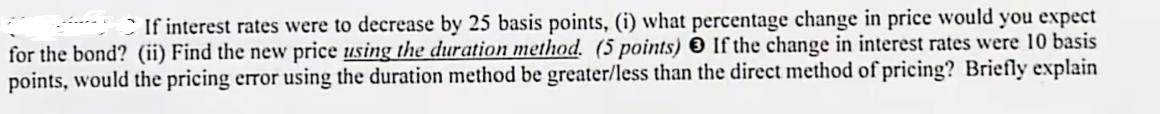

C If interest rates were to decrease by 25 basis points, (i) what percentage change in price would you expect for the bond? (ii) Find the new price using the duration method. (5 points) If the change in interest rates were 10 basis points, would the pricing error using the duration method be greater/less than the direct method of pricing? Briefly explain

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

To answer your question I would need to know some additional information about the bond in question ... View full answer

Get step-by-step solutions from verified subject matter experts