Answered step by step

Verified Expert Solution

Question

1 Approved Answer

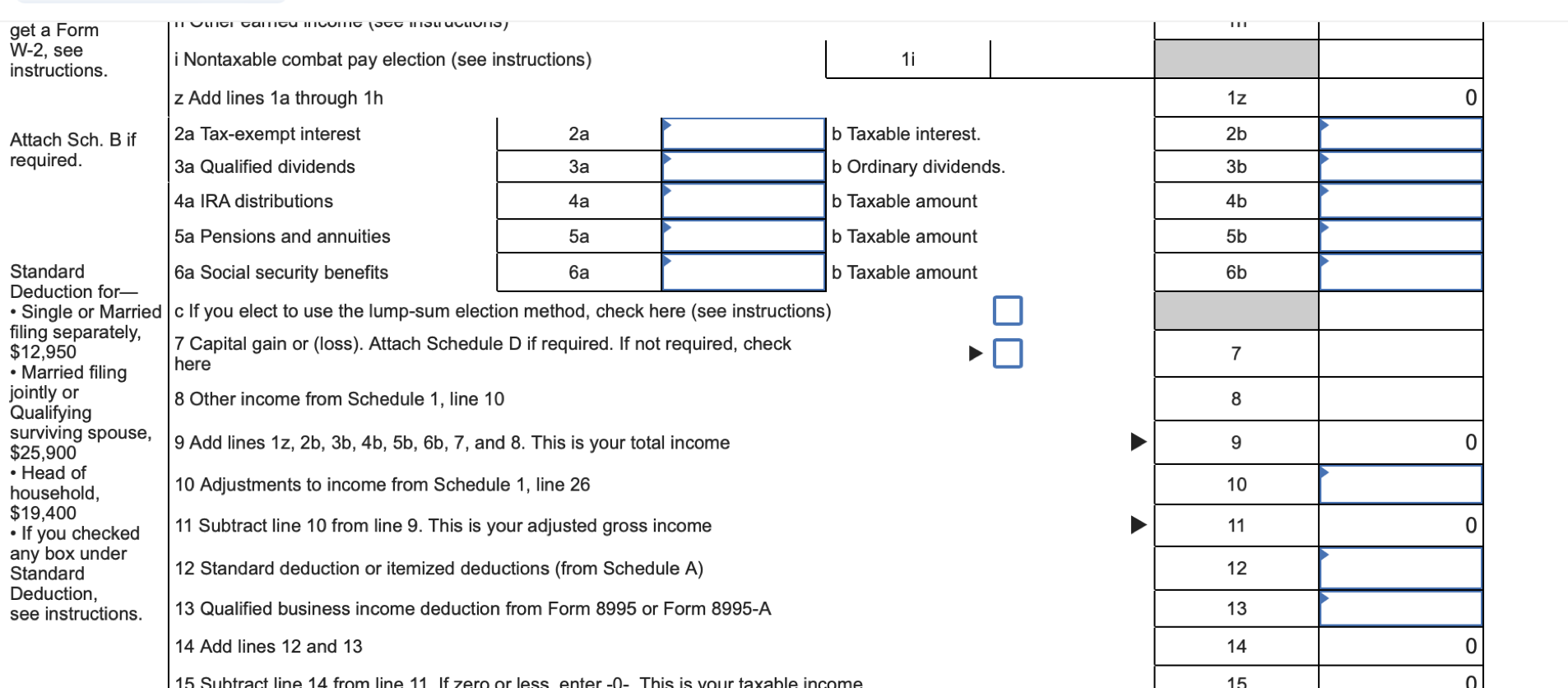

c If you elect to use the lump-sum election method, check here (see instructions) 7 Capital gain or (loss). Attach Schedule D if required. If

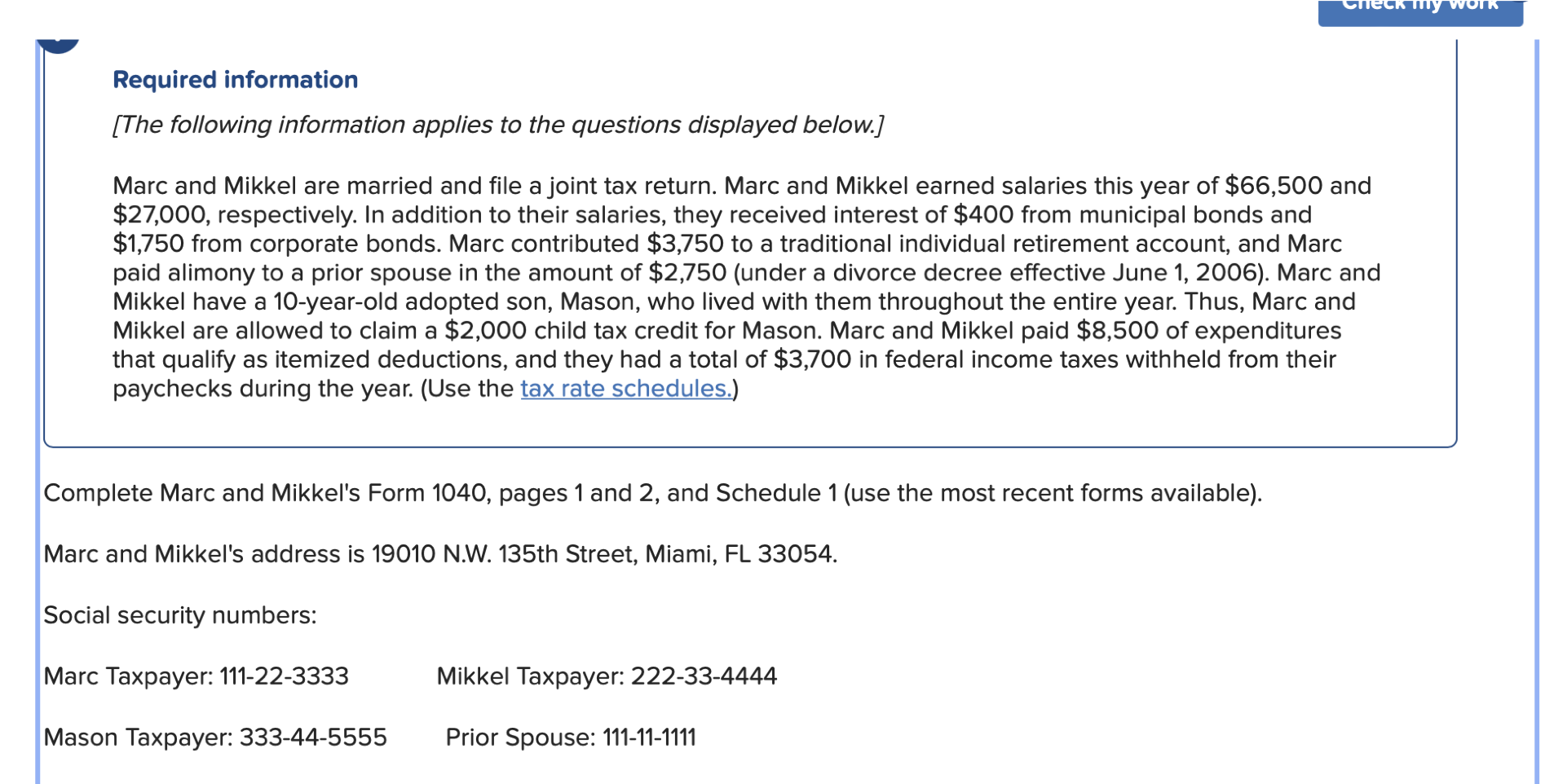

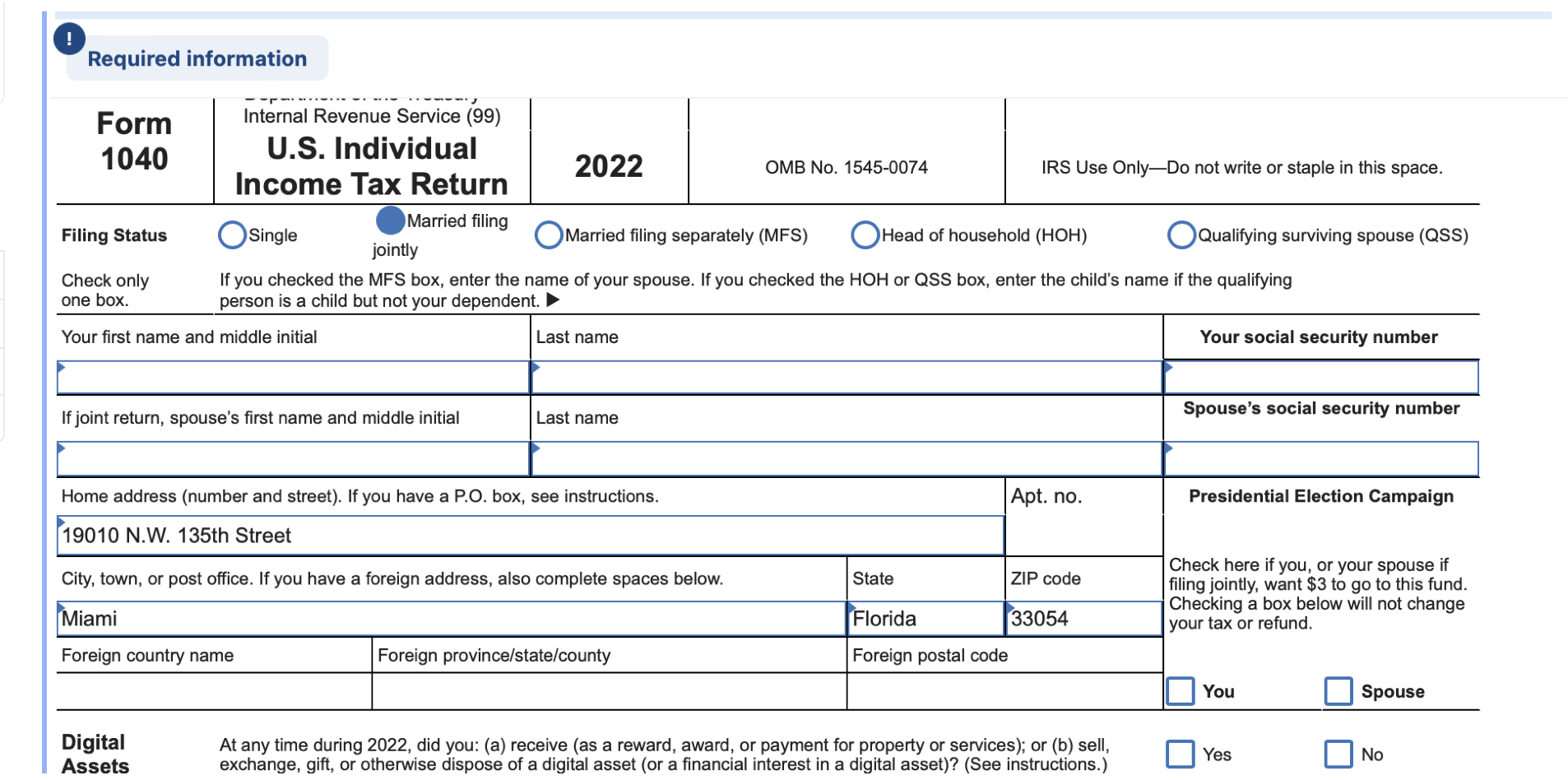

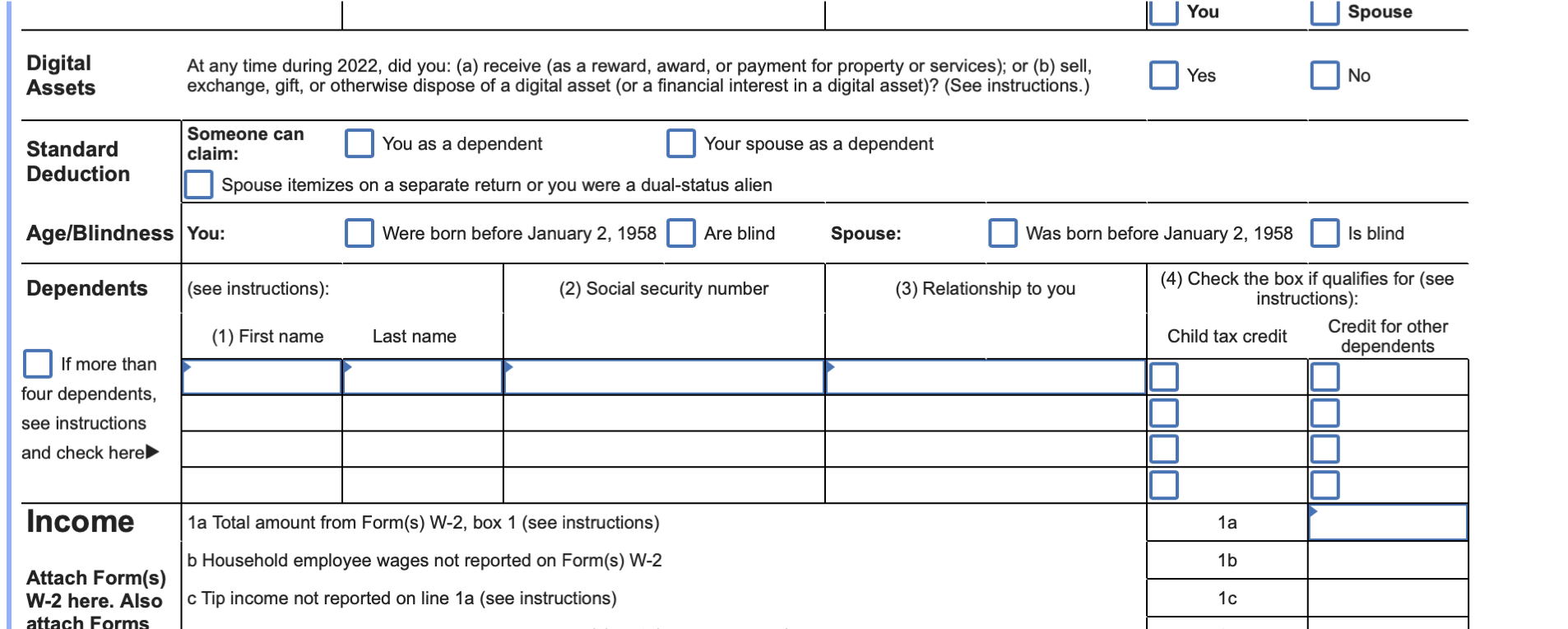

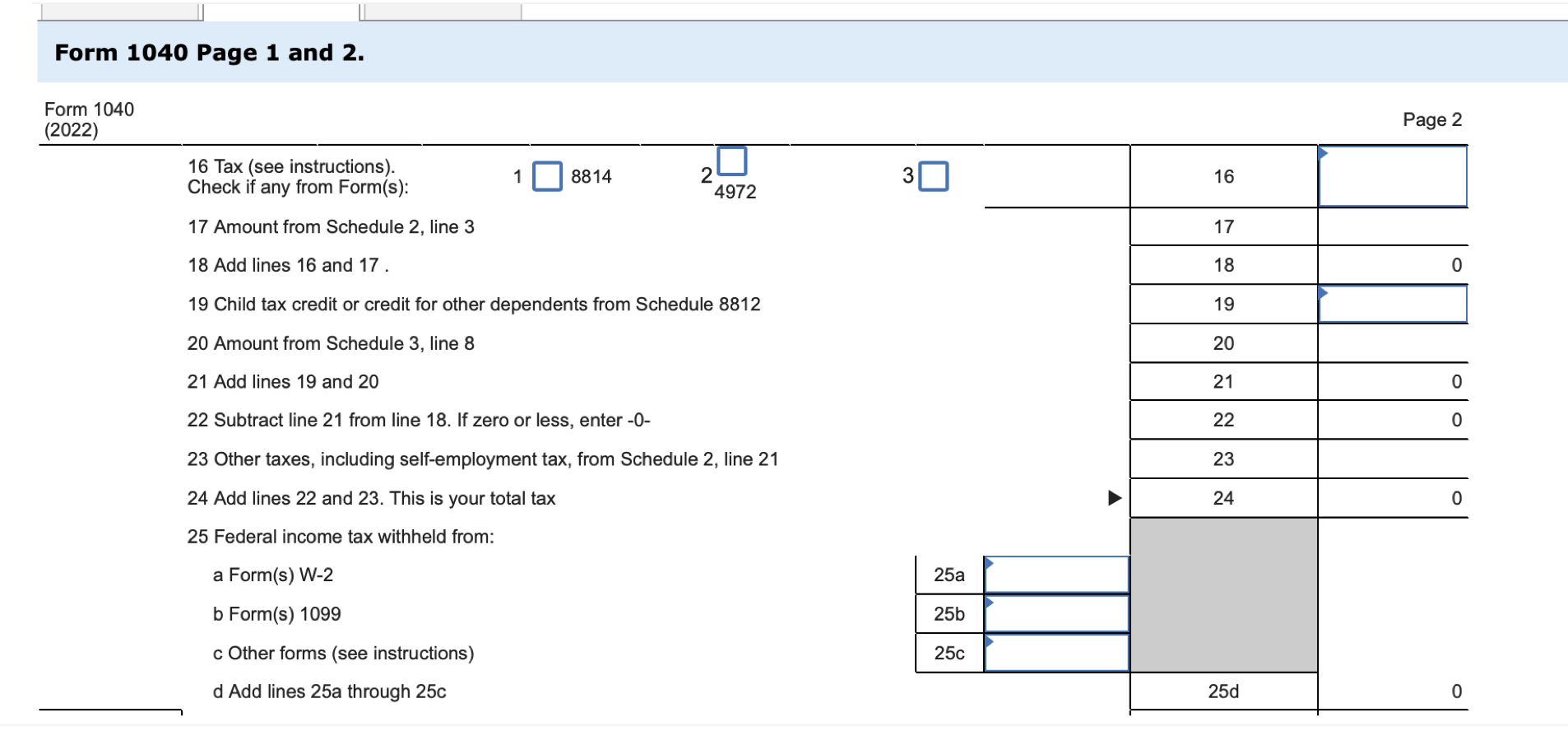

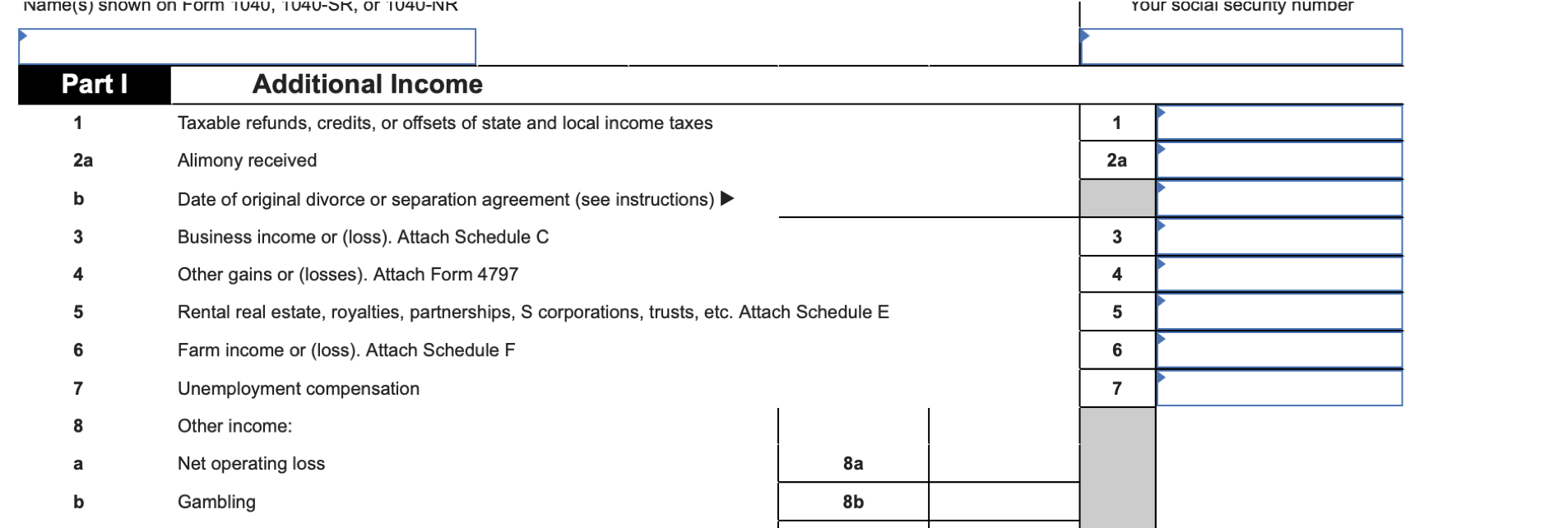

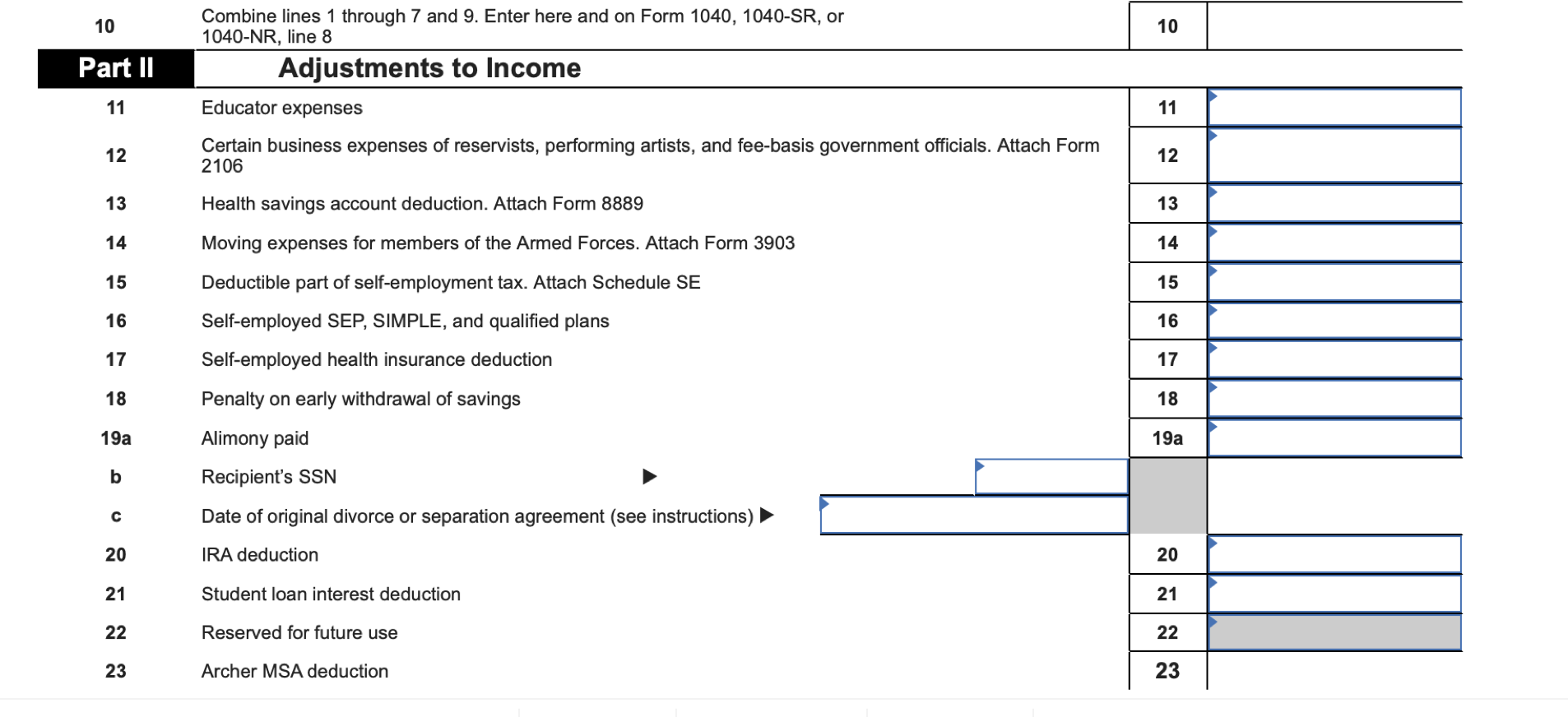

c If you elect to use the lump-sum election method, check here (see instructions) 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here 8 Other income from Schedule 1, line 10 9 Add lines 1z,2b,3b,4b,5b,6b,7, and 8 . This is your total income 10 Adjustments to income from Schedule 1, line 26 11 Subtract line 10 from line 9 . This is your adjusted gross income 12 Standard deduction or itemized deductions (from Schedule A) 13 Qualified business income deduction from Form 8995 or Form 8995-A 14 Add lines 12 and 13 Required information [The following information applies to the questions displayed below.] Marc and Mikkel are married and file a joint tax return. Marc and Mikkel earned salaries this year of $66,500 and $27,000, respectively. In addition to their salaries, they received interest of $400 from municipal bonds and $1,750 from corporate bonds. Marc contributed $3,750 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $2,750 