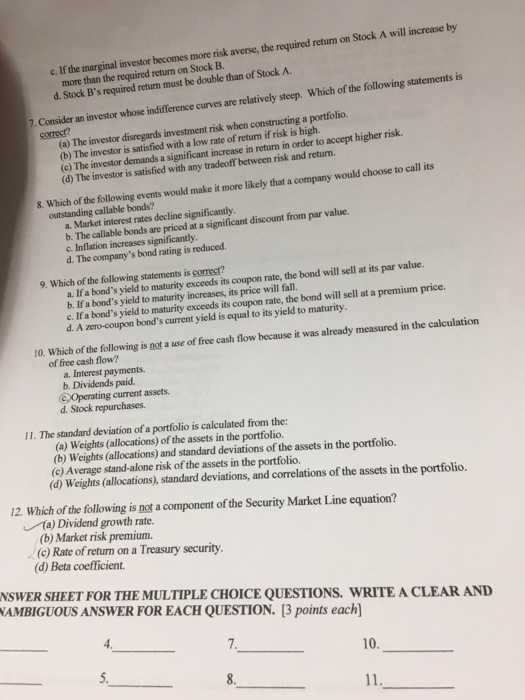

c. If the marginal investor becomes more risk averse, the required return on Stock A will increase more than the required return on Stock B. d. Stock B's required return must be double than of Stock A. Which of the following statements is 7. Consider an investor whose indifference curves are relatively steep. correct? (a) The investor disregards investment risk when constructing a portfolio. (b) The investor is satisfied with a low rate of return if risk is high. (e) The investor demands a significant increase in return in order to accept higher risk. (d) The investor is satisfied with any tradeoff between risk and return. 8. Which of the following events would make it more likely that a company would choose to call its outstanding callable bonds? a. Market interest rates decline significantly b. The callable bonds are priced at a significant discount from par value. c. Inflation increases significantly d. The company's bond rating is reduced 9. Which of the following statements is correct? a. Ifa bond's yield to maturity exceeds its coupon rate, the bond will sell at its par value. b. If a bond's yield to maturity increases, its price will fall. c. If a bond's yield to maturity exceeds its coupon rate, the bond will sell at a premium price. d. A zero-coupon bond's current yield is equal to its yield to maturity 10. Which of the following is not a use of free cash flow because it was already measured in the calculation of free cash flow? a. Interest payments. b. Dividends paid. c, Operating current assets. d. Stock repurchases. I1. The standard deviation of a portfolio is calculated from the: (a) Weights (allocations) of the assets in the portfolio. (b) Weights (allocations) and standard deviations of the assets in the portfolio. (c) Average stand-alone risk of the assets in the portfolio. (d) Weights (allocations), standard deviations, and correlations of the assets in the portfolio. 12. Which of the following is not a component of the Security Market Line equation? a) Dividend growth rate. (b) Market risk premium. (c) Rate of return on a Treasury security (d) Beta coefficient. NSWER SHEET FOR THE MULTIPLE CHOICE QUESTIONS. WRITE A CLEAR AND NAMBIGUOUS ANSWER FOR EACH QUESTION. 13 points each] 7. 10