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $8,500 of expenditures that qualify as itemized deductions, and they had a total of $3,700 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules.) omplete Marc and Mikkel's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent forms available). larc and Mikkel's address is 19010 N.W. 135th Street, Miami, FL 33054. ocial security numbers: arc Taxpayer: 111-22-3333 ason Taxpayer: 333-44-5555 Mikkel Taxpayer: 222-33-4444 Prior Spouse: 111-11-1111 Part I Additional Income 1 2a b 3 4 5 6 7 8 a b Taxable refunds, credits, or offsets of state and local income taxes Alimony received Date of original divorce or separation agreement (see instructions) Business income or (loss). Attach Schedule C Other gains or (losses). Attach Form 4797 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or (loss). Attach Schedule F Unemployment compensation Other income: Net operating loss Gambling 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 10 Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forces. Attach Form 3903 15 Deductible part of self-employment tax. Attach Schedule SE 16 Self-employed SEP, SIMPLE, and qualified plans 17 Self-employed health insurance deduction 18 Penalty on early withdrawal of savings 19a Alimony paid b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 20 IRA deduction 21 Student loan interest deduction 22 Reserved for future use 23 Archer MSA deduction \begin{tabular}{|c|c|l|} \hline \multirow{4}{*}{ government officials. Attach Form } & 11 & \\ \cline { 2 - 3 } & 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline & 19a & \\ \hline & & \\ \hline & 20 & \\ \hline & 21 & \\ \hline & 22 & \\ \hline & 23 & \\ \hline \end{tabular} Form 1040 Page 1 and 2. Form 1040 (2022) Page 2 c If you elect to use the lump-sum election method, check here (see instructions) 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here 8 Other income from Schedule 1, line 10 9 Add lines 1z,2b,3b,4b,5b,6b,7, and 8 . This is your total income 10 Adjustments to income from Schedule 1, line 26 11 Subtract line 10 from line 9 . This is your adjusted gross income 12 Standard deduction or itemized deductions (from Schedule A) 13 Qualified business income deduction from Form 8995 or Form 8995-A 14 Add lines 12 and 13 Required information [The following information applies to the questions displayed below.] Marc and Mikkel are married and file a joint tax return. Marc and Mikkel earned salaries this year of $66,500 and $27,000, respectively. In addition to their salaries, they received interest of $400 from municipal bonds and $1,750 from corporate bonds. Marc contributed $3,750 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $2,750 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $8,500 of expenditures that qualify as itemized deductions, and they had a total of $3,700 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules.) omplete Marc and Mikkel's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent forms available). larc and Mikkel's address is 19010 N.W. 135th Street, Miami, FL 33054. ocial security numbers: arc Taxpayer: 111-22-3333 ason Taxpayer: 333-44-5555 Mikkel Taxpayer: 222-33-4444 Prior Spouse: 111-11-1111 Part I Additional Income 1 2a b 3 4 5 6 7 8 a b Taxable refunds, credits, or offsets of state and local income taxes Alimony received Date of original divorce or separation agreement (see instructions) Business income or (loss). Attach Schedule C Other gains or (losses). Attach Form 4797 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or (loss). Attach Schedule F Unemployment compensation Other income: Net operating loss Gambling 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 10 Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forces. Attach Form 3903 15 Deductible part of self-employment tax. Attach Schedule SE 16 Self-employed SEP, SIMPLE, and qualified plans 17 Self-employed health insurance deduction 18 Penalty on early withdrawal of savings 19a Alimony paid b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 20 IRA deduction 21 Student loan interest deduction 22 Reserved for future use 23 Archer MSA deduction \begin{tabular}{|c|c|l|} \hline \multirow{4}{*}{ government officials. Attach Form } & 11 & \\ \cline { 2 - 3 } & 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline & 19a & \\ \hline & & \\ \hline & 20 & \\ \hline & 21 & \\ \hline & 22 & \\ \hline & 23 & \\ \hline \end{tabular} Form 1040 Page 1 and 2. Form 1040 (2022) Page 2

c If you elect to use the lump-sum election method, check here (see instructions) 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here 8 Other income from Schedule 1, line 10 9 Add lines 1z,2b,3b,4b,5b,6b,7, and 8 . This is your total income 10 Adjustments to income from Schedule 1, line 26 11 Subtract line 10 from line 9 . This is your adjusted gross income 12 Standard deduction or itemized deductions (from Schedule A) 13 Qualified business income deduction from Form 8995 or Form 8995-A 14 Add lines 12 and 13 Required information [The following information applies to the questions displayed below.] Marc and Mikkel are married and file a joint tax return. Marc and Mikkel earned salaries this year of $66,500 and $27,000, respectively. In addition to their salaries, they received interest of $400 from municipal bonds and $1,750 from corporate bonds. Marc contributed $3,750 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $2,750 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $8,500 of expenditures that qualify as itemized deductions, and they had a total of $3,700 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules.) omplete Marc and Mikkel's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent forms available). larc and Mikkel's address is 19010 N.W. 135th Street, Miami, FL 33054. ocial security numbers: arc Taxpayer: 111-22-3333 ason Taxpayer: 333-44-5555 Mikkel Taxpayer: 222-33-4444 Prior Spouse: 111-11-1111 Part I Additional Income 1 2a b 3 4 5 6 7 8 a b Taxable refunds, credits, or offsets of state and local income taxes Alimony received Date of original divorce or separation agreement (see instructions) Business income or (loss). Attach Schedule C Other gains or (losses). Attach Form 4797 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or (loss). Attach Schedule F Unemployment compensation Other income: Net operating loss Gambling 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 10 Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forces. Attach Form 3903 15 Deductible part of self-employment tax. Attach Schedule SE 16 Self-employed SEP, SIMPLE, and qualified plans 17 Self-employed health insurance deduction 18 Penalty on early withdrawal of savings 19a Alimony paid b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 20 IRA deduction 21 Student loan interest deduction 22 Reserved for future use 23 Archer MSA deduction \begin{tabular}{|c|c|l|} \hline \multirow{4}{*}{ government officials. Attach Form } & 11 & \\ \cline { 2 - 3 } & 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline & 19a & \\ \hline & & \\ \hline & 20 & \\ \hline & 21 & \\ \hline & 22 & \\ \hline & 23 & \\ \hline \end{tabular} Form 1040 Page 1 and 2. Form 1040 (2022) Page 2 c If you elect to use the lump-sum election method, check here (see instructions) 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here 8 Other income from Schedule 1, line 10 9 Add lines 1z,2b,3b,4b,5b,6b,7, and 8 . This is your total income 10 Adjustments to income from Schedule 1, line 26 11 Subtract line 10 from line 9 . This is your adjusted gross income 12 Standard deduction or itemized deductions (from Schedule A) 13 Qualified business income deduction from Form 8995 or Form 8995-A 14 Add lines 12 and 13 Required information [The following information applies to the questions displayed below.] Marc and Mikkel are married and file a joint tax return. Marc and Mikkel earned salaries this year of $66,500 and $27,000, respectively. In addition to their salaries, they received interest of $400 from municipal bonds and $1,750 from corporate bonds. Marc contributed $3,750 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $2,750 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $8,500 of expenditures that qualify as itemized deductions, and they had a total of $3,700 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules.) omplete Marc and Mikkel's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent forms available). larc and Mikkel's address is 19010 N.W. 135th Street, Miami, FL 33054. ocial security numbers: arc Taxpayer: 111-22-3333 ason Taxpayer: 333-44-5555 Mikkel Taxpayer: 222-33-4444 Prior Spouse: 111-11-1111 Part I Additional Income 1 2a b 3 4 5 6 7 8 a b Taxable refunds, credits, or offsets of state and local income taxes Alimony received Date of original divorce or separation agreement (see instructions) Business income or (loss). Attach Schedule C Other gains or (losses). Attach Form 4797 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or (loss). Attach Schedule F Unemployment compensation Other income: Net operating loss Gambling 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 10 Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forces. Attach Form 3903 15 Deductible part of self-employment tax. Attach Schedule SE 16 Self-employed SEP, SIMPLE, and qualified plans 17 Self-employed health insurance deduction 18 Penalty on early withdrawal of savings 19a Alimony paid b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 20 IRA deduction 21 Student loan interest deduction 22 Reserved for future use 23 Archer MSA deduction \begin{tabular}{|c|c|l|} \hline \multirow{4}{*}{ government officials. Attach Form } & 11 & \\ \cline { 2 - 3 } & 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline & 19a & \\ \hline & & \\ \hline & 20 & \\ \hline & 21 & \\ \hline & 22 & \\ \hline & 23 & \\ \hline \end{tabular} Form 1040 Page 1 and 2. Form 1040 (2022) Page 2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started